Region:Europe

Author(s):Dev

Product Code:KRAB0617

Pages:99

Published On:August 2025

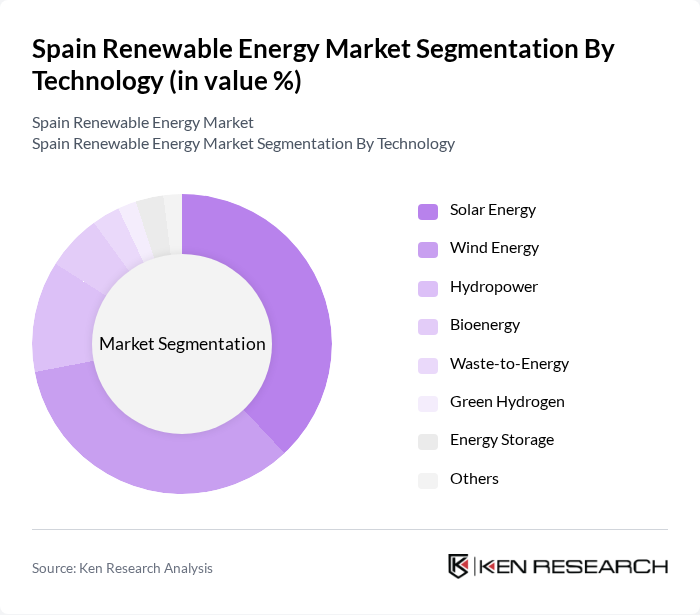

By Technology:The technology segment of the renewable energy market includes various sources such as solar energy, wind energy, hydropower, bioenergy, waste-to-energy, green hydrogen, energy storage, and others. Each of these technologies plays a crucial role in the overall energy landscape, with solar and wind energy being the most prominent due to their scalability and decreasing costs .

The solar energy segment is currently dominating the market, driven by decreasing costs of photovoltaic technology and favorable government policies. The increasing adoption of solar panels in residential and commercial sectors reflects a growing consumer preference for sustainable energy solutions. Additionally, advancements in energy storage technologies are enhancing the viability of solar energy, making it a preferred choice for many consumers and businesses .

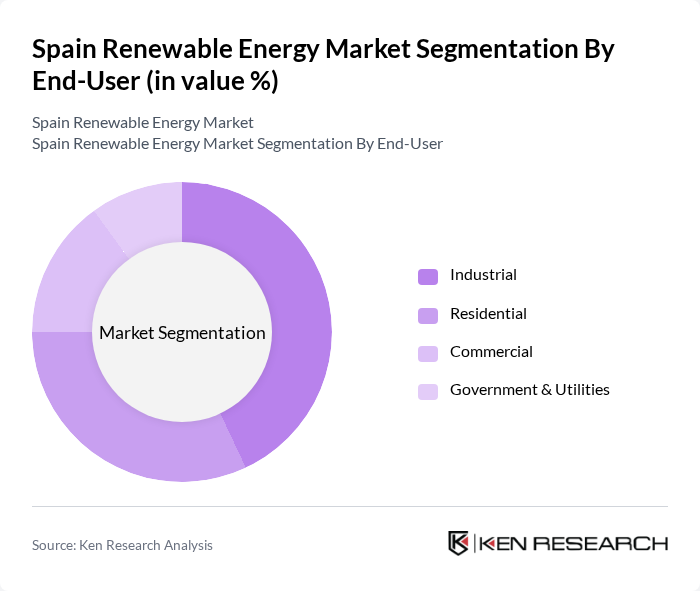

By End-User:The end-user segmentation includes industrial, residential, commercial, and government & utilities sectors. Each sector has unique energy needs and consumption patterns, influencing the adoption of renewable technologies. The industrial sector is a significant consumer due to its high energy demands, while residential and commercial sectors are increasingly adopting renewable solutions for sustainability and cost savings .

The industrial sector is leading the market, primarily due to its substantial energy requirements and the push for sustainability. Industries are increasingly investing in renewable energy to reduce operational costs and meet regulatory requirements. The residential sector is also growing rapidly, driven by consumer awareness and government incentives for solar installations, making it a significant contributor to the overall market .

The Spain Renewable Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Iberdrola S.A., Acciona Energía, Endesa S.A., Siemens Gamesa Renewable Energy S.A., EDP Renováveis S.A., Solaria Energía y Medio Ambiente S.A., Fotowatio Renewable Ventures (FRV), Naturgy Energy Group S.A., Green Eagle Solutions, Grenergy Renovables S.A., Capital Energy, Plenium Partners, Ecooo Energía Ciudadana, Enel Green Power España S.L., Vestas Mediterranean S.A.U. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the renewable energy market in Spain appears promising, driven by increasing investments in innovative technologies and a strong commitment to sustainability. The government’s ambitious targets for renewable energy generation, coupled with rising consumer demand for green energy, are expected to foster significant growth. Additionally, the integration of smart grid technologies and energy management systems will enhance efficiency and reliability, paving the way for a more resilient energy landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Technology | Solar Energy Wind Energy Hydropower Bioenergy Waste-to-Energy Green Hydrogen Energy Storage Others |

| By End-User | Industrial Residential Commercial Government & Utilities |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Solar Energy Developers | 100 | Project Managers, Business Development Executives |

| Wind Energy Operators | 80 | Operations Managers, Technical Directors |

| Hydropower Facility Managers | 60 | Plant Managers, Environmental Compliance Officers |

| Energy Policy Experts | 40 | Regulatory Affairs Specialists, Policy Analysts |

| Investors in Renewable Projects | 50 | Investment Analysts, Portfolio Managers |

The Spain Renewable Energy Market is valued at approximately USD 23 billion, driven by increasing demand for sustainable energy solutions, government initiatives, and technological advancements that enhance energy efficiency.