Region:Africa

Author(s):Shubham

Product Code:KRAA1102

Pages:96

Published On:August 2025

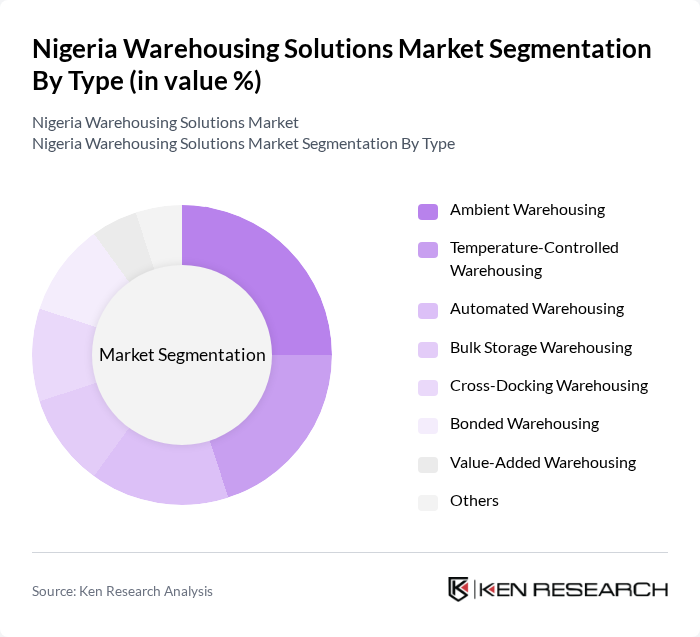

By Type:The market is segmented into various types of warehousing solutions, including Ambient Warehousing, Temperature-Controlled Warehousing, Automated Warehousing, Bulk Storage Warehousing, Cross-Docking Warehousing, Bonded Warehousing, Value-Added Warehousing, and Others. Each type addresses specific needs based on the nature of goods stored and the operational requirements of businesses. Ambient warehousing is most prevalent for general goods, while temperature-controlled warehousing is increasingly important for pharmaceuticals, food, and perishable goods. Automated warehousing is gaining traction as companies invest in technology to improve inventory management and reduce labor costs. Bonded and cross-docking facilities support international trade and rapid distribution .

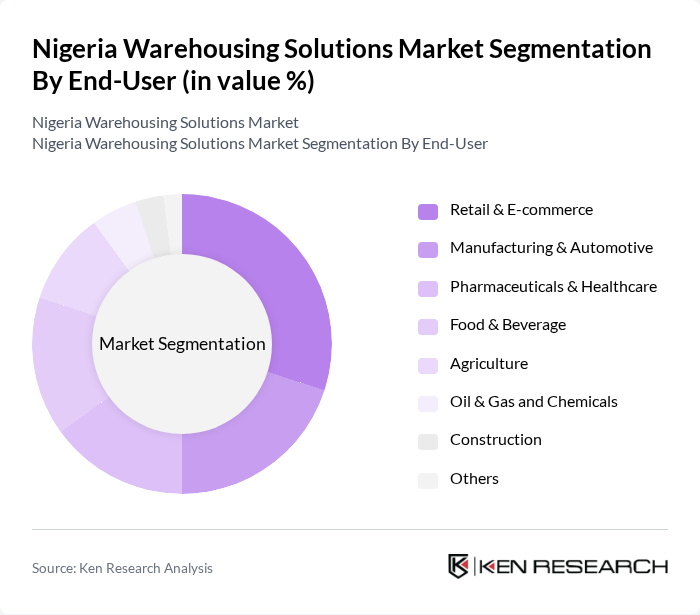

By End-User:The warehousing solutions market is further segmented by end-users, including Retail & E-commerce, Manufacturing & Automotive, Pharmaceuticals & Healthcare, Food & Beverage, Agriculture, Oil & Gas and Chemicals, Construction, and Others. Retail and e-commerce are the largest end-users, reflecting the surge in online shopping and the need for efficient last-mile delivery. Manufacturing and automotive sectors require extensive warehousing for raw materials and finished goods, while pharmaceuticals and food sectors demand specialized storage for sensitive products. Agriculture and oil & gas sectors also contribute significantly, driven by Nigeria’s economic structure .

The Nigeria Warehousing Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jumia Logistics, DHL Supply Chain Nigeria, Kuehne + Nagel Nigeria, Red Star Express, GIG Logistics, APM Terminals Apapa, Maersk Nigeria, Bolloré Transport & Logistics Nigeria, FedEx Nigeria (Red Star Express Partner), AGS Movers Nigeria, CML Logistics, Sifax Group, BUA Group, Dangote Group, and Nigerian Breweries contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Nigeria warehousing solutions market appears promising, driven by the ongoing digital transformation of supply chains and the increasing adoption of automation technologies. As businesses seek to enhance operational efficiency, investments in smart warehousing solutions are expected to rise. Additionally, the growing emphasis on sustainability will likely lead to the integration of eco-friendly practices in warehousing operations, aligning with global trends and consumer preferences for environmentally responsible logistics solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Ambient Warehousing Temperature-Controlled Warehousing Automated Warehousing Bulk Storage Warehousing Cross-Docking Warehousing Bonded Warehousing Value-Added Warehousing Others |

| By End-User | Retail & E-commerce Manufacturing & Automotive Pharmaceuticals & Healthcare Food & Beverage Agriculture Oil & Gas and Chemicals Construction Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Fulfillment Centers Retail Distribution Centers Others |

| By Storage Capacity | Less than 10,000 sq. ft. ,000 - 50,000 sq. ft. ,000 - 100,000 sq. ft. More than 100,000 sq. ft. |

| By Service Type | Warehousing Services Value-Added Logistics Services Inventory Management Transportation Services Packaging & Labelling Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Pay-Per-Use Pricing Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Port Cities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| FMCG Warehousing Solutions | 100 | Warehouse Managers, Supply Chain Analysts |

| Pharmaceutical Distribution Centers | 60 | Operations Managers, Compliance Officers |

| E-commerce Fulfillment Centers | 70 | Logistics Coordinators, IT Managers |

| Agricultural Product Storage | 50 | Farm Managers, Supply Chain Executives |

| Cold Chain Logistics | 40 | Quality Assurance Managers, Facility Supervisors |

The Nigeria Warehousing Solutions Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the expansion of e-commerce, demand for efficient supply chain management, and investments in logistics infrastructure and technology.