Region:Europe

Author(s):Dev

Product Code:KRAB0584

Pages:90

Published On:August 2025

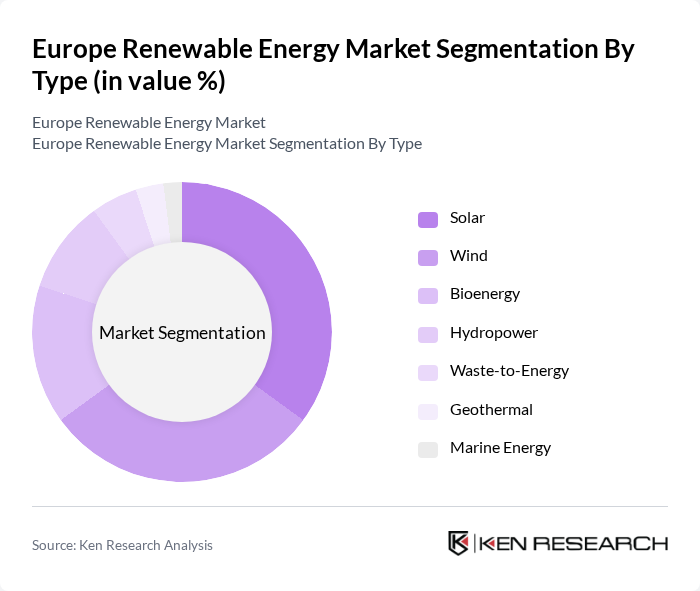

By Type:The market is segmented into various types of renewable energy sources, including solar, wind, bioenergy, hydropower, waste-to-energy, geothermal, and marine energy. Solar and wind are the fastest-growing segments, driven by declining installation costs and supportive policy frameworks. Bioenergy and hydropower remain essential for grid stability, while waste-to-energy, geothermal, and marine energy contribute to diversification and innovation within the energy mix.

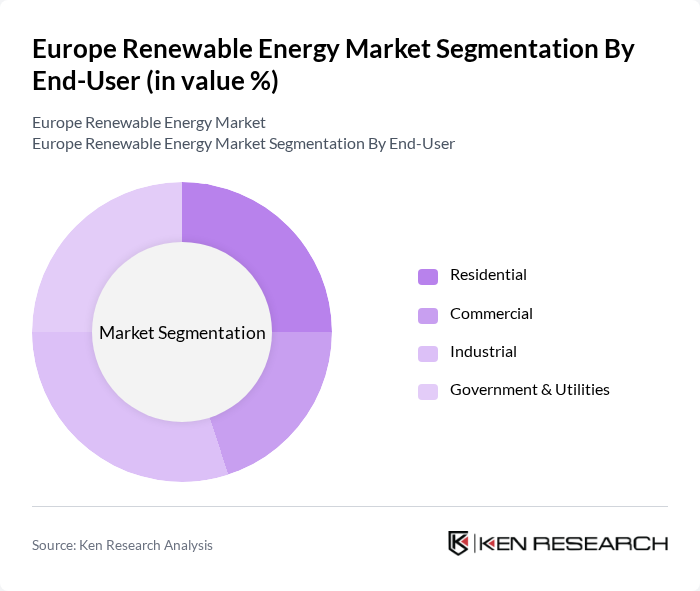

By End-User:The end-user segmentation includes residential, commercial, industrial, and government & utilities sectors. Residential and commercial segments are increasingly adopting distributed solar and energy storage solutions, while industrial users focus on large-scale wind and bioenergy projects for decarbonization. Government and utilities drive grid-scale investments and policy implementation, shaping the overall market direction.

The Europe Renewable Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Gamesa Renewable Energy, Vestas Wind Systems A/S, Ørsted A/S, Enel Green Power S.p.A., EDP Renováveis S.A., RWE AG, Iberdrola S.A., TotalEnergies SE, Engie S.A., Acciona Energía, Statkraft AS, Nordex SE, E.ON SE, Brookfield Renewable Partners L.P., Vattenfall AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the renewable energy market in Europe appears promising, driven by increasing investments and technological innovations. It is anticipated that renewable energy will constitute amajority share of the EU's electricity mix in future, propelled by advancements in energy storage and grid integration. Additionally, the rise of decentralized energy systems will empower consumers, allowing for greater participation in energy production and consumption, ultimately leading to a more resilient energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Wind Bioenergy Hydropower Waste-to-Energy Geothermal Marine Energy |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Power Generation Transportation Energy Storage Others |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Feed-in Tariffs |

| By Distribution Mode | Direct Sales Online Sales Distributors Retail Outlets |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wind Energy Project Development | 100 | Project Managers, Development Directors |

| Solar Energy Installation | 70 | Installation Managers, Operations Directors |

| Hydropower Generation | 50 | Plant Managers, Regulatory Affairs Specialists |

| Energy Storage Solutions | 60 | Product Managers, Technology Developers |

| Policy and Regulation Impact | 80 | Energy Policy Analysts, Government Officials |

The Europe Renewable Energy Market is valued at approximately USD 145 billion, driven by increasing investments in sustainable energy, supportive government policies, and rising consumer awareness about climate change. This market is expected to continue expanding due to ongoing technological advancements.