Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0225

Pages:100

Published On:August 2025

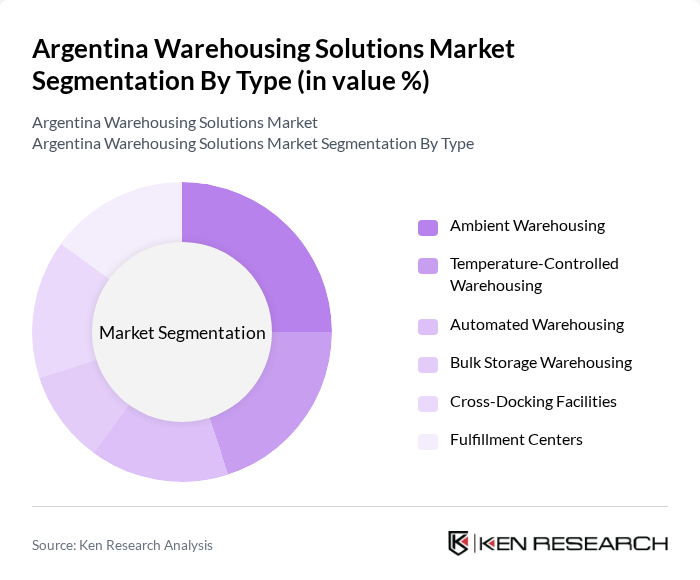

By Type:The market is segmented into various types of warehousing solutions, including Ambient Warehousing, Temperature-Controlled Warehousing, Automated Warehousing, Bulk Storage Warehousing, Cross-Docking Facilities, and Fulfillment Centers. Each type serves specific needs based on the nature of goods stored and the operational requirements of businesses .

The Ambient Warehousing segment is currently dominating the market due to its versatility and cost-effectiveness for storing a wide range of goods. This type of warehousing is particularly favored by retailers and e-commerce businesses that require quick access to inventory without the need for specialized temperature controls. The growing trend of online shopping has further accelerated the demand for ambient warehousing solutions, making it a critical component of the logistics infrastructure in Argentina .

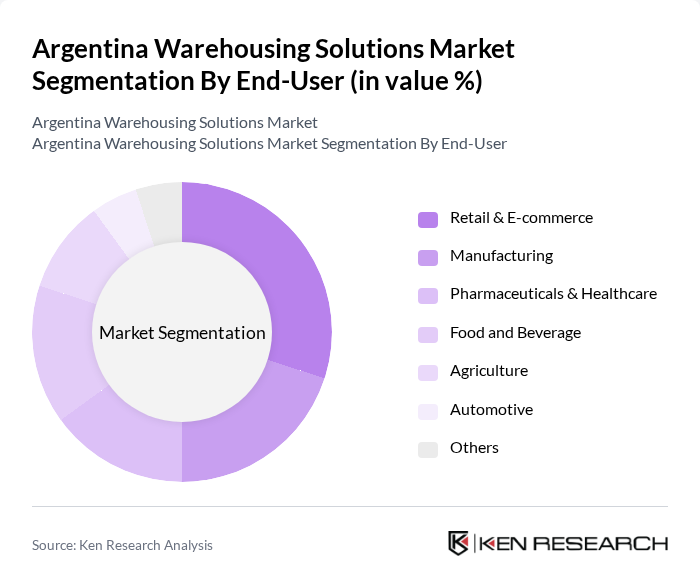

By End-User:The market is segmented by end-users, including Retail & E-commerce, Manufacturing, Pharmaceuticals & Healthcare, Food and Beverage, Agriculture, Automotive, and Others. Each end-user category has distinct warehousing needs based on the nature of their products and supply chain requirements .

The Retail & E-commerce segment is leading the market, driven by the rapid growth of online shopping and the need for efficient logistics solutions. As consumers increasingly prefer online purchasing, retailers are investing in warehousing capabilities to ensure quick order fulfillment and inventory management. This trend is further supported by advancements in technology, enabling better inventory tracking and management, which are essential for meeting customer expectations in the fast-paced e-commerce environment .

The Argentina Warehousing Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Andreani, DHL Supply Chain Argentina, CTC Logistics, OCA, TGL Transportes y Logística, Logística Argentina, TGS (Transportadora de Gas del Sur), Cargotrans, Interlog, Grupo Logístico Cruz del Sur, Kuehne + Nagel Argentina, Cargill Argentina, Grupo Logístico Andreani, Logística y Distribución S.A., Grupo Proa contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Argentina warehousing solutions market appears promising, driven by the ongoing digital transformation and the increasing demand for efficient logistics. As e-commerce continues to expand, companies are likely to invest in smart warehousing technologies, enhancing operational efficiency. Additionally, the focus on sustainability will push logistics providers to adopt eco-friendly practices, aligning with global trends. These developments will create a more competitive landscape, fostering innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Ambient Warehousing Temperature-Controlled Warehousing Automated Warehousing Bulk Storage Warehousing Cross-Docking Facilities Fulfillment Centers |

| By End-User | Retail & E-commerce Manufacturing Pharmaceuticals & Healthcare Food and Beverage Agriculture Automotive Others |

| By Location | Buenos Aires Metropolitan Area (AMBA) Córdoba Rosario Other Urban Centers Rural Warehousing |

| By Service Type | Storage Services Value-Added Services (Packaging, Labeling, Kitting) Inventory Management Transportation & Distribution Reverse Logistics Others |

| By Technology | Warehouse Management Systems (WMS) Automated Guided Vehicles (AGVs) Internet of Things (IoT) Solutions Robotics & Automation Others |

| By Ownership | Private Warehousing Public Warehousing Contract Warehousing (3PL) Cooperative Warehousing Others |

| By Duration of Storage | Short-term Storage Long-term Storage Seasonal Storage Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Solutions | 100 | Warehouse Managers, Supply Chain Executives |

| Manufacturing Logistics | 80 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Centers | 90 | eCommerce Directors, Logistics Coordinators |

| Cold Chain Storage Facilities | 60 | Facility Managers, Quality Assurance Officers |

| Third-Party Logistics Providers | 70 | Business Development Managers, Account Executives |

The Argentina Warehousing Solutions Market is valued at approximately USD 2.7 billion, reflecting a significant growth driven by the increasing demand for efficient logistics and supply chain management, particularly in the retail and e-commerce sectors.