Middle East Renewable Energy Market Overview

- The Middle East Renewable Energy Market is valued at USD 52 billion, based on a five-year historical analysis. This growth is primarily driven by increasing investments in solar and wind energy projects, government initiatives to diversify energy sources, rapid expansion in green hydrogen, and a growing awareness of environmental sustainability among consumers and businesses. Falling costs for solar and wind technologies, large-scale desalination powered by renewables, and robust public-private partnerships are accelerating market expansion .

- Countries such as Saudi Arabia, the United Arab Emirates, and Egypt dominate the Middle East Renewable Energy Market due to their substantial investments in renewable energy infrastructure, favorable government policies, and abundant natural resources. These nations are leading the transition towards sustainable energy solutions, positioning themselves as regional leaders in renewable energy production. Iran also holds a significant share, driven by strong solar and wind resources and supportive national strategies .

- In 2023, the UAE government implemented a comprehensive renewable energy strategy aimed at increasing the share of clean energy in its energy mix to 50% by 2050. This initiative includes investments of USD 163 billion in renewable energy projects, as outlined in the UAE Energy Strategy 2050 issued by the UAE Ministry of Energy & Infrastructure. The strategy mandates operational targets for clean energy share, competitive bidding for large-scale projects, and compliance with national sustainability standards .

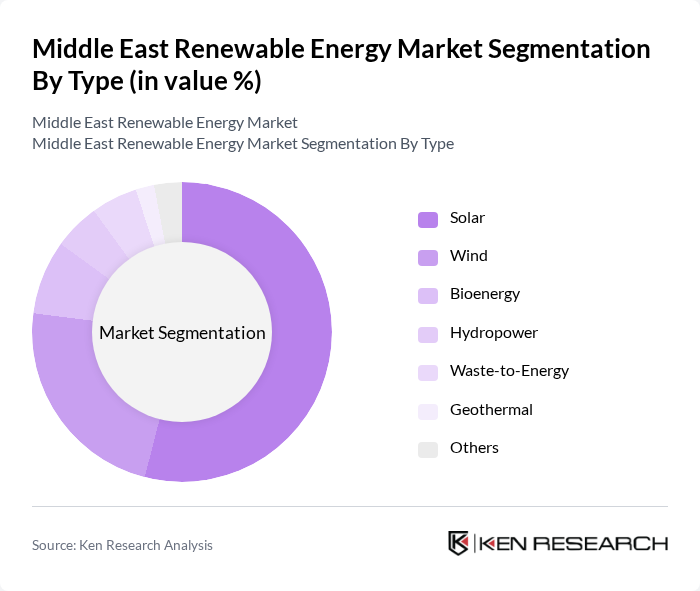

Middle East Renewable Energy Market Segmentation

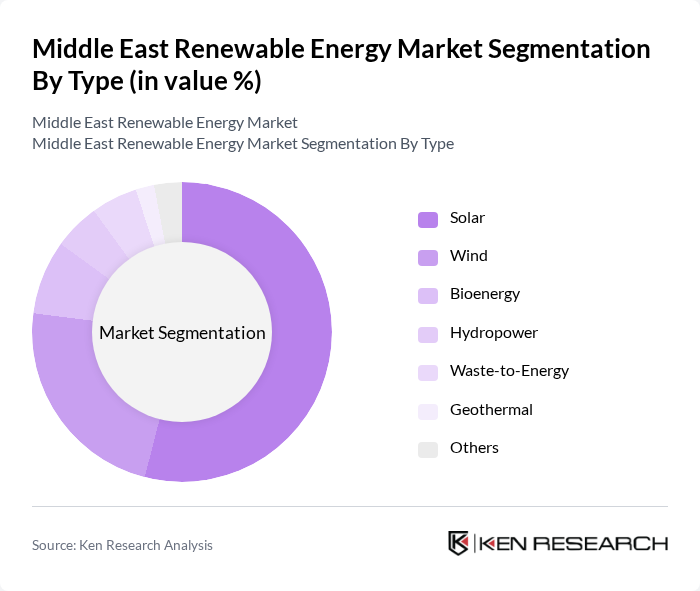

By Type:The market is segmented into various types of renewable energy sources, including solar, wind, bioenergy, hydropower, waste-to-energy, geothermal, and others. Solar power is the largest segment, accounting for over half of the market share, driven by abundant solar resources, declining photovoltaic (PV) costs, and large-scale utility projects. Wind energy follows, supported by favorable wind corridors and technology advancements. Bioenergy, hydropower, and waste-to-energy are growing steadily, with notable integration in water desalination and industrial processes. Geothermal and other sources remain niche but are expanding through pilot projects and hybrid systems .

