Region:Europe

Author(s):Dev

Product Code:KRAA1676

Pages:97

Published On:August 2025

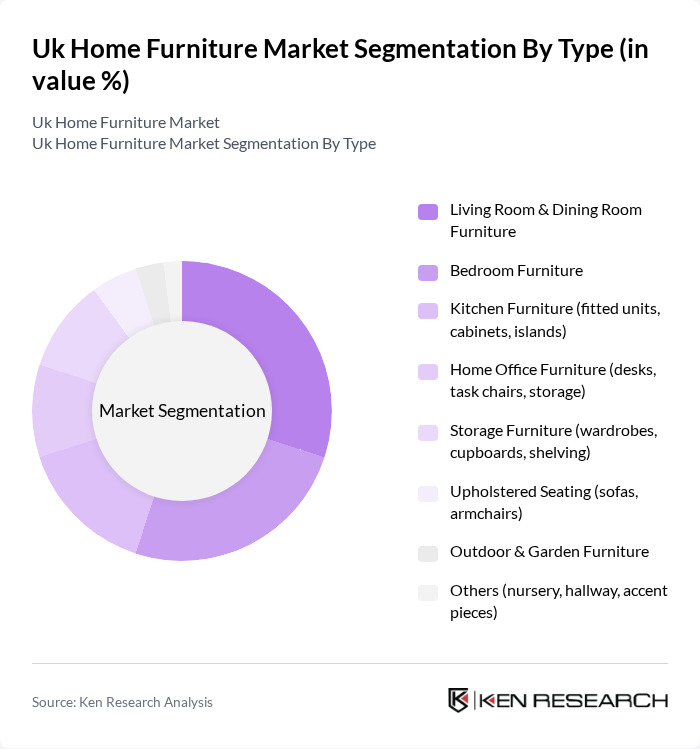

By Type:The market is segmented into various types of furniture, including Living Room & Dining Room Furniture, Bedroom Furniture, Kitchen Furniture, Home Office Furniture, Storage Furniture, Upholstered Seating, Outdoor & Garden Furniture, and Others. Among these, Living Room & Dining Room Furniture is the leading segment, driven by consumer preferences for stylish and functional designs that enhance the home environment. The trend towards open-plan living spaces has also increased the demand for versatile dining and living room solutions.

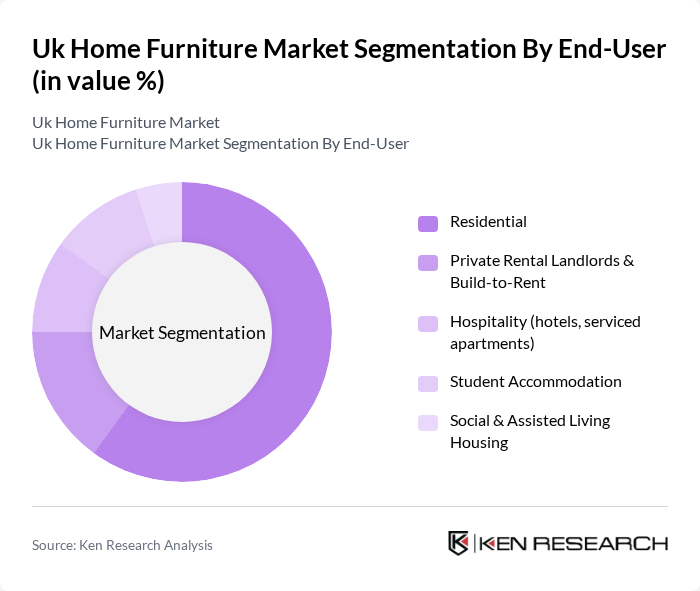

By End-User:The end-user segmentation includes Residential, Private Rental Landlords & Build-to-Rent, Hospitality, Student Accommodation, and Social & Assisted Living Housing. The Residential segment dominates the market, driven by the increasing trend of home ownership and the desire for personalized living spaces. Consumers are investing in furniture that reflects their style and meets their functional needs, contributing to the growth of this segment.

The UK Home Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, DFS Furniture plc, John Lewis & Partners, Argos (Sainsbury’s), Habitat (Sainsbury’s), Wayfair, Furniture Village, ScS Group plc, Oak Furnitureland, Dunelm Group plc, B&Q (Kingfisher plc), Homebase, Next Home (Next plc), Loaf, Heal’s contribute to innovation, geographic expansion, and service delivery in this space.

The UK home furniture market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As more consumers prioritize home aesthetics and functionality, the demand for innovative designs and smart furniture solutions is expected to rise. Additionally, the increasing focus on sustainability will likely shape product offerings, encouraging manufacturers to adopt eco-friendly practices. The integration of technology in furniture design will further enhance user experience, positioning the market for significant transformation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Living Room & Dining Room Furniture Bedroom Furniture Kitchen Furniture (fitted units, cabinets, islands) Home Office Furniture (desks, task chairs, storage) Storage Furniture (wardrobes, cupboards, shelving) Upholstered Seating (sofas, armchairs) Outdoor & Garden Furniture Others (nursery, hallway, accent pieces) |

| By End-User | Residential Private Rental Landlords & Build-to-Rent Hospitality (hotels, serviced apartments) Student Accommodation Social & Assisted Living Housing |

| By Sales Channel | Specialty Furniture Retailers Home Centers & DIY Sheds Online Retail (D2C, marketplaces) Flagship & Brand Stores Others (department stores, catalog/TV) |

| By Price Range | Budget Mid-Range Premium Luxury/Designer |

| By Material | Solid Wood & Engineered Wood Metal Upholstery & Mattresses (fabric/leather/foam) Glass & Stone/Composite Tops Plastic & Rattan/Wicker (incl. synthetic) |

| By Design Style | Modern/Contemporary Traditional/Classical Scandinavian/Minimalist Rustic/Industrial |

| By Functionality | Multi-functional & Modular Space-saving (folding, nesting, sofa beds) Customizable/Made-to-Order Standard |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Furniture Sales | 120 | Store Managers, Sales Representatives |

| Consumer Furniture Purchases | 150 | Homeowners, Renters |

| Online Furniture Shopping Trends | 100 | E-commerce Managers, Digital Marketing Specialists |

| Interior Design Preferences | 80 | Interior Designers, Home Decorators |

| Furniture Manufacturing Insights | 70 | Production Managers, Supply Chain Coordinators |

The UK Home Furniture Market is valued at approximately USD 18.5 billion, reflecting a robust demand driven by consumer spending on home improvement and preferences for personalized, multifunctional designs.