Region:Europe

Author(s):Rebecca

Product Code:KRAA2167

Pages:81

Published On:August 2025

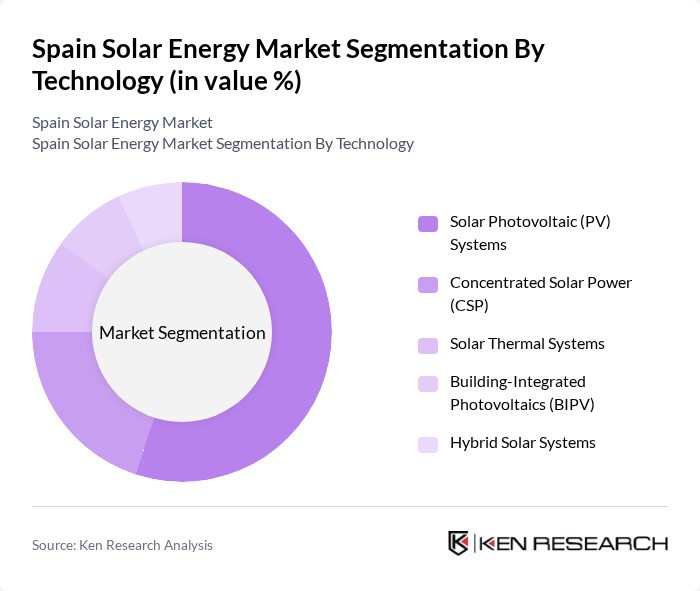

By Technology:The technology segment of the solar energy market includes various subsegments such as Solar Photovoltaic (PV) Systems, Concentrated Solar Power (CSP), Solar Thermal Systems, Building-Integrated Photovoltaics (BIPV), and Hybrid Solar Systems. Among these, Solar Photovoltaic (PV) Systems dominate the market due to their widespread adoption and decreasing costs. The increasing efficiency of PV panels, combined with the growing trend of residential and commercial solar installations, has significantly contributed to their market leadership .

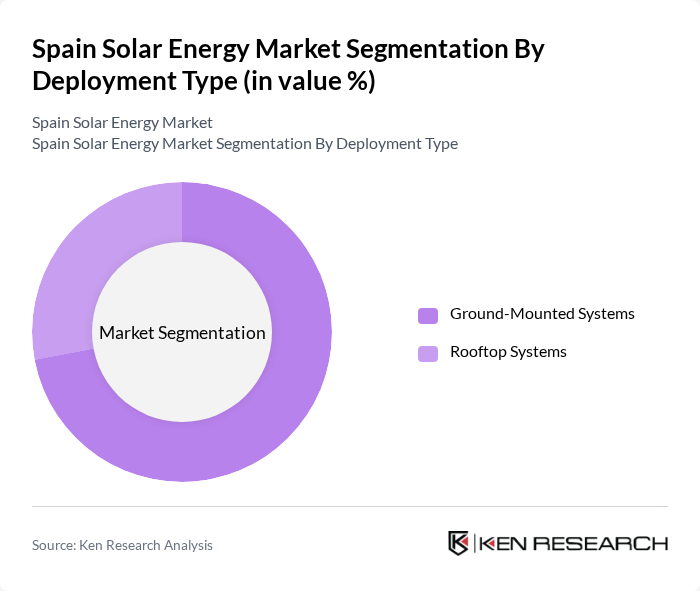

By Deployment Type:The deployment type segment encompasses Ground-Mounted Systems and Rooftop Systems. Ground-Mounted Systems are currently the leading subsegment, primarily due to the development of large-scale solar farms in rural areas with ample land. These systems benefit from economies of scale and are often more efficient than rooftop installations, which are limited by available roof space and structural considerations. Ground-mounted systems account for approximately 72% of the market, while rooftop systems represent a growing share driven by favorable policies for self-consumption and distributed generation .

The Spain Solar Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Acciona Energía, Iberdrola Renovables, Endesa (Enel Group), Fotowatio Renewable Ventures (FRV), Solaria Energía y Medio Ambiente S.A., Grenergy Renovables S.A., EDP Renováveis (EDPR), Siemens Gamesa Renewable Energy S.A., Enel Green Power España, Trina Solar Limited, Canadian Solar Inc., First Solar, Inc., JinkoSolar Holding Co., Ltd., REC Group, LONGi Green Energy Technology Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the solar energy market in Spain appears promising, driven by increasing investments in renewable technologies and supportive government policies. In future, the market is expected to see a significant rise in solar capacity, with a focus on integrating energy storage solutions. Additionally, the trend towards decentralized energy generation will likely continue, as more consumers opt for solar installations, contributing to energy independence and sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Technology | Solar Photovoltaic (PV) Systems Concentrated Solar Power (CSP) Solar Thermal Systems Building-Integrated Photovoltaics (BIPV) Hybrid Solar Systems |

| By Deployment Type | Ground-Mounted Systems Rooftop Systems |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Grid-Connected Systems Off-Grid Systems Rooftop Installations Utility-Scale Projects |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Feed-in Tariffs |

| By Distribution Mode | Direct Sales Online Sales Distributors Retail Outlets |

| By Region | Andalusia Castile-La Mancha Extremadura Murcia Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Installations | 100 | Homeowners, Solar Installation Managers |

| Commercial Solar Projects | 60 | Facility Managers, Energy Procurement Officers |

| Utility-Scale Solar Developments | 50 | Project Developers, Energy Analysts |

| Solar Technology Providers | 40 | Product Managers, R&D Engineers |

| Regulatory and Policy Insights | 40 | Government Officials, Policy Advisors |

The Spain Solar Energy Market is valued at approximately USD 13 billion, reflecting significant growth driven by increasing demand for renewable energy, government incentives, and advancements in solar technology.