Region:Asia

Author(s):Shubham

Product Code:KRAA0693

Pages:80

Published On:August 2025

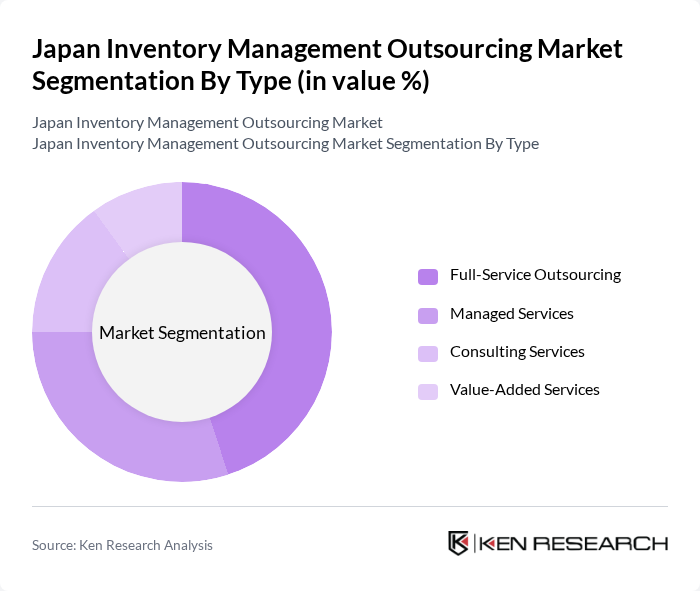

By Type:The market is segmented into Full-Service Outsourcing, Managed Services, Consulting Services, and Value-Added Services. Full-Service Outsourcing leads the market, driven by businesses seeking end-to-end solutions that encompass all aspects of inventory management, including warehousing, order fulfillment, and real-time tracking. Managed Services are increasingly adopted by companies aiming to outsource specific inventory functions for operational efficiency. Consulting Services are gaining momentum as organizations seek expert advice to optimize inventory processes, while Value-Added Services such as analytics, packaging, and returns management are becoming more important for differentiation and customer satisfaction .

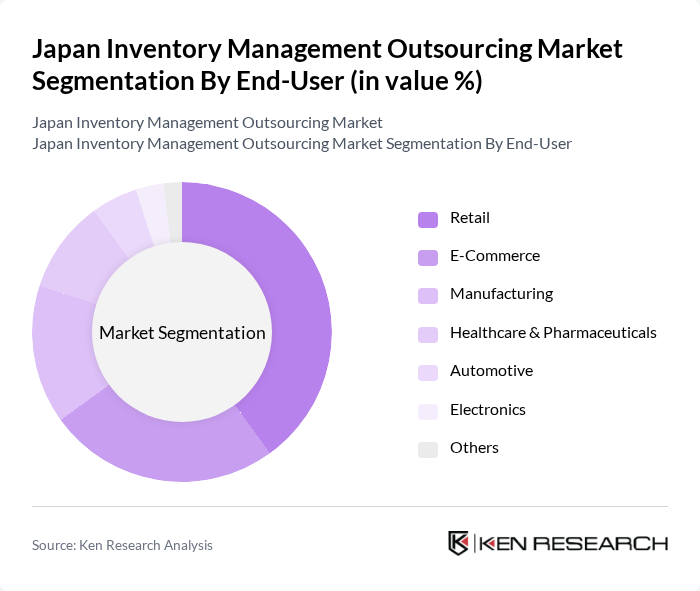

By End-User:The end-user segmentation includes Retail, E-Commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Electronics, and Others. The Retail sector dominates the market, driven by the need for real-time inventory visibility and efficient stock management to meet dynamic consumer demand. E-Commerce is expanding rapidly, requiring advanced inventory solutions for high transaction volumes and omnichannel fulfillment. Manufacturing and Healthcare sectors are significant contributors, given their need for precise inventory control and regulatory compliance. Automotive and Electronics industries are increasingly leveraging outsourcing to streamline complex supply chains and improve responsiveness .

The Japan Inventory Management Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hitachi Transport System, Ltd., Nippon Express Holdings, Inc., Yamato Holdings Co., Ltd., SG Holdings Co., Ltd. (Sagawa Express), Kintetsu World Express, Inc., Mitsubishi Logistics Corporation, Sankyu Inc., Senko Group Holdings Co., Ltd., Mitsui-Soko Holdings Co., Ltd., Sumitomo Warehouse Co., Ltd., Panasonic Connect Co., Ltd., Prologis, Inc. (Japan), NEXT Logistics Japan, Ltd., LOGISTEED, Ltd. (formerly Hitachi Transport System), and Rakuten Super Logistics Japan contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Japan inventory management outsourcing market appears promising, driven by technological advancements and the growing e-commerce sector. As businesses increasingly adopt cloud-based solutions and AI technologies, the demand for specialized inventory management services is expected to rise. Additionally, the emphasis on sustainability practices will likely influence service offerings, as companies seek to align with environmental goals. Overall, the market is poised for growth, with innovative solutions addressing evolving consumer needs and operational challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Outsourcing Managed Services Consulting Services Value-Added Services |

| By End-User | Retail E-Commerce Manufacturing Healthcare & Pharmaceuticals Automotive Electronics Others |

| By Service Model | On-Premise Cloud-Based Hybrid |

| By Industry Vertical | Consumer Goods Food & Beverage Logistics & Transportation Energy & Utilities Others |

| By Geographic Coverage | National Regional Local |

| By Contract Type | Fixed-Price Contracts Time and Materials Contracts Cost-Plus Contracts |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 60 | Supply Chain Managers, Inventory Analysts |

| Manufacturing Outsourcing Practices | 50 | Operations Directors, Procurement Managers |

| E-commerce Fulfillment Strategies | 55 | Logistics Coordinators, eCommerce Operations Heads |

| Third-party Logistics Providers | 45 | Business Development Managers, Service Delivery Managers |

| Technology Adoption in Inventory Management | 40 | IT Managers, Digital Transformation Leads |

The Japan Inventory Management Outsourcing Market is valued at approximately USD 2.7 billion, reflecting a growing demand for efficient supply chain management and advanced inventory solutions, particularly driven by the expansion of e-commerce and automation technologies.