Region:Africa

Author(s):Shubham

Product Code:KRAA0680

Pages:86

Published On:August 2025

By Type:The logistics outsourcing market is segmented into Freight Forwarding, Warehousing and Storage, Transportation Services (Road, Rail, Air, Sea), Courier, Express, and Parcel (CEP), Value-Added Services (such as packaging, labeling, quality control, and reverse logistics), Supply Chain Management, and Others. Each segment addresses distinct operational requirements, with transportation services and freight forwarding forming the backbone of the sector, while value-added services and supply chain management are increasingly sought after for their role in optimizing efficiency and customer satisfaction .

By End-User:The end-user segmentation of the logistics outsourcing market includes Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, Pharmaceuticals, Automotive, Food and Beverage, E-commerce, and Others. Each sector has unique logistics requirements, with wholesale and retail trade, manufacturing, and construction representing the largest demand for outsourced logistics services due to their scale and complexity .

The South Africa Logistics Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Imperial Logistics, Bidvest International Logistics, DHL Supply Chain South Africa, Kuehne + Nagel South Africa, Transnet Freight Rail, Barloworld Logistics, Grindrod Limited, DSV South Africa, Rhenus Logistics South Africa, Value Logistics, Onelogix Group, Laser Logistics, SAA Cargo, UTi Worldwide (now part of DSV), Cargo Carriers Limited contribute to innovation, geographic expansion, and service delivery in this space.

The South African logistics outsourcing market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As companies increasingly adopt digital solutions, the integration of AI and IoT in logistics operations will enhance efficiency and transparency. Furthermore, the focus on sustainability will lead to the development of eco-friendly logistics practices, aligning with global trends. These factors will create a dynamic environment for logistics outsourcing, fostering innovation and competitiveness in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Warehousing and Storage Transportation Services (Road, Rail, Air, Sea) Courier, Express, and Parcel (CEP) Value-Added Services (Packaging, Labeling, Quality Control, Reverse Logistics) Supply Chain Management Others |

| By End-User | Agriculture, Fishing, and Forestry Construction Manufacturing Oil and Gas, Mining and Quarrying Wholesale and Retail Trade Pharmaceuticals Automotive Food and Beverage E-commerce Others |

| By Service Model | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Brokerage Integrated Logistics Services Others |

| By Distribution Mode | Road Rail Air Sea and Inland Waterways Intermodal Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Performance-Based Pricing Others |

| By Customer Type | B2B B2C Government Non-Profit Others |

| By Geographic Coverage | National Regional International Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Outsourcing | 100 | Logistics Coordinators, Supply Chain Managers |

| Manufacturing Supply Chain Management | 80 | Operations Directors, Procurement Managers |

| E-commerce Fulfillment Strategies | 90 | eCommerce Operations Managers, Logistics Analysts |

| Transportation Management Solutions | 60 | Fleet Managers, Transportation Directors |

| Third-Party Logistics Partnerships | 50 | Business Development Managers, Client Relationship Managers |

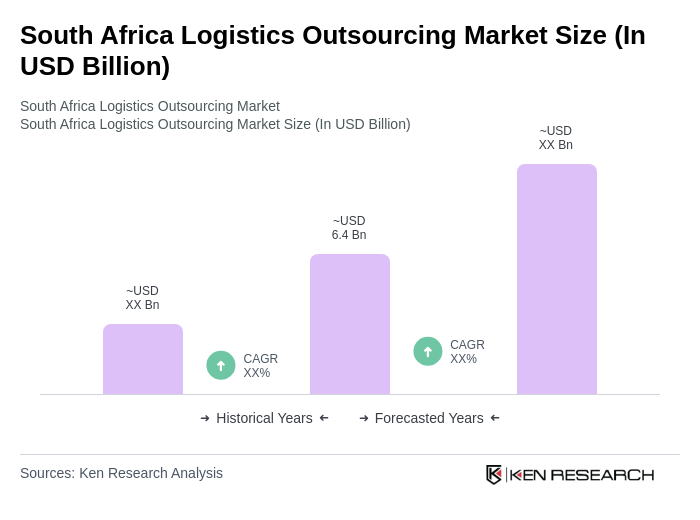

The South Africa Logistics Outsourcing Market is valued at approximately USD 6.4 billion, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient supply chain solutions and the rapid expansion of e-commerce.