Region:North America

Author(s):Shubham

Product Code:KRAA0758

Pages:93

Published On:August 2025

By Type:The market is segmented into a range of services that address varied aspects of inventory management. The primary subsegments include Third-Party Logistics (3PL), which provide end-to-end logistics and inventory solutions; Warehouse Management Services, which focus on optimizing storage and movement of goods; Inventory Optimization Services, leveraging analytics for stock level efficiency; Order Fulfillment Services, ensuring timely and accurate delivery; Reverse Logistics Services, managing returns and recycling; and Others, which cover specialized and value-added inventory services .

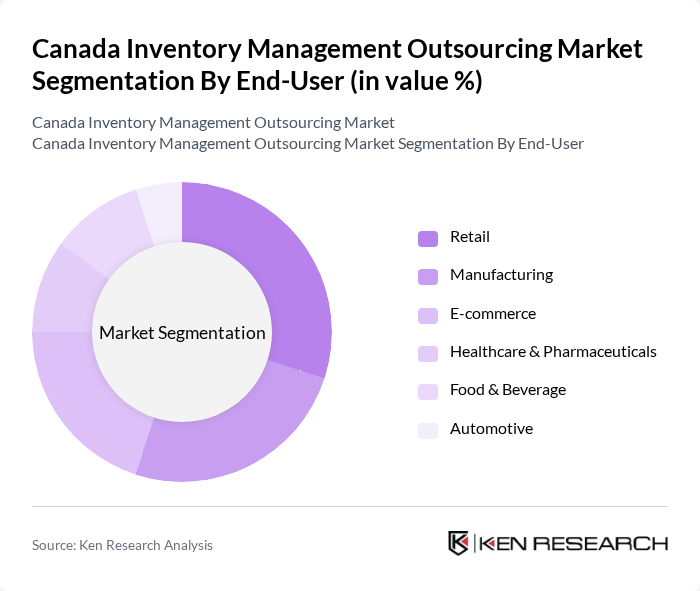

By End-User:The end-user segmentation encompasses industries that leverage inventory management outsourcing for operational efficiency. Key subsegments are Retail, which relies on real-time inventory visibility; Manufacturing, requiring just-in-time inventory and supply chain integration; E-commerce, demanding rapid fulfillment and returns management; Healthcare & Pharmaceuticals, which need regulatory-compliant inventory controls; Food & Beverage, focusing on perishability and traceability; Automotive, requiring complex parts management; and Others, which include sectors with specialized inventory needs .

The Canada Inventory Management Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as SCI Group Inc., Metro Supply Chain Group, DB Schenker Canada, Kuehne + Nagel Ltd., DHL Supply Chain (Canada), GXO Logistics (Canada), FedEx Supply Chain (Canada), DSV Solutions (Canada), XTL Logistics, VersaCold Logistics Services, Purolator Inc., Ryder Canada, NFI Industries (Canada), Penske Logistics (Canada), and CEVA Logistics (Canada) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada inventory management outsourcing market appears promising, driven by ongoing technological advancements and the increasing need for operational efficiency. As businesses continue to embrace automation and data analytics, the demand for sophisticated inventory solutions will rise. Furthermore, the integration of AI and machine learning technologies is expected to enhance decision-making processes, leading to improved inventory accuracy and reduced costs. This evolving landscape will create new opportunities for service providers to innovate and meet the changing needs of Canadian businesses.

| Segment | Sub-Segments |

|---|---|

| By Type | Third-Party Logistics (3PL) Warehouse Management Services Inventory Optimization Services Order Fulfillment Services Reverse Logistics Services Others |

| By End-User | Retail Manufacturing E-commerce Healthcare & Pharmaceuticals Food & Beverage Automotive Others |

| By Sales Channel | Direct Sales Online Sales Distributors Channel Partners Others |

| By Distribution Mode | Centralized Distribution Decentralized Distribution Hybrid Distribution Others |

| By Industry Vertical | Consumer Goods Automotive Electronics Food and Beverage Healthcare & Pharmaceuticals Others |

| By Service Model | Managed Services Professional Services Consulting Services Technology-Enabled Services Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go Fixed Pricing Performance-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 80 | Inventory Managers, Supply Chain Analysts |

| Manufacturing Outsourcing Practices | 60 | Operations Managers, Procurement Specialists |

| E-commerce Fulfillment Strategies | 50 | Logistics Coordinators, eCommerce Directors |

| Third-Party Logistics Engagement | 40 | 3PL Executives, Business Development Managers |

| Technology Adoption in Inventory Management | 45 | IT Managers, Supply Chain Technology Officers |

The Canada Inventory Management Outsourcing Market is valued at approximately USD 2.7 billion, reflecting a five-year historical analysis. This valuation is driven by the increasing demand for efficient supply chain solutions and advanced inventory management technologies.