Region:Central and South America

Author(s):Shubham

Product Code:KRAA1917

Pages:100

Published On:August 2025

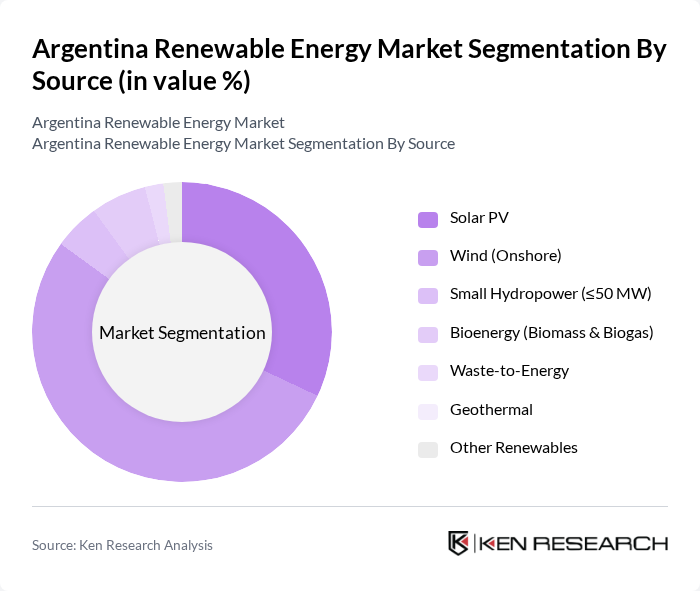

By Source:The market is segmented into solar PV, wind (onshore), small hydropower, bioenergy, waste-to-energy, geothermal, and other renewables. Wind currently leads installed non-hydro renewable capacity due to exceptional Patagonia wind resources, while solar PV is expanding rapidly in the Northwest; small hydro, biomass/biogas and WtE contribute smaller shares.

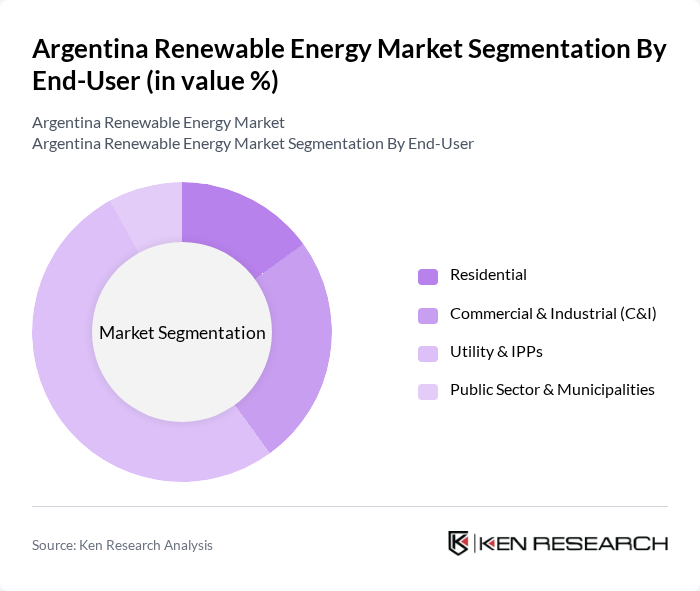

By End-User:The end-user segmentation includes residential, commercial & industrial (C&I), utility & independent power producers (IPPs), and public sector & municipalities. Utility-scale and IPP-led projects dominate grid-connected additions through tenders and private market contracts; C&I demand is rising via corporate PPAs and self-generation schemes, while residential and municipal programs remain smaller in aggregate.

