Region:Asia

Author(s):Geetanshi

Product Code:KRAA2016

Pages:81

Published On:August 2025

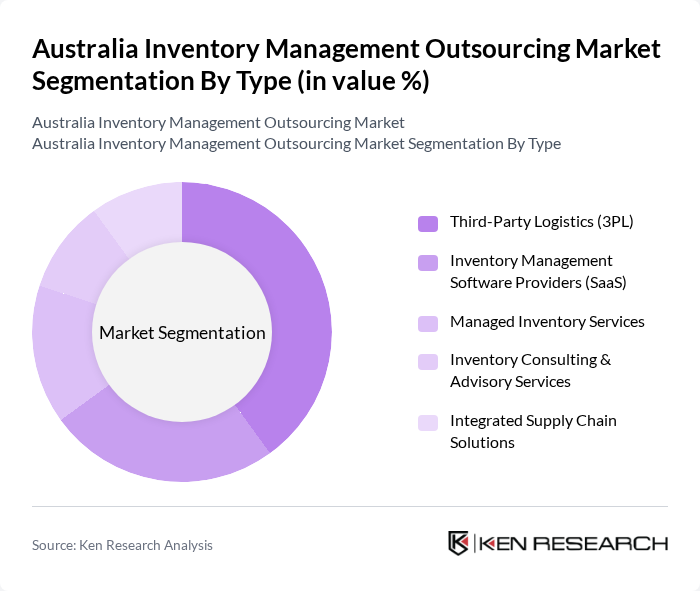

By Type:

The market is segmented into various types, including Third-Party Logistics (3PL), Inventory Management Software Providers (SaaS), Managed Inventory Services, Inventory Consulting & Advisory Services, and Integrated Supply Chain Solutions. Among these, Third-Party Logistics (3PL) is the leading sub-segment, driven by the increasing need for businesses to outsource logistics functions to enhance efficiency and reduce operational costs. The growing trend of e-commerce has further propelled the demand for 3PL services, as companies seek to streamline their supply chains and improve customer satisfaction. Industry analysis confirms that 3PL providers are expanding their service portfolios to include real-time inventory tracking, predictive analytics, and integrated fulfillment solutions, supporting the segment’s dominance.

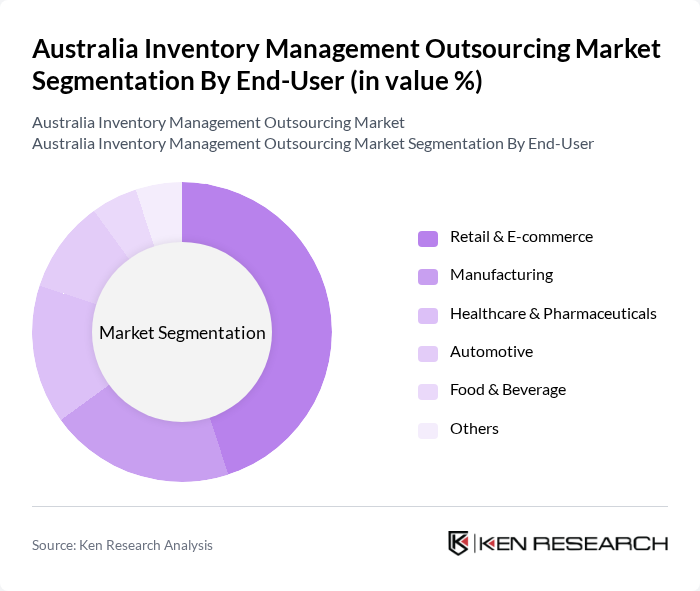

By End-User:

This market is further segmented by end-users, including Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Food & Beverage, and Others. The Retail & E-commerce segment dominates the market, driven by the rapid growth of online shopping and the need for efficient inventory management to meet consumer demands. The increasing reliance on digital platforms for sales has led retailers to adopt advanced inventory solutions to optimize stock levels and enhance order fulfillment processes. Manufacturing and Healthcare sectors are also accelerating adoption of outsourced inventory management to improve supply chain resilience and regulatory compliance.

The Australia Inventory Management Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Crown Worldwide Group, Toll Group, DB Schenker Australia, Linfox, Kuehne + Nagel Australia, Mainfreight Australia, CEVA Logistics, Qube Holdings, DHL Supply Chain Australia, GEODIS Australia, Agility Logistics Australia, C.H. Robinson Australia, XPO Logistics, Ryder Supply Chain Solutions, Expeditors International Australia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia inventory management outsourcing market appears promising, driven by technological advancements and the increasing complexity of supply chains. As businesses continue to embrace digital transformation, the demand for innovative inventory solutions will rise. Companies are likely to prioritize real-time tracking and data analytics, enhancing operational efficiency. Furthermore, the integration of sustainable practices will shape the market, as organizations seek to align with environmental regulations and consumer expectations, fostering a more resilient and adaptive industry landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Third-Party Logistics (3PL) Inventory Management Software Providers (SaaS) Managed Inventory Services Inventory Consulting & Advisory Services Integrated Supply Chain Solutions |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Food & Beverage Others |

| By Industry Vertical | Consumer Goods Automotive Electronics & Electricals Pharmaceuticals & Healthcare Food & Beverage Others |

| By Service Model | On-Demand Inventory Services Subscription-Based Inventory Services Pay-Per-Use Inventory Services Hybrid Models |

| By Geographic Coverage | National Providers Regional Providers Local Providers Cross-Border/International Providers |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Multinational Corporations |

| By Pricing Model | Fixed Pricing Variable Pricing Tiered Pricing Performance-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Supply Chain Analysts |

| Manufacturing Outsourcing Practices | 80 | Operations Managers, Procurement Specialists |

| E-commerce Fulfillment Strategies | 90 | Logistics Coordinators, eCommerce Managers |

| Third-Party Logistics Engagement | 60 | 3PL Managers, Business Development Executives |

| Technology Adoption in Inventory Management | 50 | IT Managers, Supply Chain Technology Specialists |

The Australia Inventory Management Outsourcing Market is valued at approximately AUD 10.7 billion, reflecting a significant growth driven by the demand for efficient supply chain solutions and the rise of e-commerce platforms requiring advanced inventory control.