Asia Pacific Home Furniture Market Overview

- The Asia Pacific Home Furniture Market is valued at USD 145 billion, based on a five-year historical analysis. This growth is primarily driven by rising disposable incomes, rapid urbanization, and a strong trend toward home improvement and interior design. The increasing demand for stylish and functional furniture, coupled with the expansion of e-commerce platforms and the popularity of modular and eco-friendly solutions, has further fueled market growth.

- Key players in this market include China, Japan, and India, which dominate due to their large populations, accelerated urbanization, and rising consumer spending on home furnishings. China, in particular, maintains a robust manufacturing base and a rapidly expanding middle class, while Japan and India are experiencing strong demand for both modern and traditional furniture styles. The region’s growth is further supported by government-backed housing initiatives and an increasing focus on sustainable living.

- In 2023, the Australian government implemented the “Furniture Product Stewardship Scheme Guidelines” issued by the Department of Climate Change, Energy, the Environment and Water. These guidelines require manufacturers to use eco-friendly materials and processes, promote product stewardship, and encourage the adoption of sustainable practices in the home furniture industry to reduce environmental impact. The scheme sets operational standards for material sourcing, recycling, and reporting, with compliance required for all domestic furniture producers.

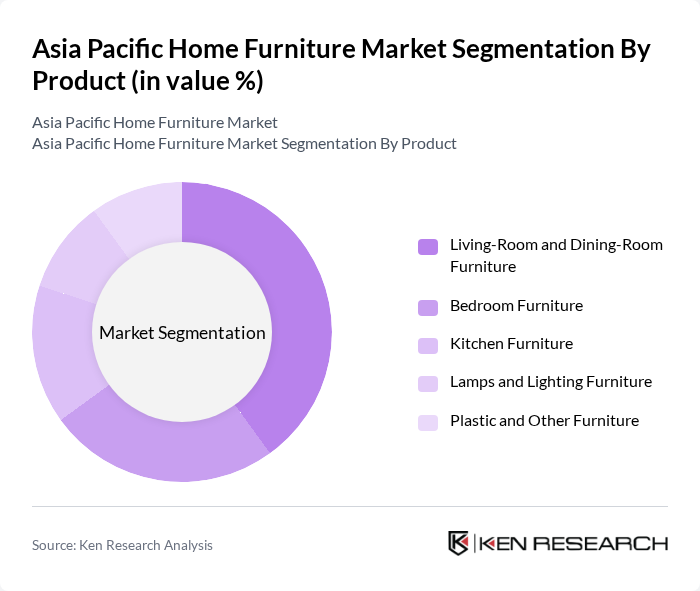

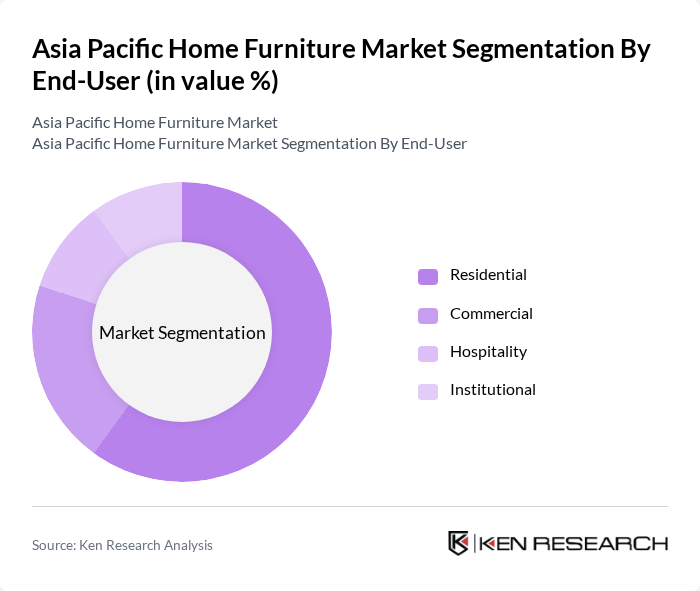

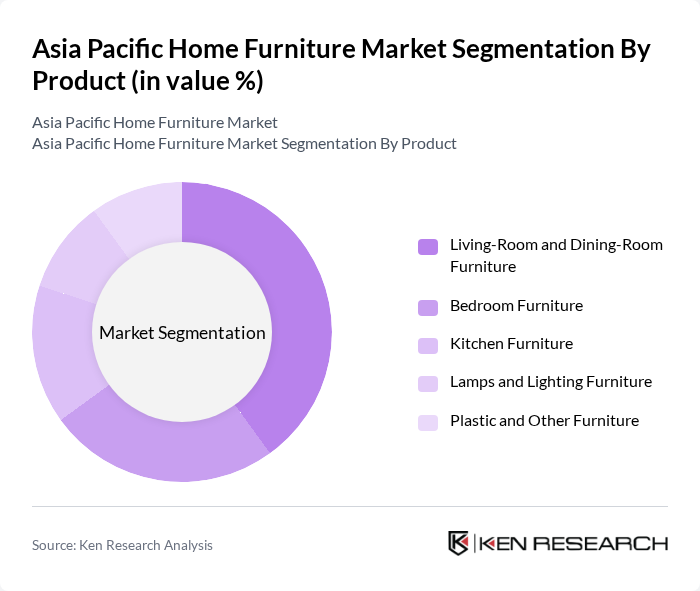

Asia Pacific Home Furniture Market Segmentation

By Product:The product segmentation of the market includes living-room and dining-room furniture, bedroom furniture, kitchen furniture, lamps and lighting furniture, and plastic and other furniture. Among these, living-room and dining-room furniture is the most dominant segment, driven by consumer preferences for stylish, multifunctional pieces that enhance home aesthetics. The trend of open-plan living spaces and demand for modular, space-saving designs have contributed to the growth of versatile furniture that serves multiple purposes.

By End-User:The end-user segmentation includes residential, commercial, hospitality, and institutional categories. The residential segment remains the largest, driven by the increasing number of households, urban migration, and a strong trend of home renovations. Consumers are investing in quality furniture that reflects personal style and enhances living spaces. The commercial segment is expanding as businesses seek to create inviting environments for customers and employees, with demand for ergonomic and space-saving solutions rising.

Asia Pacific Home Furniture Market Competitive Landscape

The Asia Pacific Home Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Nitori Holdings Co., Ltd., Muji (Ryohin Keikaku Co., Ltd.), Ashley Furniture Industries, Inc., Godrej Interio, Kuka Home, Shunde Kinwai Furniture Co., Ltd., Zuoyou Furniture Co., Ltd., Steelcase Inc., Herman Miller, Inc. (MillerKnoll), La-Z-Boy Incorporated, Natuzzi S.p.A., Scanteak, Flexform S.p.A., Furlenco (House of Kieraya Pvt. Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

Asia Pacific Home Furniture Market Industry Analysis

Growth Drivers

- Rising Disposable Income:The Asia Pacific region has witnessed a significant increase in disposable income, with an average growth rate of 6.4% annually. In future, the average disposable income per capita is projected to reach approximately $4,600, enabling consumers to invest more in home furnishings. This financial empowerment is driving demand for higher-quality and aesthetically pleasing furniture, as households prioritize comfort and style in their living spaces, thus boosting the home furniture market.