The Argentina Renewable Energy Market features leading participants such as YPF Luz (YPF Energía Eléctrica S.A.), Genneia S.A., Pampa Energía S.A., Central Puerto S.A., AES Argentina Generación S.A., Enel Green Power Argentina S.A., Acciona Energía (Argentina), TotalEnergies (Total Eren Argentina), Solarpack (Argentina), Canadian Solar (Argentina), Vestas Argentina, Siemens Gamesa Renewable Energy (Argentina), Nordex Group (Nordex-Acciona Windpower Argentina), 360 Energy S.A., Verano Energy (Argentina), which drive utility-scale wind and solar buildout, corporate PPAs, and equipment supply.

The future of Argentina's renewable energy market appears promising, driven by increasing energy demand and supportive government policies. In the near future, the country is expected to enhance its renewable energy capacity significantly, with a focus on solar and wind projects. The integration of smart grid technologies and energy storage solutions will further optimize energy distribution. However, addressing regulatory uncertainties and infrastructure challenges will be crucial for sustaining growth and attracting international investments in the sector.

| Segment | Sub-Segments |

|---|---|

| By Source | Solar PV Wind (Onshore) Small Hydropower (?50 MW) Bioenergy (Biomass & Biogas) Waste-to-Energy Geothermal Other Renewables |

| By End-User | Residential Commercial & Industrial (C&I) Utility & IPPs Public Sector & Municipalities |

| By Investment & Financing Mechanism | Domestic Private Capital Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Programs (e.g., RenovAr/MATER) |

| By Connection/Application | Grid-Connected (Utility-Scale) Distributed Generation (DG) Off-Grid & Remote Systems Rooftop & Behind-the-Meter |

| By Policy Instrument | Fiscal Incentives (Tax Credits/Exemptions) Net Metering / Distributed Generation Regime Renewable PPAs (MATER) Renewable Energy Certificates / Guarantees of Origin |

| By Technology | Solar Photovoltaic (Crystalline, Thin-Film) Concentrated Solar Power (CSP) Onshore Wind Turbines Energy Storage Coupled (Hybrid) |

| By Regional Resource Cluster | Patagonia (Wind) Northwest/NOA (Solar) Cuyo (Solar & Wind) Buenos Aires Province & Pampas (Wind & Demand Centers) Northeast/NEA (Biomass & Small Hydro) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Solar Energy Developers | 100 | Project Managers, Business Development Managers |

| Wind Energy Operators | 80 | Operations Managers, Technical Directors |

| Hydropower Facility Managers | 60 | Plant Managers, Environmental Compliance Officers |

| Government Energy Policy Makers | 50 | Regulatory Affairs Specialists, Energy Policy Analysts |

| Investors in Renewable Projects | 70 | Investment Analysts, Portfolio Managers |

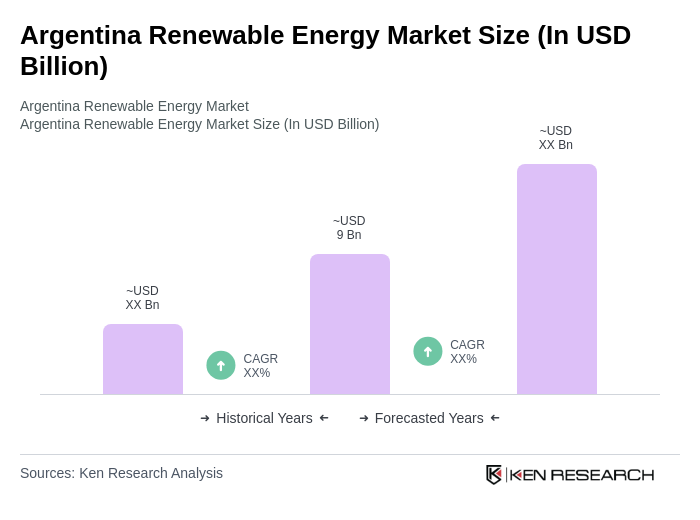

The Argentina Renewable Energy Market is valued at approximately USD 9 billion, driven by government policies aimed at increasing the share of renewables in the power mix, strong wind and solar resources, and ongoing capacity additions through public tenders and private investments.