Region:Middle East

Author(s):Rebecca

Product Code:KRAD4333

Pages:92

Published On:December 2025

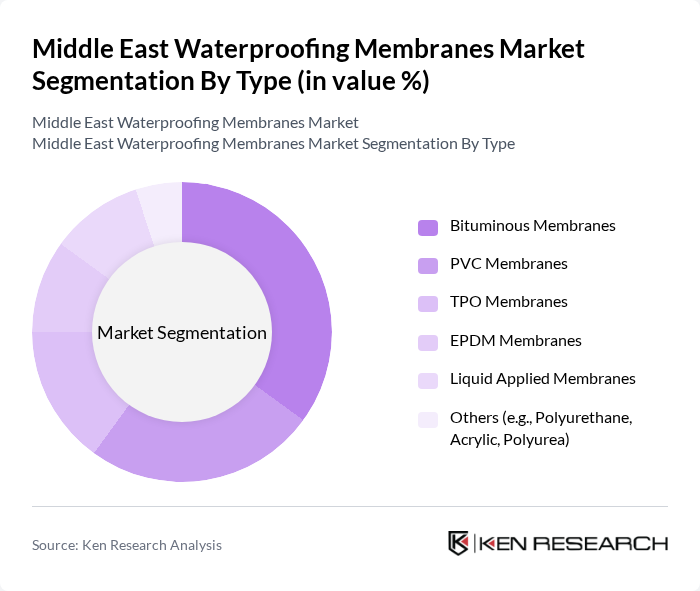

By Type:The market is segmented into various types of waterproofing membranes, including Bituminous Membranes, PVC Membranes, TPO Membranes, EPDM Membranes, Liquid Applied Membranes, and Others (e.g., Polyurethane, Acrylic, Polyurea). Bitumen-based membranes are consistently reported as the dominant product category in the Middle East due to their durability under extreme weather, cost-effectiveness, and suitability for large roof and below-grade applications, making them a preferred choice for both residential and commercial projects.

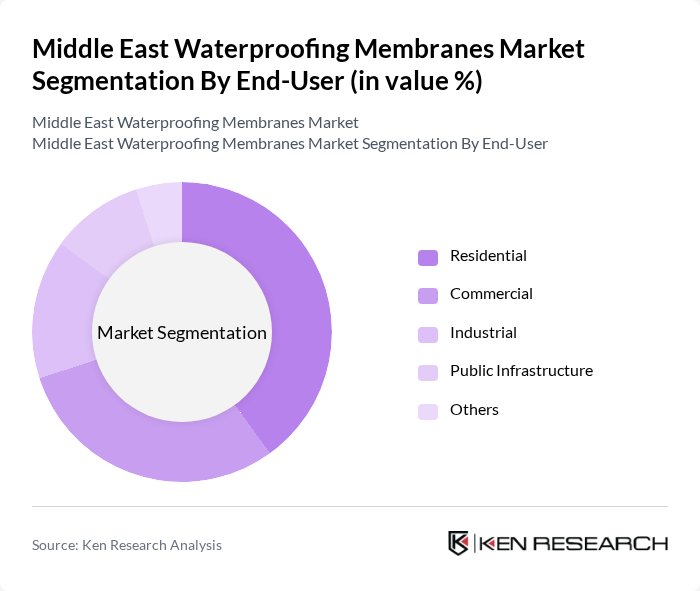

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Public Infrastructure, and Others. The Residential segment is currently leading the market due to the increasing number of housing projects and the growing awareness of waterproofing solutions among homeowners, while government initiatives promoting sustainable, energy-efficient building envelopes and better moisture protection in roofs and basements support waterproofing adoption across all end-user segments.

The Middle East Waterproofing Membranes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sika AG, Mapei S.p.A., SOPREMA Group, Saint-Gobain (including Weber and CertainTeed brands in building materials where applicable), BASF SE (construction chemicals – now largely under MBCC Group / Master Builders Solutions after divestment), Awazel Saudi Waterproofing Co., Henkel AG & Co. KGaA (Ceresit, Loctite Construction), Bostik (an Arkema company), Gulf Waterproofing Company (GWC), Izomaks Industries, Renolit SE, Polyglass S.p.A. (a Mapei Group company), GAF (Standard Industries), Johns Manville (a Berkshire Hathaway company), and local and regional players (e.g., Bituroll, Gulf Seal, Bitumat) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East waterproofing membranes market appears promising, driven by ongoing construction projects and a growing emphasis on sustainability. As governments continue to invest in infrastructure, the demand for advanced waterproofing solutions is expected to rise. Additionally, the trend towards smart building technologies will likely enhance the integration of waterproofing membranes, ensuring better performance and energy efficiency. This evolving landscape presents significant opportunities for innovation and market expansion in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Bituminous Membranes PVC Membranes TPO Membranes EPDM Membranes Liquid Applied Membranes Others (e.g., Polyurethane, Acrylic, Polyurea) |

| By End-User | Residential Commercial Industrial Public Infrastructure Others |

| By Application | Roof Waterproofing Basement & Foundation Waterproofing Water-Retaining Structures (Tanks, Pools, Reservoirs) Infrastructure (Bridges, Tunnels, Podiums, Car Parks) Others |

| By Material | Polymeric Membranes (PVC, TPO, EPDM, HDPE) Cementitious & Crystalline Membranes Bituminous & Asphalt-Based Membranes Others (e.g., Spray-Applied, Hybrid Systems) |

| By Region | Saudi Arabia United Arab Emirates Rest of GCC (Qatar, Kuwait, Oman, Bahrain) Levant (Jordan, Lebanon, Others) North Africa |

| By Installation Method | Torch-Applied Self-Adhesive Mechanically Fastened Fully Adhered (Cold-Applied, Liquid-Applied) Others |

| By Distribution Channel | Direct Sales (Project / Specification Sales) Distributors & Dealers Retail & Trade Counters Online & E-Procurement Channels Others |

The Middle East Waterproofing Membranes Market is valued at approximately USD 1.2 billion, driven by increased construction activities and a growing awareness of waterproofing solutions that enhance building longevity and energy efficiency.