Region:North America

Author(s):Dev

Product Code:KRAB0521

Pages:81

Published On:August 2025

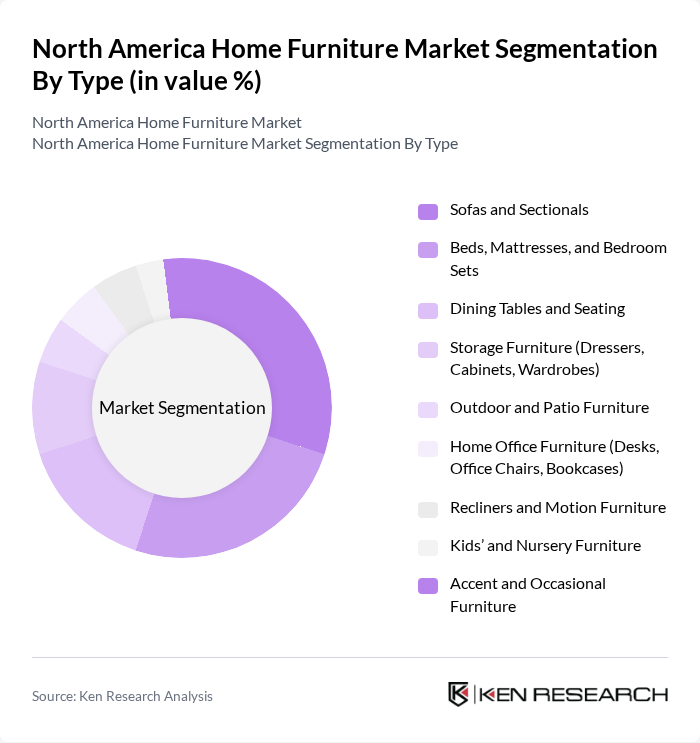

By Type:The market is segmented into various types of furniture, including sofas and sectionals, beds, mattresses, and bedroom sets, dining tables and seating, storage furniture, outdoor and patio furniture, home office furniture, recliners, kids’ furniture, and accent furniture. Each sub-segment caters to different consumer needs and preferences, reflecting trends in home decor and functionality.

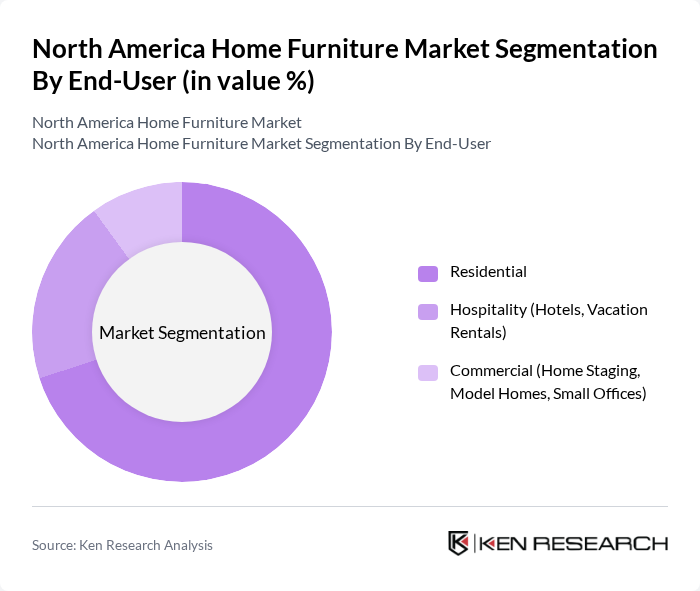

By End-User:The end-user segmentation includes residential, hospitality, and commercial sectors. Each segment has unique requirements, with residential consumers focusing on comfort and aesthetics, while hospitality and commercial sectors prioritize durability and functionality.

The North America Home Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ashley Furniture Industries, LLC, La-Z-Boy Incorporated, IKEA North America Services, LLC, Wayfair Inc., Williams-Sonoma, Inc. (Pottery Barn, West Elm), RH (Restoration Hardware Holdings, Inc.), Tempur Sealy International, Inc., Sleep Number Corporation, Mattress Firm Group Inc., Ethan Allen Interiors Inc., Bassett Furniture Industries, Inc., Hooker Furnishings Corporation, Flexsteel Industries, Inc., American Signature, Inc. (Value City Furniture), Sauder Woodworking Co., The Home Depot, Inc. (Home Decorators Collection), Lowe’s Companies, Inc., Costco Wholesale Corporation, Walmart Inc. (Mainstays, Better Homes & Gardens), Canadian Tire Corporation, Limited (CTC), Crate & Barrel Holdings (CB2), Haverty Furniture Companies, Inc., Rooms To Go Incorporated, Bob’s Discount Furniture, LLC, Leon’s Furniture Limited (incl. The Brick), Sleep Country Canada Holdings Inc., Dorel Industries Inc. (Dorel Home), Palliser Furniture Ltd., Urban Outfitters, Inc. (Anthropologie, Terrain), Article Furniture International Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The North America home furniture market is poised for transformative growth, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, manufacturers are increasingly adopting eco-friendly practices, which will likely reshape product offerings. Additionally, the integration of smart technology into furniture design is expected to enhance functionality and appeal to tech-savvy consumers. These trends indicate a dynamic market landscape, where innovation and consumer-centric strategies will play pivotal roles in shaping future developments.

| Segment | Sub-Segments |

|---|---|

| By Type | Sofas and Sectionals Beds, Mattresses, and Bedroom Sets Dining Tables and Seating Storage Furniture (Dressers, Cabinets, Wardrobes) Outdoor and Patio Furniture Home Office Furniture (Desks, Office Chairs, Bookcases) Recliners and Motion Furniture Kids’ and Nursery Furniture Accent and Occasional Furniture |

| By End-User | Residential Hospitality (Hotels, Vacation Rentals) Commercial (Home Staging, Model Homes, Small Offices) |

| By Distribution Channel | Online (E-commerce Marketplaces and DTC) Offline (Specialty Furniture Stores, Big-Box Retail, Warehouse Clubs) Omnichannel (Click-and-Collect, Showroom-to-Home Delivery) |

| By Price Range | Budget Mid-range Premium and Luxury |

| By Material | Solid Wood and Engineered Wood Metal Upholstery (Fabric and Leather) Glass and Stone/Composite Wicker, Rattan, and Plastics |

| By Style | Modern/Contemporary Traditional Transitional Rustic/Farmhouse Scandinavian/Minimalist |

| By Functionality | Multi-functional and Space-Saving Standard Customizable and Modular |

| By Country | United States Canada Mexico |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 150 | Homeowners, Renters |

| Commercial Furniture Solutions | 100 | Office Managers, Facilities Coordinators |

| Online Furniture Shopping Trends | 120 | eCommerce Shoppers, Digital Commerce Analysts |

| Eco-friendly Furniture Preferences | 80 | Sustainability Advocates, Green Product Buyers |

| Luxury Furniture Market Insights | 70 | Interior Designers, High-End Retail Buyers |

The North America Home Furniture Market is valued at approximately USD 233 billion, reflecting a significant growth driven by increased consumer spending on home improvement and a shift towards personalized and comfortable living spaces.