Region:Asia

Author(s):Shubham

Product Code:KRAB0698

Pages:93

Published On:August 2025

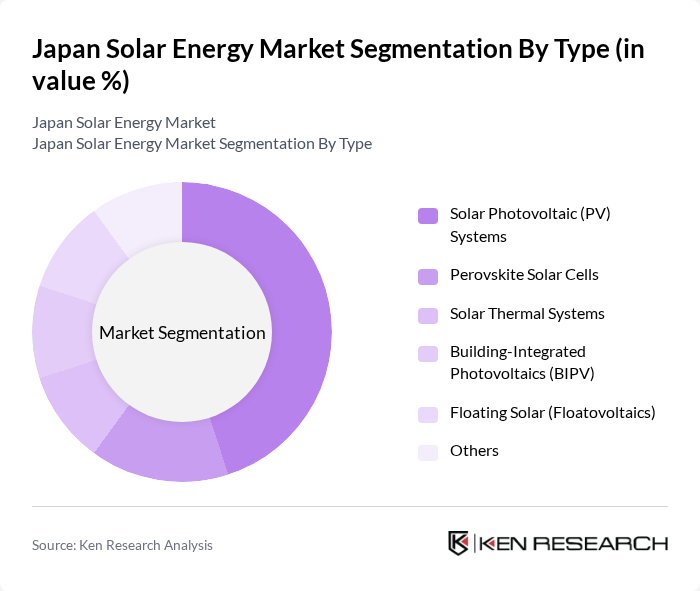

By Type:The market is segmented into various types of solar technologies, including Solar Photovoltaic (PV) Systems, Perovskite Solar Cells, Solar Thermal Systems, Building-Integrated Photovoltaics (BIPV), Floating Solar (Floatovoltaics), and Others. Among these, Solar Photovoltaic (PV) Systems dominate the market due to their widespread adoption and efficiency in converting sunlight into electricity. The increasing affordability of PV systems and advancements in technology have further propelled their popularity, making them the preferred choice for both residential and commercial applications.

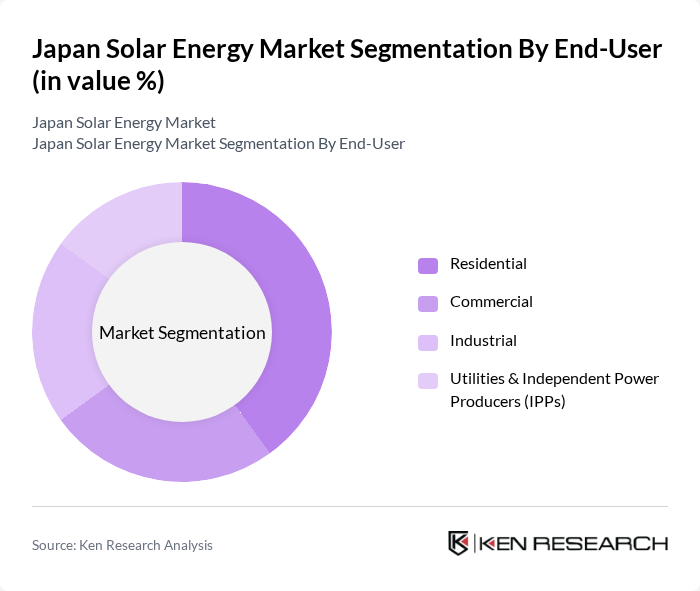

By End-User:The market is segmented by end-users into Residential, Commercial, Industrial, and Utilities & Independent Power Producers (IPPs). The Residential segment is currently the leading sub-segment, driven by increasing consumer awareness of renewable energy benefits and government incentives for home solar installations. The trend towards energy independence and rising electricity costs have also contributed to the growing adoption of solar solutions among homeowners.

The Japan Solar Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sharp Corporation, Kyocera Corporation, Panasonic Holdings Corporation, Mitsubishi Electric Corporation, Hitachi, Ltd., Solar Frontier K.K., Toshiba Corporation, Canadian Solar Inc., JinkoSolar Holding Co., Ltd., Trina Solar Limited, LONGi Green Energy Technology Co., Ltd., Hanwha Q CELLS Japan Co., Ltd., REC Group, Risen Energy Co., Ltd., SMA Solar Technology AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the solar energy market in Japan appears promising, driven by increasing investments in renewable technologies and a strong governmental push towards sustainability. In future, the integration of smart grid technologies is expected to enhance energy management, while community solar projects will likely gain traction, allowing more consumers to participate in solar energy generation. Furthermore, advancements in energy storage solutions will facilitate greater adoption of solar energy, ensuring a more resilient and sustainable energy landscape for Japan.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Photovoltaic (PV) Systems Perovskite Solar Cells Solar Thermal Systems Building-Integrated Photovoltaics (BIPV) Floating Solar (Floatovoltaics) Others |

| By End-User | Residential Commercial Industrial Utilities & Independent Power Producers (IPPs) |

| By Application | Grid-Connected Systems Off-Grid Systems Rooftop Installations Utility-Scale Projects Space-Based and Offshore Solar Projects |

| By Investment Source | Domestic Investments Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Feed-in Tariffs (FiT) Feed-in Premium (FiP) Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Installations | 100 | Homeowners, Solar Installers |

| Commercial Solar Projects | 80 | Facility Managers, Energy Managers |

| Utility-Scale Solar Developments | 60 | Project Developers, Energy Analysts |

| Government Policy Impact | 50 | Regulatory Officials, Policy Advisors |

| Solar Technology Suppliers | 40 | Manufacturers, Supply Chain Managers |

The Japan Solar Energy Market is valued at approximately USD 6 billion, reflecting significant growth driven by increasing demand for sustainable energy, government incentives, and technological advancements in solar energy systems.