Region:Central and South America

Author(s):Shubham

Product Code:KRAA1814

Pages:97

Published On:August 2025

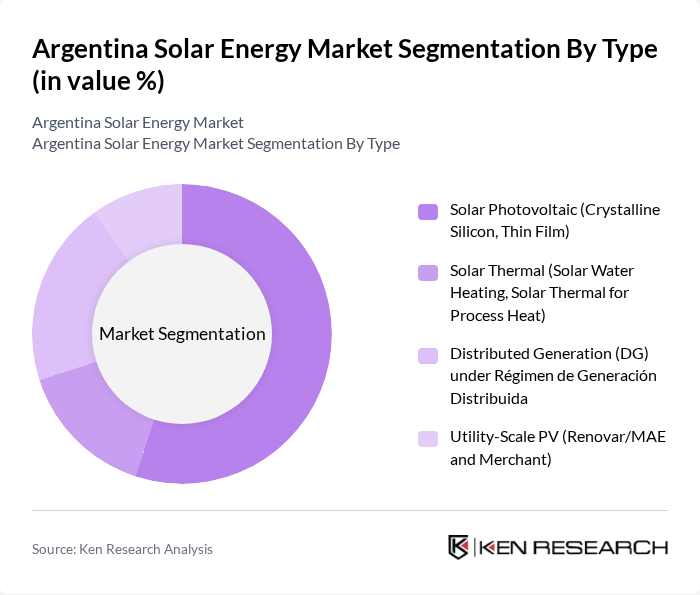

By Type:The segmentation of the market by type includes various technologies utilized in solar energy generation. The primary subsegments are Solar Photovoltaic (Crystalline Silicon, Thin Film), Solar Thermal (Solar Water Heating, Solar Thermal for Process Heat), Distributed Generation (DG) under Régimen de Generación Distribuida, and Utility-Scale PV (Renovar/MAE and Merchant). Among these, Solar Photovoltaic technology is the most dominant due to its versatility and decreasing costs, making it the preferred choice for both residential and commercial applications.

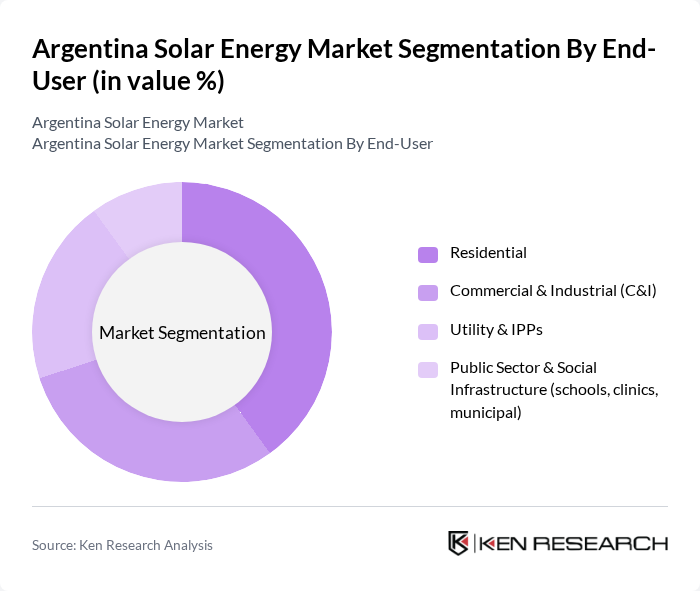

By End-User:The market segmentation by end-user includes Residential, Commercial & Industrial (C&I), Utility & IPPs, and Public Sector & Social Infrastructure (schools, clinics, municipal). The Residential segment is currently leading the market, driven by increasing consumer awareness of renewable energy benefits and government incentives for solar installations. The trend towards energy independence and sustainability is further propelling the growth of this segment; public programs for off-grid and social infrastructure have also expanded adoption in schools and clinics.

The Argentina Solar Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Genneia S.A., YPF Luz (YPF Energía Eléctrica S.A.), 360 Energy S.A., Empresa Mendocina de Energías (EMESA), Pampa Energía S.A., Enel Green Power Argentina, Canadian Solar Inc., Trina Solar Co., Ltd., JinkoSolar Holding Co., Ltd., LONGi Green Energy Technology Co., Ltd., SMA Solar Technology AG, First Solar, Inc., Solarpack Corporación Tecnológica, S.A., Acciona Energía, Risen Energy Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the solar energy market in Argentina appears promising, driven by increasing energy demands and supportive government policies. As technological advancements continue to lower costs and improve efficiency, solar energy is expected to become a more viable option for both residential and commercial users. Additionally, the growing emphasis on sustainability and corporate responsibility will likely encourage more businesses to invest in solar solutions, further expanding the market and contributing to Argentina's renewable energy goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Photovoltaic (Crystalline Silicon, Thin Film) Solar Thermal (Solar Water Heating, Solar Thermal for Process Heat) Distributed Generation (DG) under Régimen de Generación Distribuida Utility-Scale PV (Renovar/MAE and Merchant) |

| By End-User | Residential Commercial & Industrial (C&I) Utility & IPPs Public Sector & Social Infrastructure (schools, clinics, municipal) |

| By Application | Power Generation (Grid-Connected) Off-Grid and Rural Electrification Rooftop PV (Net Metering/Net Billing) Solar Heating (water heating, space/process heating) |

| By Investment Source | Domestic Private Investment Foreign Direct Investment (FDI) Project Finance (Non-Recourse, Green/Climate Funds) Public-Private Partnerships (PPP) & Multilateral-Funded Programs |

| By Policy Support | Net Metering/Distributed Generation Incentives (Ley 27.424) Tax Incentives (VAT reductions, accelerated depreciation, import benefits) Renewable Purchase Obligations/Targets (Ley 27.191) Tendered Programs (Renovar rounds, Mater/MAE corporate PPA market) |

| By Distribution Mode | EPC/Turnkey Installer/Dealer Network Direct Manufacturer Supply Online & Marketplace Sales |

| By Price Range | Residential Systems (?10 kW) C&I Systems (10 kW–5 MW) Utility-Scale Projects (>5 MW) Solar Thermal Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Installations | 150 | Homeowners, Solar Installation Companies |

| Commercial Solar Projects | 100 | Facility Managers, Energy Procurement Officers |

| Utility-Scale Solar Developments | 80 | Project Developers, Utility Executives |

| Government Policy Impact | 60 | Regulatory Officials, Policy Analysts |

| Investment Trends in Solar Energy | 70 | Investors, Financial Analysts |

The Argentina Solar Energy Market is valued at approximately USD 1.6 billion, reflecting cumulative investments and growth in installed solar capacity, supported by national renewable policies and private capital mobilization.