Region:Central and South America

Author(s):Rebecca

Product Code:KRAA0367

Pages:88

Published On:August 2025

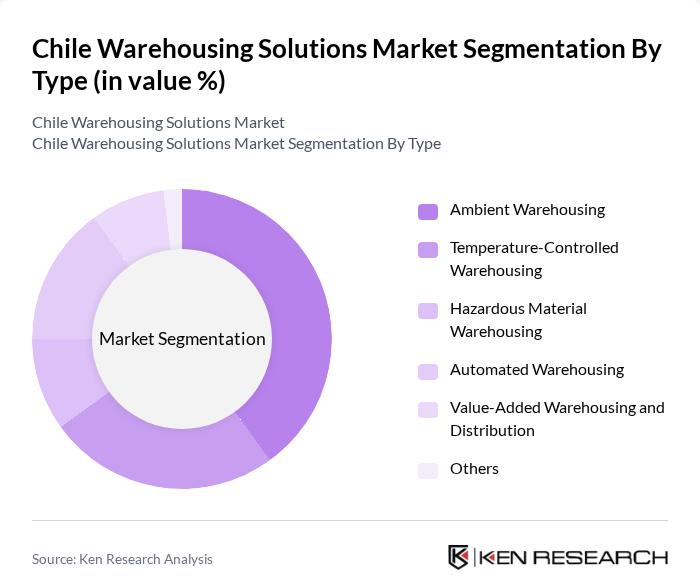

By Type:The warehousing solutions market can be segmented into various types, including Ambient Warehousing, Temperature-Controlled Warehousing, Hazardous Material Warehousing, Automated Warehousing, Value-Added Warehousing and Distribution, and Others. Among these, Ambient Warehousing is currently the leading sub-segment due to its versatility and cost-effectiveness, catering to a wide range of industries. The demand for Temperature-Controlled Warehousing is also on the rise, driven by the food and pharmaceutical sectors requiring specific storage conditions. The increasing focus on automation is propelling the growth of Automated Warehousing, which enhances operational efficiency and reduces labor costs .

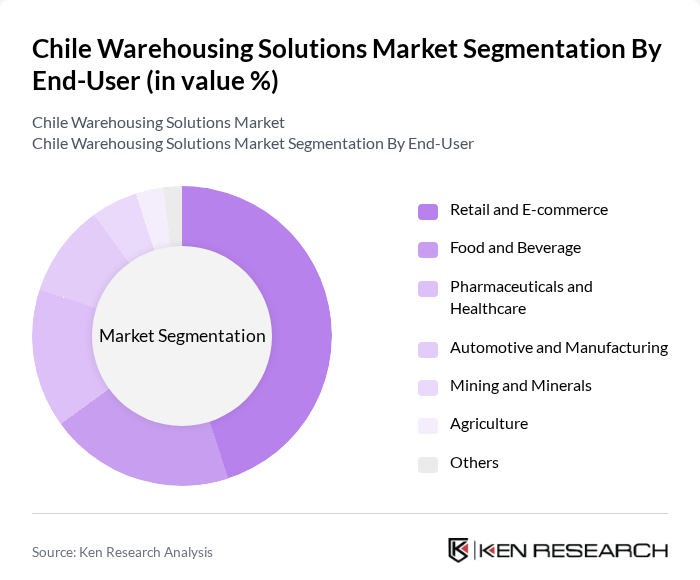

By End-User:The end-user segmentation includes Retail and E-commerce, Food and Beverage, Pharmaceuticals and Healthcare, Automotive and Manufacturing, Mining and Minerals, Agriculture, and Others. The Retail and E-commerce sector is the dominant end-user, driven by the rapid growth of online shopping and the need for efficient order fulfillment. The Food and Beverage sector also significantly contributes to the market, requiring specialized storage solutions to maintain product quality. The Pharmaceuticals and Healthcare sector is increasingly adopting advanced warehousing solutions to ensure compliance with stringent regulations and maintain the integrity of sensitive products .

The Chile Warehousing Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DSV, Agunsa Logistics, Andes Logistics de Chile, DB Schenker, CEVA Logistics, Maersk Logistics, Friosan, Rhenus Logistics, Geodis, Yusen Logistics, Nippon Express, C.H. Robinson, Panalpina contribute to innovation, geographic expansion, and service delivery in this space.

The Chile warehousing solutions market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As e-commerce continues to expand, companies will increasingly invest in smart warehousing solutions that leverage AI and IoT for enhanced efficiency. Additionally, the focus on sustainability will lead to the adoption of green practices in warehousing operations. These trends will shape the future landscape, creating opportunities for innovation and growth within the sector, while also addressing the challenges of operational costs and labor shortages.

| Segment | Sub-Segments |

|---|---|

| By Type | Ambient Warehousing Temperature-Controlled Warehousing Hazardous Material Warehousing Automated Warehousing Value-Added Warehousing and Distribution Others |

| By End-User | Retail and E-commerce Food and Beverage Pharmaceuticals and Healthcare Automotive and Manufacturing Mining and Minerals Agriculture Others |

| By Region | Santiago Metropolitan Region Valparaíso Concepción (Biobío) Antofagasta Others |

| By Technology | Warehouse Management Systems (WMS) Automated Guided Vehicles (AGVs) Robotics and Automation RFID and Tracking Technologies IoT-enabled Solutions Others |

| By Application | Order Fulfillment Inventory Management Cross-Docking Returns Management Last-Mile Delivery Support Others |

| By Investment Source | Private Investments Public Funding Foreign Direct Investment (FDI) Joint Ventures Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Infrastructure Development Regulatory Support for Green Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Solutions | 100 | Warehouse Managers, Supply Chain Executives |

| E-commerce Fulfillment Centers | 70 | Operations Directors, Logistics Coordinators |

| Manufacturing Warehousing Needs | 60 | Production Managers, Inventory Control Specialists |

| Cold Storage Facilities | 40 | Facility Managers, Quality Assurance Officers |

| Third-Party Logistics Providers | 80 | Business Development Managers, Account Executives |

The Chile Warehousing Solutions Market is valued at approximately USD 1.8 billion, reflecting a significant growth driven by the increasing demand for efficient logistics and supply chain management, particularly in the retail and e-commerce sectors.