Region:Asia

Author(s):Shubham

Product Code:KRAA1919

Pages:84

Published On:August 2025

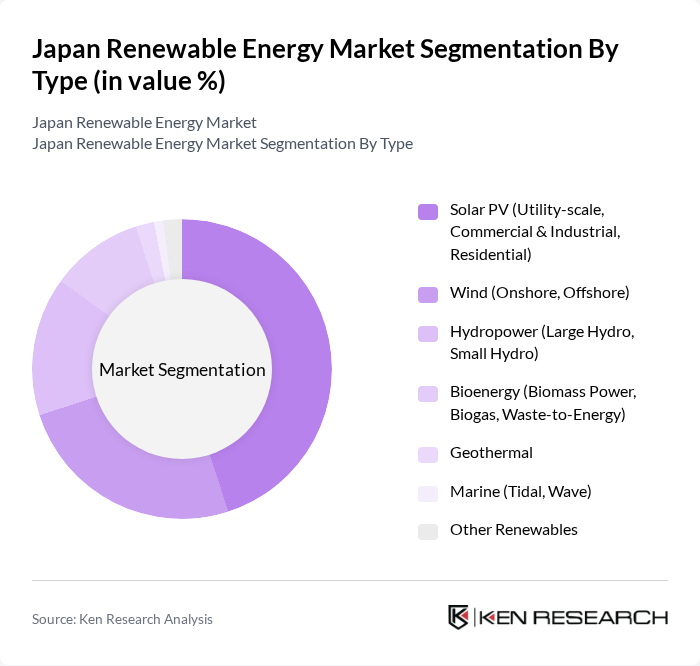

By Type:The market is segmented into various types of renewable energy sources, including solar PV, wind, hydropower, bioenergy, geothermal, marine, and other renewables. Among these, solar PV has emerged as the dominant segment due to its widespread adoption, mature project pipeline, and declining levelized costs under Japan’s feed-in schemes; national installed capacity surpasses 75 GW of renewables with solar as the largest contributor. In generation terms, renewables collectively account for roughly one-quarter of electricity, with policy support focused on scaling solar and accelerating offshore wind.

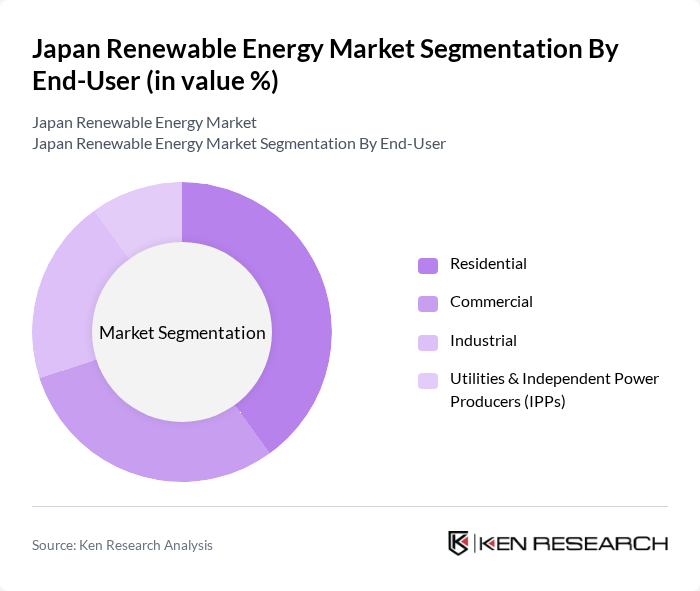

By End-User:The end-user segmentation includes residential, commercial, industrial, and utilities & independent power producers (IPPs). The residential segment is currently leading the market, supported by widespread rooftop solar adoption under feed-in incentives and net surplus sale arrangements that enable households to reduce electricity bills and emissions.

