Region:Central and South America

Author(s):Dev

Product Code:KRAA0441

Pages:99

Published On:August 2025

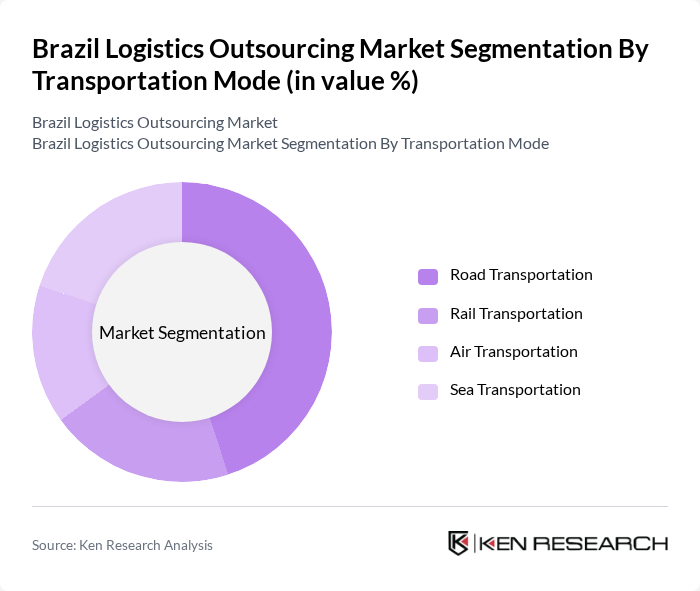

By Transportation Mode:The transportation mode segment includes various methods of moving goods, each with its unique advantages and applications. The primary modes are road, rail, air, and sea transportation. Road transportation is favored for its flexibility and reach, especially for domestic distribution. Rail is preferred for bulk commodities and long-haul freight, offering cost efficiency over long distances. Air transportation is essential for time-sensitive and high-value deliveries, while sea transportation is crucial for international trade and large-volume shipments .

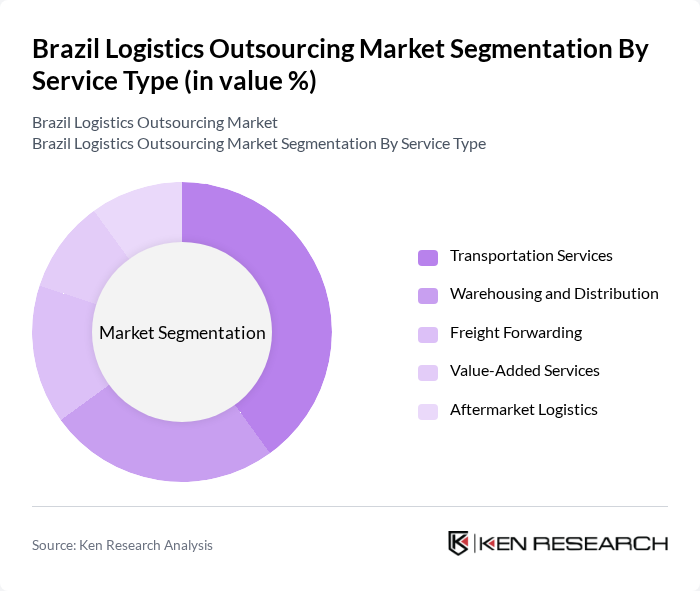

By Service Type:This segment encompasses various logistics services, including transportation services, warehousing and distribution, freight forwarding, value-added services, and aftermarket logistics. Transportation services form the backbone of logistics operations, ensuring timely and reliable movement of goods. Warehousing and distribution support inventory management and order fulfillment, while freight forwarding manages complex international shipments. Value-added services—such as packaging, labeling, and reverse logistics—enhance supply chain efficiency and customer satisfaction. Aftermarket logistics addresses post-sale support, including returns and repairs .

The Brazil Logistics Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as JSL S.A., Grupo TPC, Loggi Tecnologia, DHL Supply Chain Brazil, Kuehne + Nagel Brasil, DB Schenker Brasil, FedEx Express Brasil, Rumo Logística, Translovato, Movida Logística, GOLLOG (GOL Linhas Aéreas), Cargill Transportes e Logística, Grupo Águia Branca, VLI Logística, Tegma Gestão Logística contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's logistics outsourcing market appears promising, driven by the ongoing digital transformation and increasing consumer expectations. As companies prioritize efficiency and sustainability, the integration of advanced technologies will play a crucial role in shaping logistics operations. Furthermore, the expansion of e-commerce and infrastructure improvements will likely create new opportunities for logistics providers, fostering a competitive environment that encourages innovation and collaboration among industry players.

| Segment | Sub-Segments |

|---|---|

| By Transportation Mode | Road Transportation Rail Transportation Air Transportation Sea Transportation |

| By Service Type | Transportation Services Warehousing and Distribution Freight Forwarding Value-Added Services Aftermarket Logistics |

| By Industry Vertical | Automotive Retail & E-commerce Healthcare & Pharmaceuticals Consumer Goods Food and Beverage Chemicals Construction Others |

| By Service Model | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Dedicated Contract Carriage Integrated Logistics Services Others |

| By Geographic Coverage | National Coverage Regional Coverage Local Coverage International Coverage Others |

| By Technology Utilization | Automated Warehousing Real-Time Tracking Systems Data Analytics Blockchain Technology Others |

| By Customer Type | B2B B2C C2C Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Outsourcing | 100 | Logistics Managers, Supply Chain Executives |

| Manufacturing Supply Chain Management | 80 | Operations Directors, Procurement Managers |

| E-commerce Fulfillment Strategies | 90 | eCommerce Operations Managers, Logistics Coordinators |

| Pharmaceutical Distribution Networks | 60 | Supply Chain Analysts, Regulatory Affairs Managers |

| Automotive Parts Logistics | 50 | Warehouse Managers, Logistics Directors |

The Brazil Logistics Outsourcing Market is valued at approximately USD 26 billion, reflecting significant growth driven by the demand for efficient supply chain solutions, e-commerce expansion, and technology-driven logistics services.