Region:Middle East

Author(s):Dev

Product Code:KRAC8680

Pages:81

Published On:November 2025

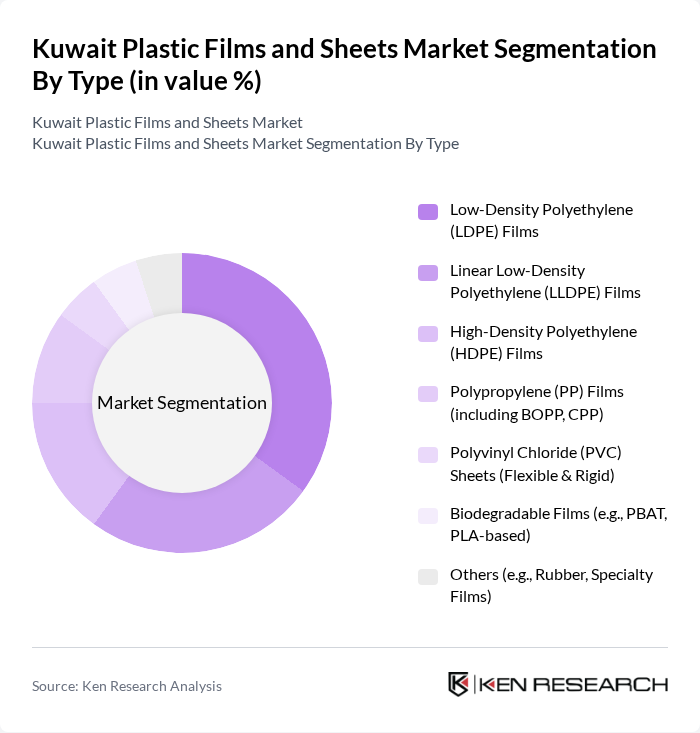

By Type:The market is segmented into various types of plastic films and sheets, including Low-Density Polyethylene (LDPE) Films, Linear Low-Density Polyethylene (LLDPE) Films, High-Density Polyethylene (HDPE) Films, Polypropylene (PP) Films (including BOPP, CPP), Polyvinyl Chloride (PVC) Sheets (Flexible & Rigid), Biodegradable Films (e.g., PBAT, PLA-based), and Others (e.g., Rubber, Specialty Films). Among these, LDPE Films dominate the market due to their versatility and widespread use in packaging applications.

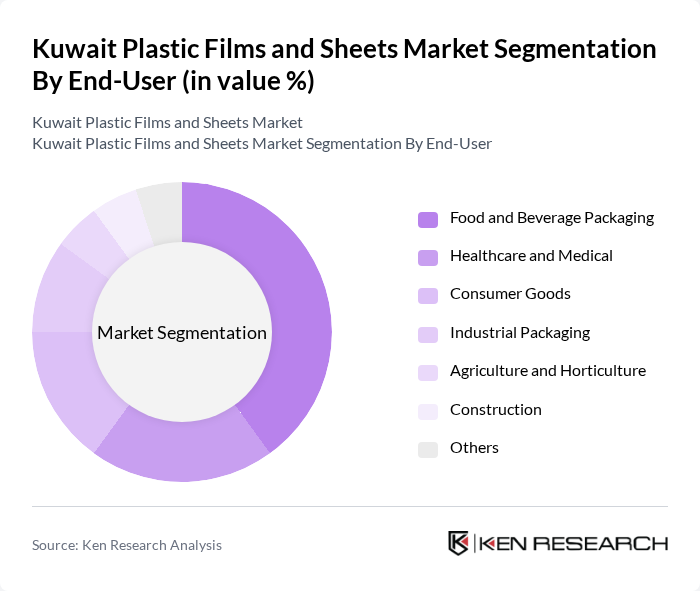

By End-User:The end-user segmentation includes Food and Beverage Packaging, Healthcare and Medical, Consumer Goods, Industrial Packaging, Agriculture and Horticulture, Construction, and Others. The Food and Beverage Packaging segment leads the market, driven by the increasing demand for packaged food products and the need for effective preservation methods.

The Kuwait Plastic Films and Sheets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Plastic Industries Company (KPIC), Gulf Plastic Industries Company, Al Dhow Plastic Industries, National Plastic & Building Material Industries Company, Al Mansour Plastic Industries, Al Fahad Plastic Factory, Al Khalij Plastic Industries, Al Sabah Plastic Industries, Al Mutlaq Plastic Factory, Al Jazeera Plastic Factory, Al Masoud Plastic Industries, Al Qabas Plastic Industries, Al Saeed Plastic Factory, Al Hamra Plastic Industries, Al Mahfouz Plastic Industries contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait plastic films and sheets market appears promising, driven by technological advancements and a shift towards sustainable practices. As the demand for eco-friendly packaging solutions continues to rise, manufacturers are likely to invest in innovative production techniques. Additionally, the expansion of e-commerce is expected to further boost the need for versatile packaging solutions, creating new avenues for growth. Overall, the market is poised for transformation, aligning with global sustainability trends and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Low-Density Polyethylene (LDPE) Films Linear Low-Density Polyethylene (LLDPE) Films High-Density Polyethylene (HDPE) Films Polypropylene (PP) Films (including BOPP, CPP) Polyvinyl Chloride (PVC) Sheets (Flexible & Rigid) Biodegradable Films (e.g., PBAT, PLA-based) Others (e.g., Rubber, Specialty Films) |

| By End-User | Food and Beverage Packaging Healthcare and Medical Consumer Goods Industrial Packaging Agriculture and Horticulture Construction Others |

| By Application | Flexible Packaging (Wraps, Bags, Pouches, Liners) Rigid Packaging (Containers, Trays) Agriculture Films (Mulch, Greenhouse, Silage) Construction Sheets (Vapor Barriers, Insulation) Medical and Hygiene Films Others |

| By Thickness | Thin Films (<50 microns) Medium Thickness Films (50–150 microns) Thick Films (>150 microns) Sheets (>500 microns) Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Mubarak Al-Kabeer Governorate Jahra Governorate Others |

| By Distribution Channel | Direct Sales Retail Online Sales Distributors Others |

| By Material Source | Virgin Materials (Local Suppliers) Imported Materials Recycled Materials Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Insights | 100 | Production Managers, Quality Control Supervisors |

| Agricultural Film Usage | 60 | Agronomists, Farm Managers |

| Construction Material Applications | 50 | Project Managers, Procurement Officers |

| Recycling and Sustainability Practices | 40 | Sustainability Managers, Environmental Compliance Officers |

| Distribution and Logistics in Plastic Supply Chain | 70 | Logistics Coordinators, Supply Chain Analysts |

The Kuwait Plastic Films and Sheets Market is valued at approximately USD 1.1 billion, driven by increasing demand for packaging solutions across various sectors, including food and beverage, healthcare, and construction.