Region:Europe

Author(s):Shubham

Product Code:KRAA1134

Pages:94

Published On:August 2025

By Type:The market is segmented into various types of warehousing solutions, including Public Warehousing, Private Warehousing, Contract Warehousing (3PL), Automated Warehousing, Cold Storage Warehousing, Cross-Docking Warehousing, Fulfillment Centers, Bonded Warehousing, and Others. Each type serves distinct needs based on storage requirements, operational efficiency, and customer preferences. Public warehousing offers flexible storage for multiple clients, private warehousing is owned and operated by individual companies for their exclusive use, contract warehousing (3PL) provides outsourced logistics services, automated warehousing leverages robotics and technology for efficiency, cold storage warehousing is designed for temperature-sensitive goods, cross-docking warehousing enables rapid transfer between transport modes, fulfillment centers focus on e-commerce order processing, bonded warehousing stores imported goods under customs control, and others include specialized or hybrid facilities .

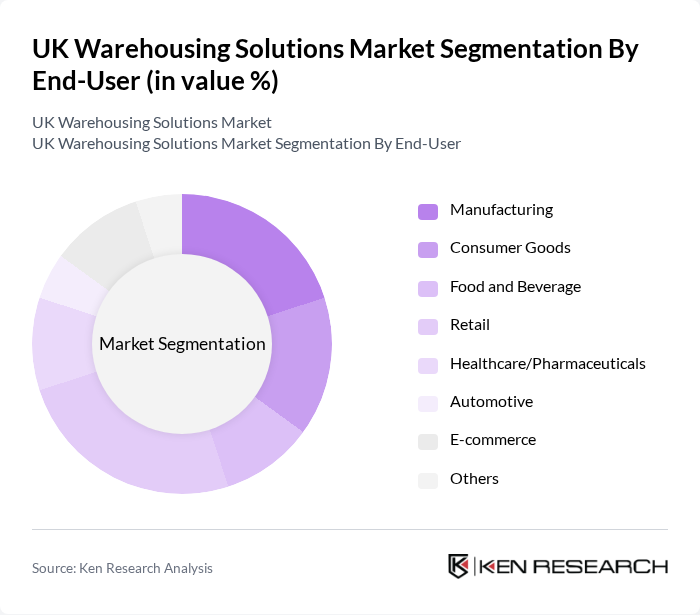

By End-User:The end-user segmentation includes Manufacturing, Consumer Goods, Food and Beverage, Retail, Healthcare/Pharmaceuticals, Automotive, E-commerce, and Others. Each sector has unique warehousing needs, influenced by factors such as product type, storage conditions, and distribution requirements. Manufacturing and automotive require large-scale, often specialized storage; food and beverage and healthcare/pharmaceuticals demand temperature and compliance controls; retail and e-commerce prioritize rapid fulfillment and last-mile delivery; consumer goods utilize a mix of storage and value-added services; others include sectors with niche requirements .

The UK Warehousing Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, XPO Logistics, Wincanton, Kuehne + Nagel, CEVA Logistics, DB Schenker, Geodis, GXO Logistics, Clipper Logistics, Palletways, Eddie Stobart Logistics, UPS Supply Chain Solutions, Maersk Logistics, Great Bear Distribution, Amazon Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The UK warehousing solutions market is poised for significant transformation as it adapts to evolving consumer behaviors and technological advancements. The integration of AI and IoT technologies will enhance operational efficiencies, while the focus on sustainability will drive innovations in energy-efficient warehousing. Additionally, the increasing demand for cold storage solutions will create new opportunities for growth, as businesses seek to meet the needs of diverse sectors, including food and pharmaceuticals, ensuring a robust future for the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Warehousing Private Warehousing Contract Warehousing (3PL) Automated Warehousing Cold Storage Warehousing Cross-Docking Warehousing Fulfillment Centers Bonded Warehousing Others |

| By End-User | Manufacturing Consumer Goods Food and Beverage Retail Healthcare/Pharmaceuticals Automotive E-commerce Others |

| By Service Type | Storage Services Transportation Services Value-Added Services Inventory Management Services Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Fulfillment Retail Distribution Others |

| By Storage Capacity | Small Scale (Up to 10,000 sq ft) Medium Scale (10,000 - 50,000 sq ft) Large Scale (Above 50,000 sq ft) Others |

| By Geographic Coverage | National Coverage Regional Coverage Local Coverage Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 60 | Warehouse Managers, Supply Chain Executives |

| E-commerce Fulfillment Centers | 50 | Operations Managers, Logistics Coordinators |

| Cold Storage Facilities | 40 | Facility Managers, Quality Control Supervisors |

| Third-Party Logistics Providers | 70 | Business Development Managers, Account Executives |

| Automotive Parts Warehousing | 40 | Procurement Managers, Inventory Control Specialists |

The UK Warehousing Solutions Market is valued at approximately USD 46 billion, reflecting significant growth driven by the increasing demand for efficient logistics and supply chain management, particularly in the e-commerce sector.