Region:North America

Author(s):Dev

Product Code:KRAC0499

Pages:80

Published On:August 2025

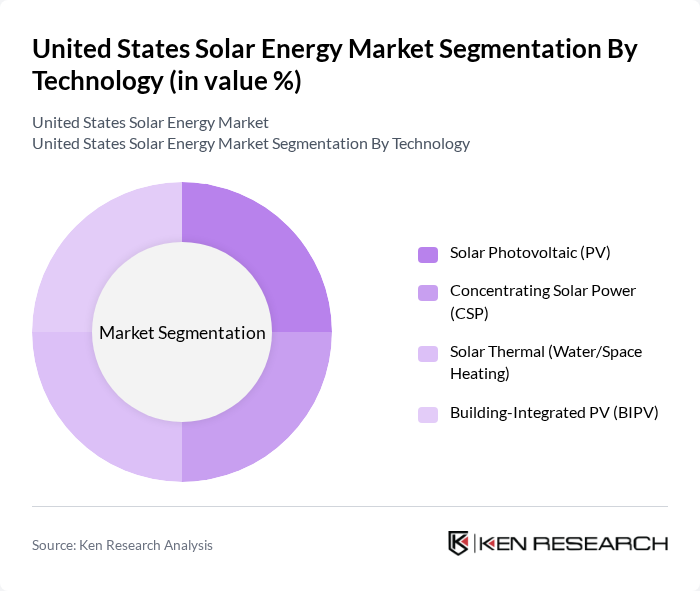

By Technology:The solar energy market can be segmented into various technologies, including Solar Photovoltaic (PV), Concentrating Solar Power (CSP), Solar Thermal (Water/Space Heating), and Building-Integrated PV (BIPV). Among these, Solar Photovoltaic (PV) technology is the most dominant due to its widespread adoption in residential and commercial sectors, driven by decreasing costs and increasing efficiency. CSP and Solar Thermal technologies are also gaining traction, particularly in utility-scale applications, while BIPV is emerging as a niche segment appealing to environmentally conscious consumers.

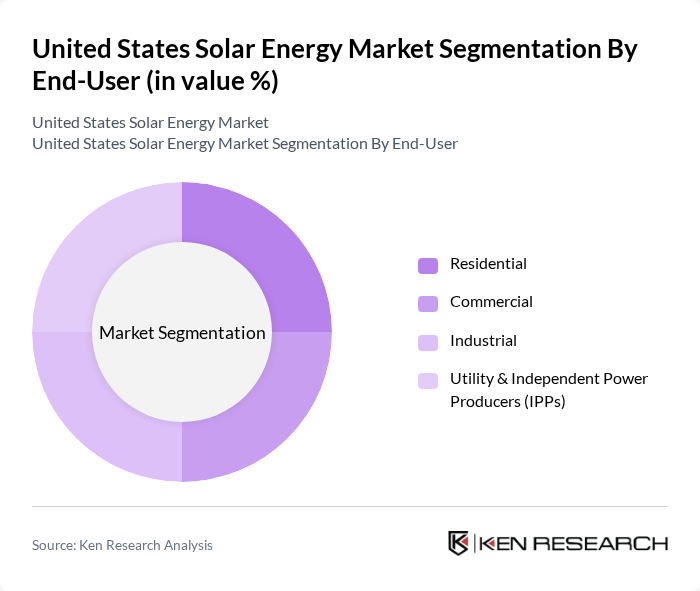

By End-User:The end-user segmentation of the solar energy market includes Residential, Commercial, Industrial, and Utility & Independent Power Producers (IPPs). The Utility & IPPs segment is currently the largest, driven by increasing demand for renewable energy and large-scale projects. The Residential segment follows closely, as homeowners seek to reduce energy costs and enhance sustainability. The Commercial sector is also growing, while the Industrial segment is expanding its capacity to meet rising energy demands.

The United States Solar Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as First Solar, Inc., SunPower Corporation, Canadian Solar Inc., JinkoSolar Holding Co., Ltd., Trina Solar Co., Ltd., Enphase Energy, Inc., Sunnova Energy International Inc., NextEra Energy, Inc. (NextEra Energy Resources), Tesla, Inc. (Tesla Energy/SolarRoof), REC Solar Holdings AS, Sunrun Inc., Avantus (formerly 8minute Solar Energy), Cypress Creek Renewables LLC, Array Technologies, Inc., SMA Solar Technology AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. solar energy market appears promising, driven by increasing technological advancements and a strong push for sustainability. As energy storage solutions become more efficient and affordable, the integration of solar energy into the grid will enhance reliability and resilience. Furthermore, the growing emphasis on carbon neutrality will likely lead to more robust government policies supporting solar adoption, fostering a favorable environment for investment and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Technology | Solar Photovoltaic (PV) Concentrating Solar Power (CSP) Solar Thermal (Water/Space Heating) Building-Integrated PV (BIPV) |

| By End-User | Residential Commercial Industrial Utility & Independent Power Producers (IPPs) |

| By Application | Grid-Connected (Net Metered/Virtual Net Metered) Off-Grid and Backup Distributed Rooftop (Residential/Commercial) Utility-Scale (Ground-Mount, >1 MW) |

| By Ownership/Financing Model | Direct Ownership (Cash/Loan) Power Purchase Agreement (PPA) Lease/Third-Party Ownership (TPO) Community Solar/Subscribed Shared Solar |

| By Policy Mechanism | Investment Tax Credit (ITC)/Production Tax Credit (PTC) Renewable Portfolio Standards (RPS)/State Incentives Net Metering/NEM Successor Tariffs Renewable Energy Certificates (RECs)/SRECs |

| By Component | Modules (Mono PERC/TOPCon/HJT) Inverters (String/Central/Micro) Trackers & Mounting Balance of System (BoS) & EPC Services |

| By Storage Coupling | PV-Only Solar-Plus-Storage (DC-Coupled) Solar-Plus-Storage (AC-Coupled) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Adoption | 140 | Homeowners, Solar System Installers |

| Commercial Solar Projects | 100 | Facility Managers, Energy Procurement Officers |

| Utility-Scale Solar Developments | 80 | Project Developers, Utility Executives |

| Policy Impact Assessment | 60 | Regulatory Analysts, Energy Policy Experts |

| Consumer Awareness and Perception | 120 | General Public, Environmental Advocates |

The United States Solar Energy Market is valued at approximately USD 75 billion, reflecting significant growth driven by investments in renewable energy, technological advancements, and consumer demand for sustainable energy solutions.