- Urbanization and Housing Development:Urbanization in Asia Pacific is accelerating, with over 50% of the population now residing in urban areas. By future, urban housing development is expected to increase by 9 million units annually, creating a robust demand for home furniture. This trend is particularly evident in countries like India and China, where new residential projects are emerging, leading to heightened consumption of furniture as urban dwellers seek to furnish their homes.

- Growth in E-commerce Platforms:The rise of e-commerce has transformed the home furniture market, with online sales projected to reach $54 billion in future, reflecting a 20% increase from the previous year. This shift is driven by the convenience of online shopping and the growing preference for digital platforms among consumers. Major retailers are enhancing their online presence, offering a wider range of products, which is further stimulating market growth as consumers increasingly turn to e-commerce for their furniture needs.

Market Challenges

- Intense Competition Among Manufacturers:The home furniture market in Asia Pacific is characterized by fierce competition, with over 1,600 manufacturers vying for market share. This saturation leads to price wars and reduced profit margins, making it challenging for companies to maintain sustainable growth. In future, the average profit margin for furniture manufacturers is expected to decline to 4%, compelling businesses to innovate and differentiate their offerings to survive in this competitive landscape.

- Fluctuating Raw Material Prices:The volatility of raw material prices poses a significant challenge for the home furniture industry. In future, the cost of key materials such as wood and metal is projected to increase by 12% due to supply chain disruptions and geopolitical tensions. This fluctuation can lead to increased production costs, forcing manufacturers to either absorb the costs or pass them on to consumers, potentially impacting sales and profitability.

Asia Pacific Home Furniture Market Future Outlook

The future of the Asia Pacific home furniture market appears promising, driven by ongoing urbanization and a growing emphasis on sustainability. As consumers increasingly prioritize eco-friendly products, manufacturers are likely to innovate with sustainable materials and practices. Additionally, the rise of smart furniture solutions is expected to reshape consumer preferences, integrating technology into home furnishings. These trends will create new avenues for growth, positioning the market for continued expansion in the coming years.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets in Southeast Asia, such as Vietnam and Indonesia, present significant growth opportunities. With a combined population exceeding 320 million and rising disposable incomes, these markets are becoming increasingly attractive for furniture manufacturers looking to expand their reach and capitalize on growing consumer demand for quality home furnishings.

- Customization and Personalization Trends:The demand for customized furniture solutions is on the rise, with consumers seeking unique designs that reflect their personal style. In future, the market for personalized furniture is expected to grow by 16%, as companies that offer tailored solutions can differentiate themselves and attract a loyal customer base, enhancing their competitive edge in the market.