Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0263

Pages:95

Published On:August 2025

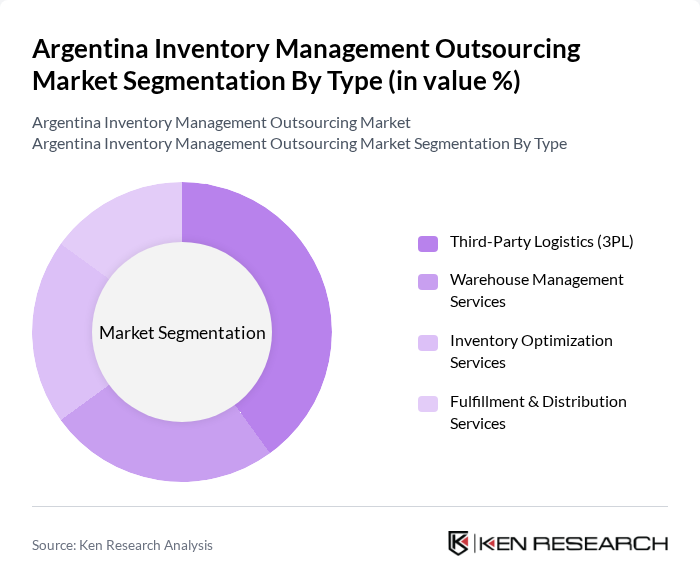

By Type:The market is segmented into various types, including Third-Party Logistics (3PL), Warehouse Management Services, Inventory Optimization Services, and Fulfillment & Distribution Services. Each of these segments plays a crucial role in enhancing operational efficiency and meeting customer demands .The Third-Party Logistics (3PL) segment is currently dominating the market due to its ability to provide comprehensive logistics solutions that include transportation, warehousing, and inventory management. Businesses are increasingly outsourcing these services to enhance efficiency and reduce operational costs. The growing trend of e-commerce has further propelled the demand for 3PL services, as companies seek to streamline their supply chains and improve customer satisfaction through faster delivery times .

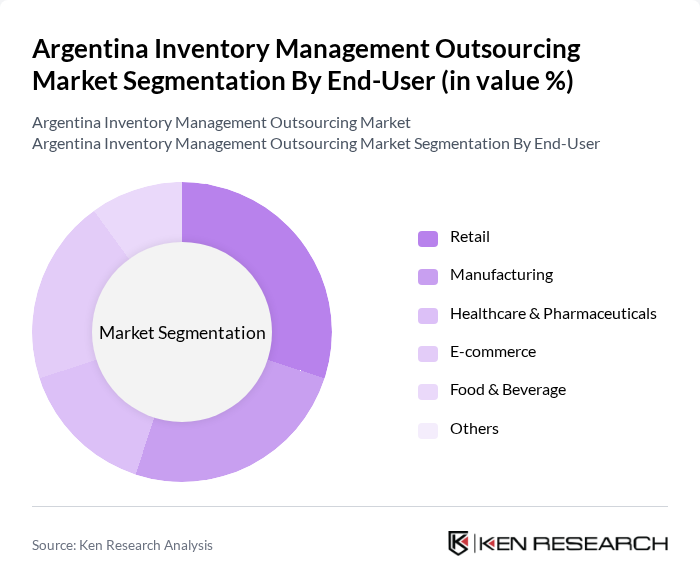

By End-User:The market is segmented by end-user into Retail, Manufacturing, Healthcare & Pharmaceuticals, E-commerce, Food & Beverage, and Others. Each sector has unique requirements that drive the demand for inventory management outsourcing services .The Retail sector is the leading end-user in the inventory management outsourcing market, driven by the need for efficient stock management and quick response to consumer demands. Retailers are increasingly adopting outsourcing solutions to manage their inventory effectively, especially with the rise of omnichannel retailing. The E-commerce sector is also witnessing significant growth, as online retailers require robust inventory management systems to handle fluctuating demand and ensure timely deliveries .

The Argentina Inventory Management Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Logístico Andreani, DHL Supply Chain Argentina, TGL Transportes y Logística, Kuehne + Nagel Argentina, Logística y Distribución S.A., CTC Logistics, XPO Logistics, FedEx Argentina, OCA S.A., Translogística, Interlogística, Logística Integral, Grupo TSE, Expreso Oro Negro, Transporte Cruz del Sur contribute to innovation, geographic expansion, and service delivery in this space.

The future of the inventory management outsourcing market in Argentina appears promising, driven by technological advancements and the growing e-commerce sector. As businesses increasingly adopt cloud-based solutions and automation, the demand for specialized inventory management services is expected to rise. Furthermore, strategic partnerships with technology providers will enhance service offerings, enabling companies to leverage innovative solutions. This evolution will likely lead to improved efficiency and competitiveness in the market, positioning outsourcing as a vital component of supply chain management.

| Segment | Sub-Segments |

|---|---|

| By Type | Third-Party Logistics (3PL) Warehouse Management Services Inventory Optimization Services Fulfillment & Distribution Services |

| By End-User | Retail Manufacturing Healthcare & Pharmaceuticals E-commerce Food & Beverage Others |

| By Industry Vertical | Consumer Goods Automotive Electronics & Electricals Pharmaceuticals & Healthcare Agriculture Others |

| By Service Model | On-Demand Services Contractual Services Managed Services Integrated Logistics Solutions Others |

| By Technology Used | RFID Technology Barcode Systems IoT Solutions Warehouse Management Systems (WMS) Automation & Robotics Others |

| By Geographic Distribution | Buenos Aires Córdoba Mendoza Rosario Santa Fe Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Supply Chain Analysts |

| Manufacturing Outsourcing Practices | 80 | Operations Managers, Procurement Specialists |

| E-commerce Fulfillment Strategies | 90 | Logistics Coordinators, E-commerce Directors |

| Third-party Logistics Providers | 70 | Business Development Managers, Account Executives |

| Technology Integration in Inventory Management | 50 | IT Managers, Systems Analysts |

The Argentina Inventory Management Outsourcing Market is valued at approximately USD 1.0 billion, reflecting a significant growth trend driven by the demand for efficient supply chain solutions and the expansion of e-commerce in the region.