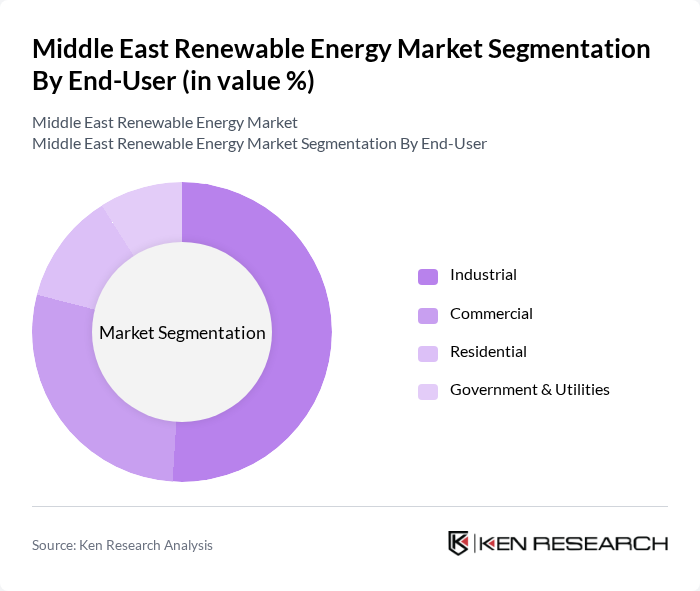

By End-User:The end-user segmentation includes industrial, commercial, residential, and government & utilities sectors. The industrial sector leads the market, driven by energy-intensive industries such as petrochemicals, cement, and manufacturing, which are adopting renewables for cost savings and sustainability. Commercial and government sectors are expanding through rooftop solar and large-scale procurement agreements. Residential adoption is increasing, supported by incentive programs and distributed generation schemes .

Middle East Renewable Energy Market Competitive Landscape

The Middle East Renewable Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as ACWA Power, Masdar, Saudi Electricity Company (SEC), Dubai Electricity and Water Authority (DEWA), Abu Dhabi National Energy Company (TAQA), EDF Renewables, Engie, TotalEnergies, JinkoSolar, Siemens Gamesa, Vestas Wind Systems A/S, Canadian Solar, Trina Solar, Enel Green Power, Brookfield Renewable Partners contribute to innovation, geographic expansion, and service delivery in this space.

Middle East Renewable Energy Market Industry Analysis

Growth Drivers

- Increasing Government Investments:The Middle East has seen substantial government investments in renewable energy, with over $20 billion allocated in future. Countries like Saudi Arabia and the UAE are leading this charge, aiming to diversify their energy portfolios. The Saudi Vision 2030 plan includes a target of generating 58.7 GW of renewable energy in future, significantly boosting the sector's growth and attracting foreign investments, which reached $5 billion in future.

- Rising Energy Demand:The region's energy demand is projected to increase by approximately 3% annually, driven by population growth and urbanization. In future, the total energy consumption in the Middle East reached approximately 1,000 TWh. This surge necessitates a shift towards renewable sources, with countries like Qatar and Kuwait investing heavily in solar and wind projects to meet future energy needs, aiming for a combined capacity of 30 GW in future.

- Technological Advancements:Technological innovations in renewable energy are enhancing efficiency and reducing costs. In future, the cost of solar photovoltaic (PV) systems dropped by approximately 13%, making solar energy more accessible. The introduction of advanced energy management systems and smart grid technologies is expected to optimize energy distribution. The Middle East is also witnessing a rise in research and development investments, with over $1 billion allocated to renewable technologies in future, fostering innovation in the sector.

Market Challenges

- Regulatory Uncertainty:The renewable energy sector in the Middle East faces significant regulatory challenges, with inconsistent policies across countries. For instance, while the UAE has established clear frameworks, other nations lack comprehensive regulations, leading to investment hesitancy. In future, only about 40% of planned renewable projects were realized due to these uncertainties, highlighting the need for cohesive regulatory environments to attract and retain investors.

- High Initial Capital Costs:The initial capital required for renewable energy projects remains a significant barrier. In future, the average investment for solar and wind projects was approximately $1.2 million per MW. This high upfront cost deters many potential investors, particularly in less affluent nations. Additionally, financing options are limited, with only about 30% of projects receiving adequate funding, which hampers the growth of the renewable energy sector in the region.

Middle East Renewable Energy Market Future Outlook

The Middle East renewable energy market is poised for transformative growth, driven by increasing investments and technological advancements. In future, the region is expected to see a significant rise in solar and wind energy projects, with a focus on sustainability and energy efficiency. Governments are likely to enhance regulatory frameworks, fostering a more conducive environment for private investments. The integration of smart technologies and energy storage solutions will further optimize energy management, paving the way for a more resilient energy landscape.

Market Opportunities

- Expansion of Solar Projects:The Middle East has immense potential for solar energy, with over 3,000 hours of sunlight annually. Countries like Saudi Arabia are planning to expand their solar capacity to 40 GW in future, creating opportunities for investment and job creation in the sector. This expansion is expected to attract over $10 billion in investments in future, significantly boosting local economies.

- Development of Wind Farms:Wind energy is gaining traction, with several countries initiating large-scale wind farm projects. The region's wind energy potential is estimated at over 80 GW, with Egypt leading the way with plans for 10 GW in future. This development is projected to generate approximately $5 billion in investments, enhancing energy security and contributing to job creation in the renewable sector.