Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA1965

Pages:98

Published On:August 2025

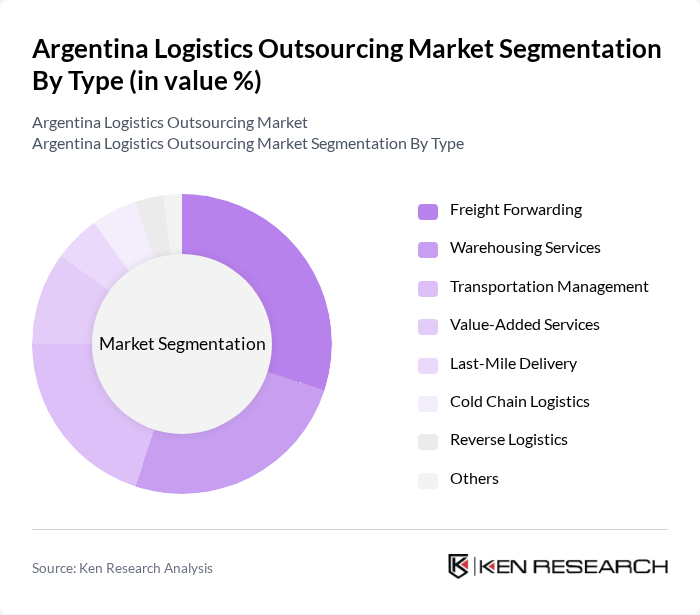

By Type:The logistics outsourcing market can be segmented into various types, including Freight Forwarding, Warehousing Services, Transportation Management, Value-Added Services, Last-Mile Delivery, Cold Chain Logistics, Reverse Logistics, and Others. Each of these segments plays a crucial role in the overall logistics ecosystem, catering to different customer needs and operational requirements. Freight Forwarding and Transportation Management are particularly significant due to Argentina’s strong agricultural exports and the need for efficient intermodal solutions. Warehousing Services and Cold Chain Logistics are also growing, driven by rising demand in food processing, pharmaceuticals, and e-commerce fulfillment .

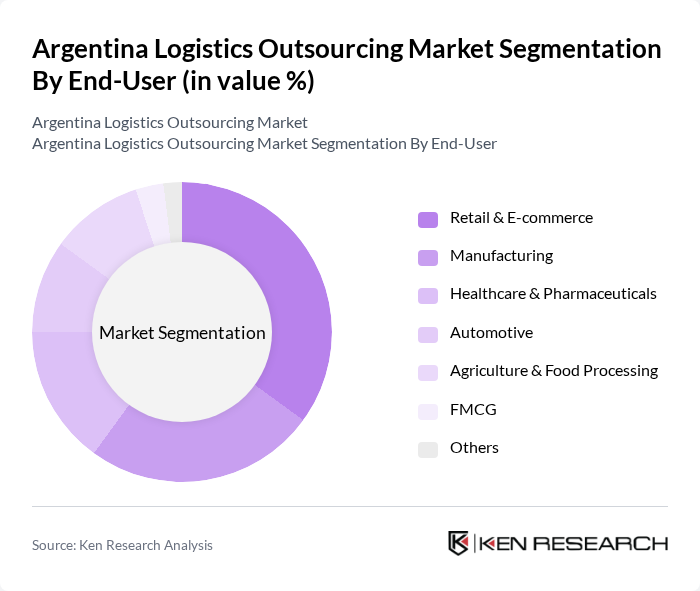

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Agriculture & Food Processing, FMCG, and Others. Each sector has unique logistics requirements, influencing the demand for specific logistics services and solutions. Retail & E-commerce leads due to the surge in online shopping and demand for fast, reliable delivery. Manufacturing and Agriculture & Food Processing are also major contributors, reflecting Argentina’s industrial and export strengths. Healthcare & Pharmaceuticals and FMCG segments are expanding, driven by the need for specialized logistics such as cold chain and value-added services .

The Argentina Logistics Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain Argentina, Kuehne + Nagel Argentina, Grupo TASA Logística, Logística y Transporte S.A., Andreani Logística, Cencosud Logistics, TGL Argentina, Translogística, OCA S.A., CTC Argentina, Cargotrans, FedEx Argentina, UPS Argentina, Grupo Logístico Andreani, Logística Integral S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The logistics outsourcing market in Argentina is poised for transformation, driven by technological advancements and evolving consumer preferences. As companies increasingly adopt automation and AI technologies, operational efficiencies are expected to improve significantly. Additionally, the focus on sustainable logistics practices will likely shape future investments, with businesses seeking eco-friendly solutions. The integration of IoT technologies will enhance real-time tracking and inventory management, further optimizing logistics operations and meeting the demands of a dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Warehousing Services Transportation Management Value-Added Services Last-Mile Delivery Cold Chain Logistics Reverse Logistics Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Agriculture & Food Processing FMCG Others |

| By Service Model | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Integrated Logistics Services Onshore Logistics Outsourcing Nearshoring Logistics Outsourcing Offshoring Logistics Outsourcing Others |

| By Distribution Mode | Road Transport Rail Transport Air Freight Sea Freight Inland Waterways Multimodal Transport Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Performance-Based Pricing Others |

| By Customer Type | SMEs Large Enterprises Government Agencies Others |

| By Geographic Coverage | Urban Areas Rural Areas Cross-Border Logistics Export Corridors (e.g., Mercosur) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Outsourcing | 100 | Logistics Managers, Supply Chain Executives |

| Pharmaceutical Distribution | 60 | Operations Directors, Compliance Officers |

| Automotive Supply Chain Management | 50 | Procurement Managers, Logistics Coordinators |

| Food and Beverage Logistics | 40 | Warehouse Managers, Quality Assurance Leads |

| E-commerce Fulfillment Services | 50 | eCommerce Operations Managers, Distribution Center Supervisors |

The Argentina Logistics Outsourcing Market is valued at approximately USD 12 billion, driven by the growing demand for efficient supply chain solutions, e-commerce expansion, and technological investments in logistics services.