Region:Middle East

Author(s):Shubham

Product Code:KRAA1076

Pages:94

Published On:August 2025

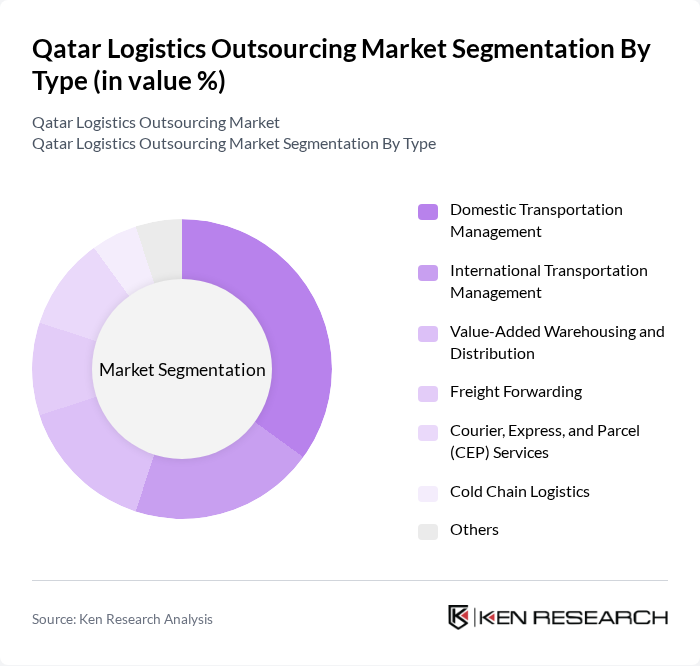

By Type:The logistics outsourcing market in Qatar is segmented into various types, including Domestic Transportation Management, International Transportation Management, Value-Added Warehousing and Distribution, Freight Forwarding, Courier, Express, and Parcel (CEP) Services, Cold Chain Logistics, and Others. Domestic Transportation Management is currently the leading sub-segment, driven by the increasing demand for efficient local delivery services and the growth of e-commerce. The rise in consumer expectations for faster delivery times has led to a surge in domestic logistics solutions, making this segment a critical focus for logistics providers. The demand for cold chain logistics is also increasing, particularly for pharmaceuticals and food products, while freight forwarding and CEP services are expanding due to Qatar's role as a regional trade hub .

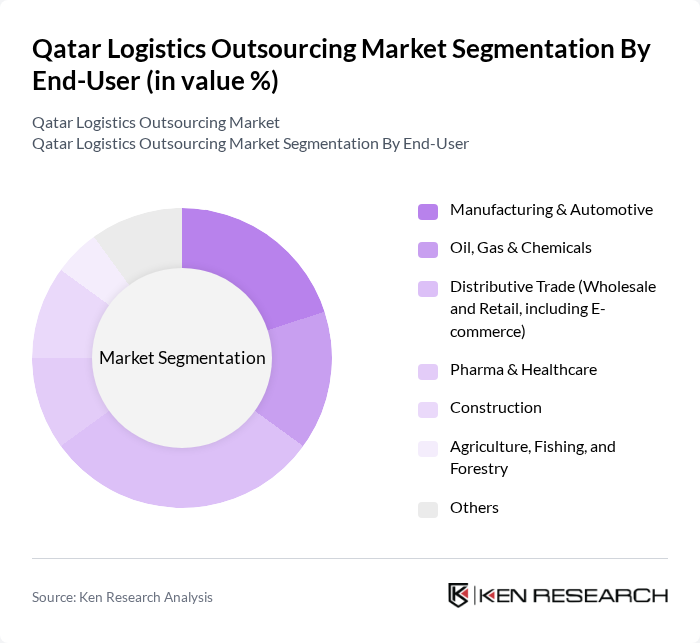

By End-User:The end-user segmentation of the logistics outsourcing market includes Manufacturing & Automotive, Oil, Gas & Chemicals, Distributive Trade (Wholesale and Retail, including E-commerce), Pharma & Healthcare, Construction, Agriculture, Fishing, and Forestry, and Others. The Distributive Trade segment is currently the most significant contributor, fueled by the rapid growth of e-commerce and retail sectors in Qatar. The increasing consumer preference for online shopping has necessitated efficient logistics solutions, making this segment a focal point for logistics service providers. The pharma and healthcare segment is also growing due to heightened demand for temperature-controlled logistics, while construction and manufacturing continue to drive demand for specialized logistics services .

The Qatar Logistics Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Warehousing Company (GWC), Agility Logistics, DB Schenker Qatar, Kuehne + Nagel Qatar, DHL Supply Chain Qatar, CEVA Logistics Qatar, Aramex Qatar, FedEx Express Qatar, UPS Supply Chain Solutions Qatar, Al-Futtaim Logistics Qatar, Qatar Airways Cargo, Mena Logistics, Qatar National Import and Export Co., Milaha (Qatar Navigation), Qatar Post contribute to innovation, geographic expansion, and service delivery in this space .

The future of the logistics outsourcing market in Qatar appears promising, driven by ongoing government initiatives and technological advancements. As the nation continues to enhance its infrastructure and embrace digital transformation, logistics providers are likely to adopt innovative solutions that improve efficiency and reduce costs. Furthermore, the increasing focus on sustainability will push companies to implement eco-friendly practices, aligning with global trends and consumer expectations, thereby fostering growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Transportation Management International Transportation Management Value-Added Warehousing and Distribution Freight Forwarding Courier, Express, and Parcel (CEP) Services Cold Chain Logistics Others |

| By End-User | Manufacturing & Automotive Oil, Gas & Chemicals Distributive Trade (Wholesale and Retail, including E-commerce) Pharma & Healthcare Construction Agriculture, Fishing, and Forestry Others |

| By Service Model | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Integrated Logistics Services Dedicated Contract Carriage Others |

| By Distribution Mode | Road Transport Air Freight Sea and Inland Waterways Rail Transport Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| By Customer Type | B2B B2C Government Others |

| By Geographic Coverage | Domestic Regional International Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Outsourcing | 60 | Logistics Managers, Supply Chain Executives |

| Healthcare Supply Chain Management | 50 | Operations Directors, Procurement Managers |

| Construction Material Logistics | 40 | Project Managers, Logistics Coordinators |

| Food and Beverage Distribution | 45 | Warehouse Managers, Distribution Supervisors |

| E-commerce Fulfillment Services | 55 | eCommerce Operations Managers, Logistics Analysts |

The Qatar Logistics Outsourcing Market is valued at approximately USD 6 billion, driven by infrastructure expansion, increased trade activities, and the demand for efficient supply chain solutions. This growth reflects Qatar's strategic position as a trade gateway between Europe, Asia, and Africa.