Region:Asia

Author(s):Geetanshi

Product Code:KRAA0317

Pages:84

Published On:August 2025

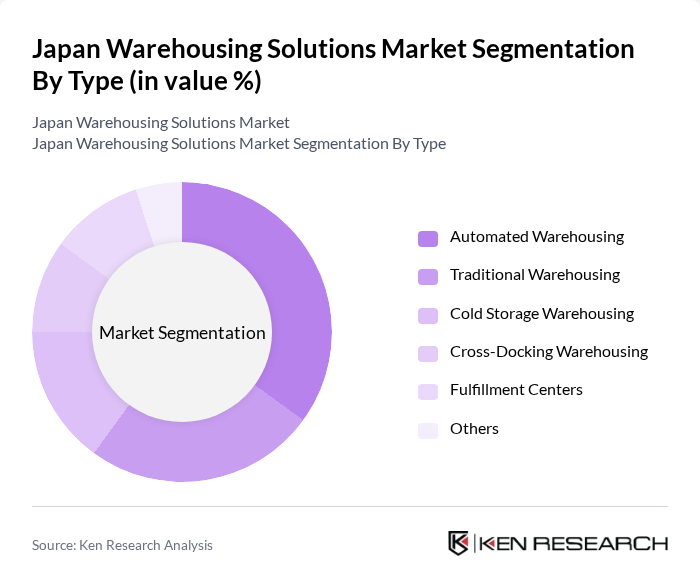

By Type:The market is segmented into Automated Warehousing, Traditional Warehousing, Cold Storage Warehousing, Cross-Docking Warehousing, Fulfillment Centers, and Others. Automated Warehousing is rapidly gaining traction, driven by the need for higher efficiency, accuracy, and labor cost reduction. Technological advancements in robotics, IoT, and AI are enabling faster processing and improved inventory management. Traditional Warehousing remains important for sectors requiring manual handling and flexible storage. Cold Storage Warehousing is critical for food and pharmaceutical industries, ensuring temperature-sensitive product integrity. Cross-Docking Warehousing is increasingly used to streamline supply chains and minimize storage time. Fulfillment Centers are essential for e-commerce, supporting rapid order processing and last-mile delivery .

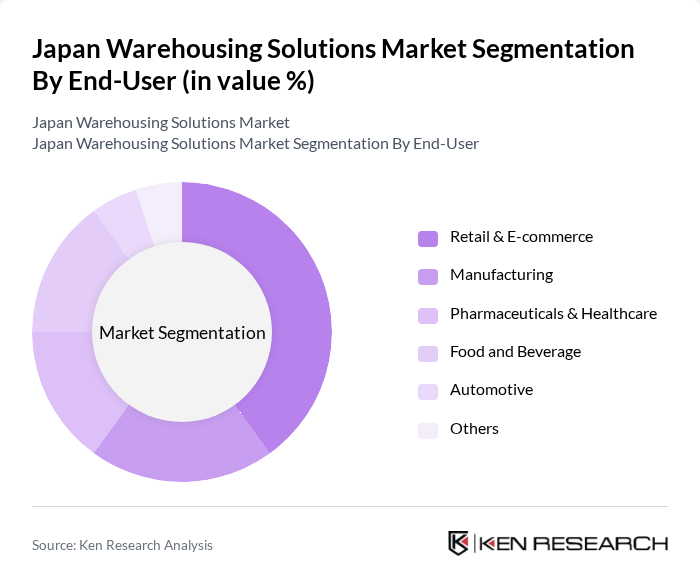

By End-User:End-user segmentation includes Retail & E-commerce, Manufacturing, Pharmaceuticals & Healthcare, Food and Beverage, Automotive, and Others. Retail & E-commerce is the leading segment, fueled by the surge in online shopping and demand for efficient logistics. This has driven significant investment in fulfillment centers and automation to meet consumer expectations for rapid delivery. Manufacturing remains a major user, requiring warehousing for both raw materials and finished goods. Pharmaceuticals & Healthcare require specialized, often temperature-controlled storage, while Food and Beverage relies on cold storage and efficient distribution. The Automotive sector depends on warehousing for parts and components, supporting supply chain continuity .

The Japan Warehousing Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Express, Yamato Holdings, Sagawa Express (SG Holdings), Seino Holdings, Hitachi Transport System, Kintetsu World Express, Mitsui-Soko Holdings, Marubeni Logistics, Hacobu, Logizard, Kuehne + Nagel, DB Schenker, CEVA Logistics, DSV, and Geodis contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan warehousing solutions market is poised for transformation, driven by technological innovations and evolving consumer preferences. As e-commerce continues to expand, companies will increasingly invest in smart warehousing technologies, including AI and robotics, to enhance efficiency. Additionally, the focus on sustainability will lead to the adoption of green warehousing practices, aligning with global environmental goals. These trends will shape the competitive landscape, encouraging firms to innovate and adapt to changing market demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Warehousing Traditional Warehousing Cold Storage Warehousing Cross-Docking Warehousing Fulfillment Centers Others |

| By End-User | Retail & E-commerce Manufacturing Pharmaceuticals & Healthcare Food and Beverage Automotive Others |

| By Service Type | Storage Services Value-Added Services (e.g., packaging, labeling, kitting) Transportation & Distribution Services Inventory Management Services Order Fulfillment Services Others |

| By Technology | Warehouse Management Systems (WMS) Automated Guided Vehicles (AGVs) Internet of Things (IoT) Solutions Robotics Process Automation (RPA) Artificial Intelligence & Data Analytics Others |

| By Location | Urban Warehousing Suburban Warehousing Rural Warehousing Port/Free Trade Zone Warehousing Others |

| By Size of Warehouse | Small Warehouses (<5,000 sqm) Medium Warehouses (5,000–20,000 sqm) Large Warehouses (>20,000 sqm) Mega Distribution Centers Others |

| By Ownership Model | Owned Warehouses Rented Warehouses Leased Warehouses Third-Party Logistics (3PL) Warehouses Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Solutions | 100 | Warehouse Managers, Supply Chain Executives |

| Automotive Parts Distribution | 60 | Logistics Coordinators, Operations Managers |

| Pharmaceutical Storage Facilities | 40 | Compliance Officers, Warehouse Supervisors |

| E-commerce Fulfillment Centers | 80 | eCommerce Operations Managers, Logistics Analysts |

| Cold Chain Logistics | 50 | Cold Chain Managers, Quality Assurance Leads |

The Japan Warehousing Solutions Market is valued at approximately USD 1.8 billion, driven by the growth of e-commerce, automation, and the need for real-time inventory management. This market is expected to continue evolving with technological advancements and changing consumer demands.