Region:Asia

Author(s):Dev

Product Code:KRAA9583

Pages:90

Published On:November 2025

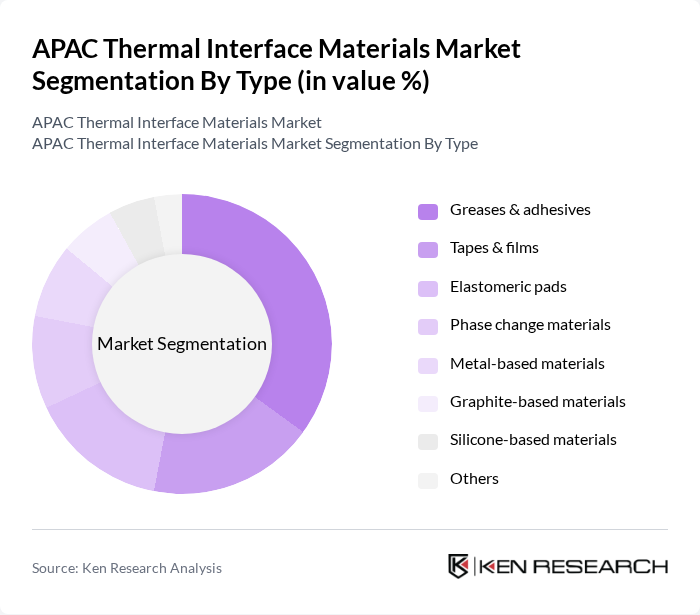

By Type:The thermal interface materials market can be segmented into various types, including greases & adhesives, tapes & films, elastomeric pads, phase change materials, metal-based materials, graphite-based materials, silicone-based materials, and others. Among these, greases & adhesives are leading the market due to their widespread application in electronics and automotive sectors, where effective heat dissipation is critical. The increasing demand for compact and efficient electronic devices, along with the growth of EVs and 5G infrastructure, drives the growth of this sub-segment .

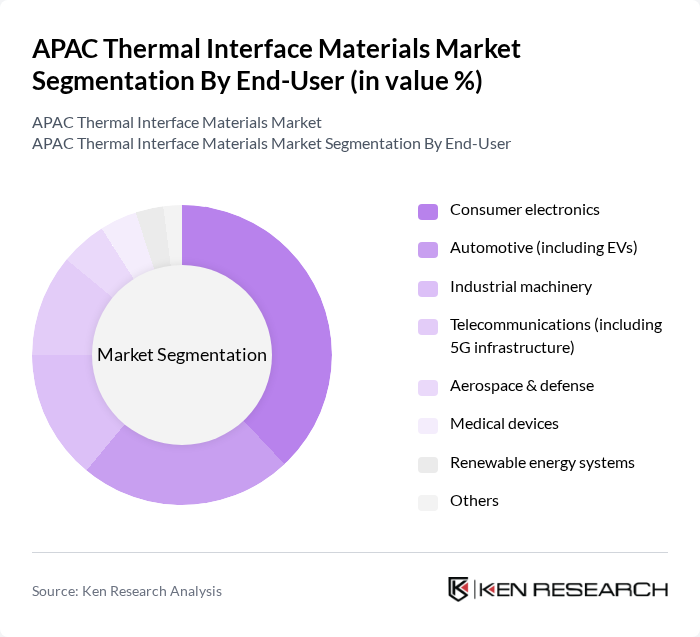

By End-User:The end-user segmentation includes consumer electronics, automotive (including EVs), industrial machinery, telecommunications (including 5G infrastructure), aerospace & defense, medical devices, renewable energy systems, and others. The consumer electronics segment is the most significant contributor to the market, driven by the rapid growth of smartphones, laptops, and other portable devices that require efficient thermal management solutions to enhance performance and reliability. Automotive (including EVs) and telecommunications are also rapidly growing due to electrification trends and 5G deployment .

The APAC Thermal Interface Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, 3M Company, Dow Inc., Laird Performance Materials (now part of DuPont), Aavid Thermalloy (Boyd Corporation), Fujipoly, Bergquist Company (now part of Henkel), Parker Chomerics, Indium Corporation, Momentive Performance Materials, Shin-Etsu Chemical Co., Ltd., Electrolube, AOS Thermal Compounds, Nanotherm, Arctic Silver Inc., Honeywell International Inc., Sibelco, H.B. Fuller Company, Shenzhen City Jia Rifeng Tai Electronic Technology Co., Ltd., Shenzhen Lianxing Electronic Technology Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC thermal interface materials market appears promising, driven by technological advancements and increasing environmental awareness. As industries shift towards eco-friendly materials, the demand for sustainable thermal solutions is expected to rise. Furthermore, the integration of smart technologies in electronics will necessitate innovative thermal management solutions, creating new avenues for growth. Companies that invest in research and development will likely lead the market, capitalizing on emerging trends and consumer preferences for high-performance, sustainable products.

| Segment | Sub-Segments |

|---|---|

| By Type | Greases & adhesives Tapes & films Elastomeric pads Phase change materials Metal-based materials Graphite-based materials Silicone-based materials Others |

| By End-User | Consumer electronics Automotive (including EVs) Industrial machinery Telecommunications (including 5G infrastructure) Aerospace & defense Medical devices Renewable energy systems Others |

| By Region | China Japan South Korea India Taiwan Southeast Asia Others |

| By Application | Thermal management in electronics Heat dissipation in automotive & EVs Cooling solutions for industrial equipment Thermal insulation in aerospace & defense Medical device thermal management Renewable energy systems Others |

| By Investment Source | Private investments Government funding Venture capital Corporate investments Others |

| By Policy Support | Government subsidies Tax incentives Research grants Regulatory support Others |

| By Technology | Advanced thermal interface materials Conventional thermal interface materials Emerging technologies (e.g., nanomaterials, graphene) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 120 | Product Development Engineers, Procurement Managers |

| Automotive Component Suppliers | 90 | Quality Assurance Managers, R&D Directors |

| Thermal Management Solution Providers | 60 | Sales Managers, Technical Support Engineers |

| Industrial Equipment Manufacturers | 50 | Operations Managers, Design Engineers |

| Research Institutions and Universities | 40 | Academic Researchers, Industry Analysts |

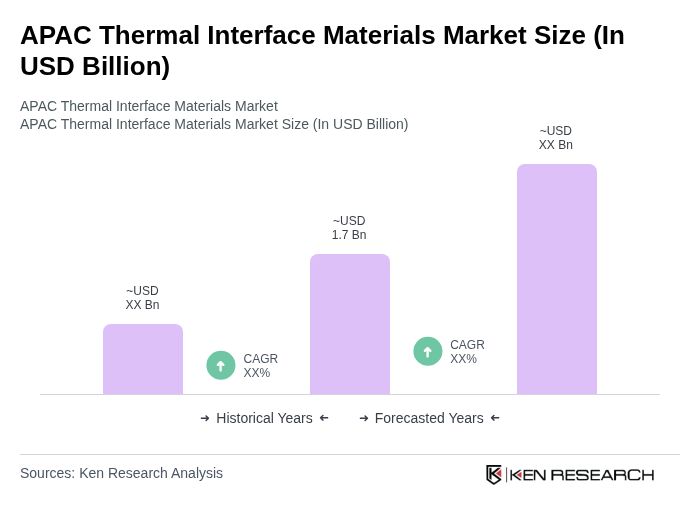

The APAC Thermal Interface Materials market is valued at approximately USD 1.7 billion, driven by the increasing demand for efficient thermal management solutions across various sectors, including consumer electronics, automotive, and industrial applications.