Region:Europe

Author(s):Shubham

Product Code:KRAA1070

Pages:90

Published On:August 2025

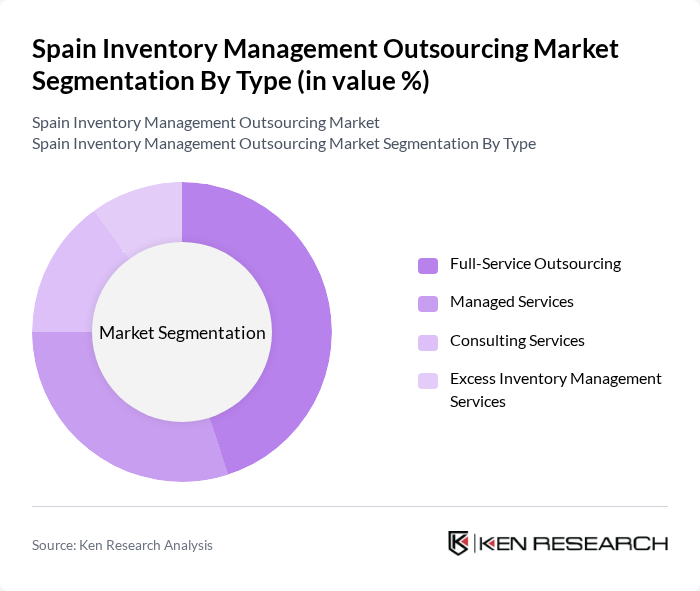

By Type:The segmentation by type includes Full-Service Outsourcing, Managed Services, Consulting Services, and Excess Inventory Management Services. Full-Service Outsourcing leads the market, as organizations seek end-to-end solutions covering procurement, warehousing, fulfillment, and analytics. Managed Services are gaining traction due to their flexibility and scalability, supporting businesses in adapting to demand fluctuations and technology integration. Consulting Services provide strategic guidance for process optimization and technology adoption, while Excess Inventory Management Services help companies minimize losses from overstock and obsolete inventory through liquidation, remarketing, and consignment solutions .

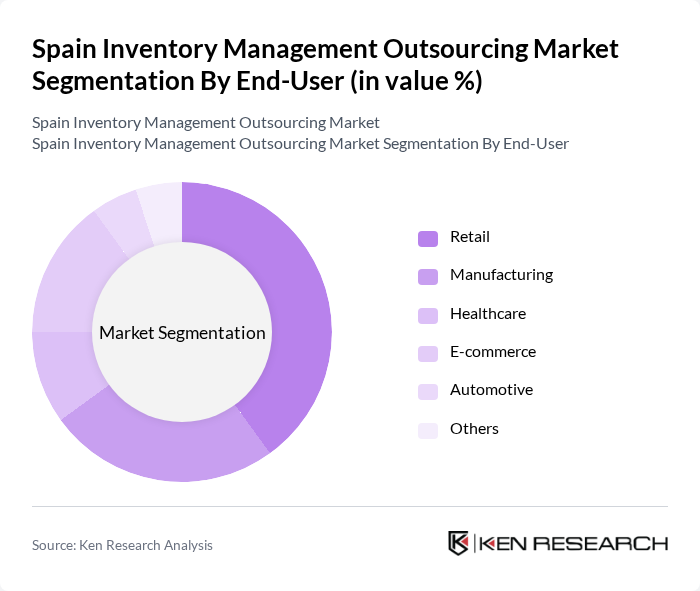

By End-User:The end-user segmentation includes Retail, Manufacturing, Healthcare, E-commerce, Automotive, and Others. The Retail sector is the dominant segment, propelled by the surge in online shopping and omnichannel strategies that require agile and accurate inventory management. E-commerce is a significant contributor, as businesses demand real-time inventory visibility and rapid fulfillment capabilities. Manufacturing and Automotive sectors are increasingly outsourcing inventory management to streamline operations, reduce costs, and enhance supply chain resilience. Healthcare organizations are also turning to outsourcing to ensure compliance, traceability, and efficiency in inventory handling .

The Spain Inventory Management Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture, Capgemini, Geodis, DHL Supply Chain Spain, CEVA Logistics, GXO Logistics, Logista, FM Logistic Iberica, ID Logistics, Grupo Sesé, DB Schenker Spain, Kuehne + Nagel Spain, XPO Logistics Spain, Alfil Logistics, and Carreras Grupo Logístico contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain inventory management outsourcing market appears promising, driven by ongoing technological advancements and the increasing complexity of supply chains. As businesses continue to embrace digital transformation, the integration of AI and IoT technologies will enhance inventory accuracy and efficiency. Furthermore, the growing emphasis on sustainability will encourage companies to adopt eco-friendly practices in their inventory management processes, fostering a more resilient and adaptive market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Outsourcing Managed Services Consulting Services Excess Inventory Management Services |

| By End-User | Retail Manufacturing Healthcare E-commerce Automotive Others |

| By Service Model | On-Premise Cloud-Based Hybrid |

| By Industry Vertical | Consumer Goods Automotive Electronics Pharmaceuticals Food & Beverage Others |

| By Geographic Coverage | National (Madrid, Barcelona, Valencia, Seville, Bilbao, Zaragoza, etc.) Regional Local |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Supply Chain Managers, Inventory Control Specialists |

| Manufacturing Outsourcing Strategies | 80 | Operations Directors, Procurement Managers |

| E-commerce Fulfillment Solutions | 90 | Logistics Coordinators, E-commerce Operations Managers |

| Third-party Logistics Providers | 70 | Business Development Managers, Client Relationship Managers |

| Technology Integration in Inventory Management | 50 | IT Managers, Systems Analysts |

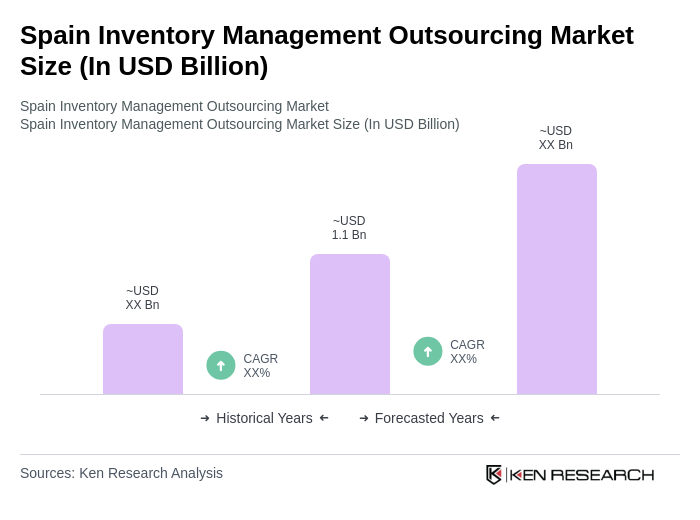

The Spain Inventory Management Outsourcing Market is valued at approximately USD 1.1 billion, reflecting a strong demand for outsourced inventory solutions as businesses prioritize supply chain efficiency and cost optimization, particularly in the context of growing e-commerce and omnichannel retailing.