Region:Global

Author(s):Shubham

Product Code:KRAA1709

Pages:90

Published On:August 2025

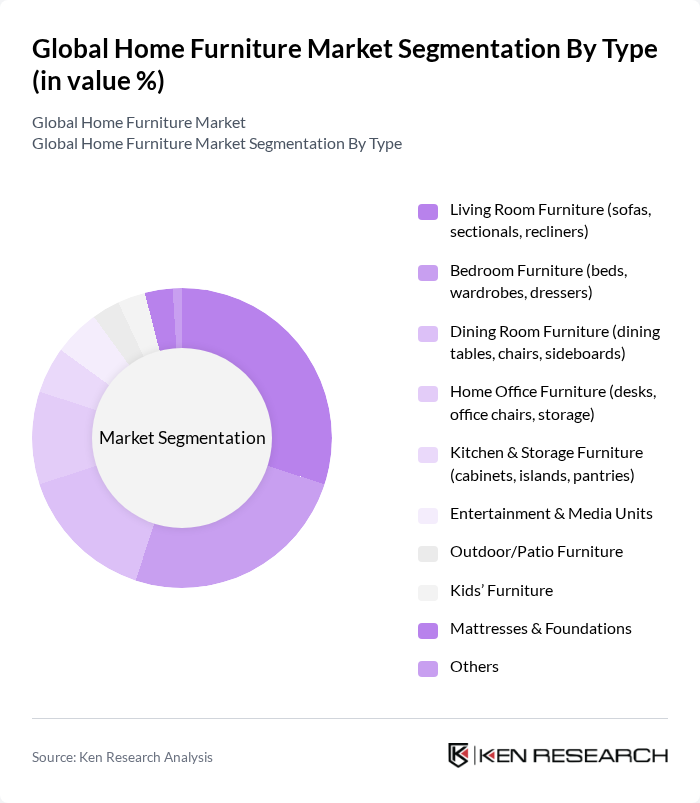

By Type:The market is segmented into various types of furniture, including living room furniture, bedroom furniture, dining room furniture, home office furniture, kitchen & storage furniture, entertainment & media units, outdoor/patio furniture, kids’ furniture, mattresses & foundations, and others. Each sub-segment caters to specific consumer needs and preferences, reflecting trends in home decor and functionality. Recent demand patterns show indoor furniture as the dominant usage category, supported by renovation and aesthetic upgrades, while outdoor/patio continues to grow with increased patio and garden furnishing.

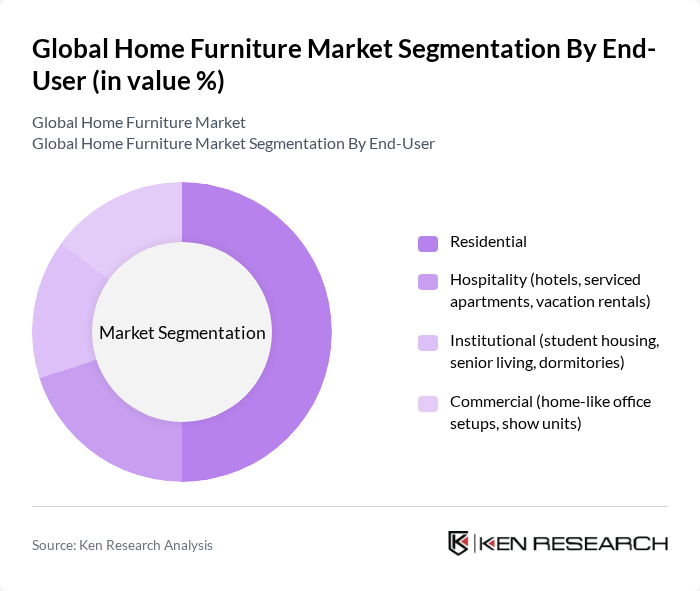

By End-User:The end-user segmentation includes residential, hospitality, institutional, and commercial sectors. Each segment has unique requirements, with residential furniture focusing on comfort and aesthetics, while hospitality and institutional furniture prioritize durability and functionality. The commercial sector increasingly adopts home-like office setups, aided by modular and ergonomic designs and e-commerce distribution that supports specification and delivery.

The Global Home Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA (Ingka Group), Ashley Furniture Industries, LLC, Wayfair Inc., Williams-Sonoma, Inc. (West Elm, Pottery Barn), La-Z-Boy Incorporated, Herman Miller, Inc. (MillerKnoll), Tempur Sealy International, Inc., Steinhoff International Holdings N.V. (incl. Pepco Group/PEP&CO), Restoration Hardware (RH), Ethan Allen Interiors Inc., Haverty Furniture Companies, Inc., DFS Furniture plc, B&B Italia S.p.A. (Design Holding), Kimball International, Inc., Sauder Woodworking Co., Inter IKEA Systems B.V. (franchisor), HNI Corporation, Hooker Furnishings Corporation, Flexsteel Industries, Inc., Mohawk Industries, Inc. (for mattresses/foundations adjacency) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the home furniture market appears promising, driven by trends such as the increasing adoption of smart furniture and a growing emphasis on sustainability. As consumers become more environmentally conscious, the demand for eco-friendly materials is expected to rise, influencing manufacturers to innovate. Additionally, the integration of technology in furniture design will cater to the needs of tech-savvy consumers, enhancing functionality and convenience in home environments, thus shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Living Room Furniture (sofas, sectionals, recliners) Bedroom Furniture (beds, wardrobes, dressers) Dining Room Furniture (dining tables, chairs, sideboards) Home Office Furniture (desks, office chairs, storage) Kitchen & Storage Furniture (cabinets, islands, pantries) Entertainment & Media Units Outdoor/Patio Furniture Kids’ Furniture Mattresses & Foundations Others |

| By End-User | Residential Hospitality (hotels, serviced apartments, vacation rentals) Institutional (student housing, senior living, dormitories) Commercial (home-like office setups, show units) |

| By Sales Channel | Specialty Stores Supermarkets & Hypermarkets Online Retail (brand DTC, marketplaces) Other Offline Retail (independent retailers, franchise stores) |

| By Material | Wood (solid wood, engineered wood) Metal Upholstered Plastic & Composite Glass & Stone |

| By Design Style | Modern/Contemporary Traditional/Classical Scandinavian/Minimalist Rustic/Industrial Transitional |

| By Price Range | Budget Mid-range Premium Luxury |

| By Distribution Mode | Direct-to-Consumer Retail Partnerships E-commerce Marketplaces Omnichannel (online-to-offline, click-and-collect) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 150 | Homeowners, Renters |

| Commercial Furniture Solutions | 100 | Office Managers, Facilities Coordinators |

| Online Furniture Shopping Trends | 120 | eCommerce Shoppers, Digital Commerce Managers |

| Luxury Furniture Market Insights | 80 | Interior Designers, High-End Retail Buyers |

| Sustainable Furniture Preferences | 90 | Eco-conscious Consumers, Sustainability Managers |

The Global Home Furniture Market is valued at approximately USD 570 billion, driven by factors such as rising disposable incomes, urbanization, and increased home improvement spending, particularly in indoor furniture categories like sofas, beds, and tables.