The Japan Renewable Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tokyo Electric Power Company Holdings, Inc. (TEPCO Renewable Power, Inc.), J-POWER (Electric Power Development Co., Ltd.), SoftBank Group Corp. (SB Energy Corp.), Mitsubishi Corporation (Mitsubishi Corporation Energy Solutions Ltd.), Marubeni Corporation, Kyocera Corporation, Hitachi, Ltd. (Hitachi Energy Japan), Chubu Electric Power Co., Inc. (Miraiz, Diamond Transmission Japan JV), ENEOS Corporation (ENEOS Transition/Power), Sumitomo Corporation, Japan Renewable Energy Corporation (JRE), Solar Frontier K.K., Canadian Solar Inc. (Canadian Solar Japan K.K.), JERA Co., Inc., Ørsted A/S contribute to innovation, geographic expansion, and service delivery in this space.

The future of Japan's renewable energy market appears promising, driven by technological advancements and increasing consumer demand for sustainable solutions. As the government continues to support renewable initiatives, the integration of smart grid technologies and energy storage systems will enhance efficiency and reliability. Furthermore, the growing emphasis on carbon neutrality will likely accelerate investments in innovative energy projects, positioning Japan as a leader in the renewable sector within the Asia-Pacific region.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar PV (Utility-scale, Commercial & Industrial, Residential) Wind (Onshore, Offshore) Hydropower (Large Hydro, Small Hydro) Bioenergy (Biomass Power, Biogas, Waste-to-Energy) Geothermal Marine (Tidal, Wave) Other Renewables |

| By End-User | Residential Commercial Industrial Utilities & Independent Power Producers (IPPs) |

| By Investment Source | Domestic (Corporate, Utility, Institutional) Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Programs (FIT/FIP, Subsidies, Green Finance) |

| By Application | Grid-Connected Off-Grid & Remote Rooftop & Distributed Generation Utility-Scale Projects |

| By Policy Support | Feed-in Tariff (FIT) / Feed-in Premium (FIP) Tax Incentives & Accelerated Depreciation Renewable Energy Certificates (RECs) Grid Access & Interconnection |

| By Distribution Mode | Direct Power Purchase Agreements (Corporate PPAs) Retail Electricity Providers EPCs and Project Developers Distributors/Installers |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Solar Energy Project Developers | 120 | Project Managers, Business Development Managers |

| Wind Energy Operators | 90 | Operations Managers, Technical Directors |

| Biomass Energy Producers | 60 | Production Managers, Sustainability Officers |

| Government Energy Policy Makers | 50 | Policy Analysts, Regulatory Affairs Specialists |

| Energy Consultants and Analysts | 70 | Market Analysts, Research Directors |

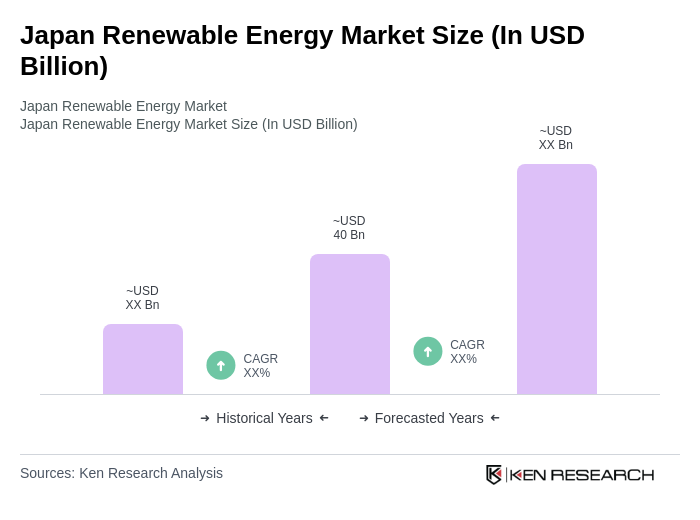

The Japan Renewable Energy Market is valued at approximately USD 40 billion, driven by government policies, technological advancements, and increased public awareness of environmental issues. This market has seen significant investments in solar, wind, and bioenergy sectors.