Region:Asia

Author(s):Shubham

Product Code:KRAA1901

Pages:80

Published On:August 2025

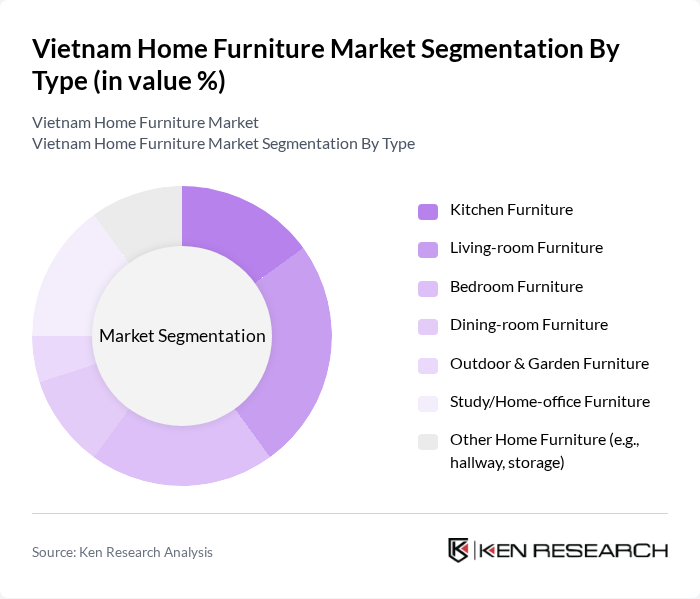

By Type:The home furniture market can be segmented into various types, including kitchen furniture, living-room furniture, bedroom furniture, dining-room furniture, outdoor & garden furniture, study/home-office furniture, and other home furniture such as hallway and storage solutions. Each type caters to specific consumer needs and preferences, reflecting trends in home design and functionality. Rising demand for modern, space-saving, and multifunctional designs—especially for urban apartments—continues to shape product choices in living, bedroom, and storage categories.

The living-room furniture segment is currently dominating the market due to its essential role in home aesthetics and comfort. Consumers are increasingly investing in stylish sofas, coffee tables, and entertainment units that reflect their personal style and enhance their living spaces. The trend towards open-plan living has also contributed to the demand for multifunctional and space-saving designs, making living-room furniture a focal point in home furnishing decisions.

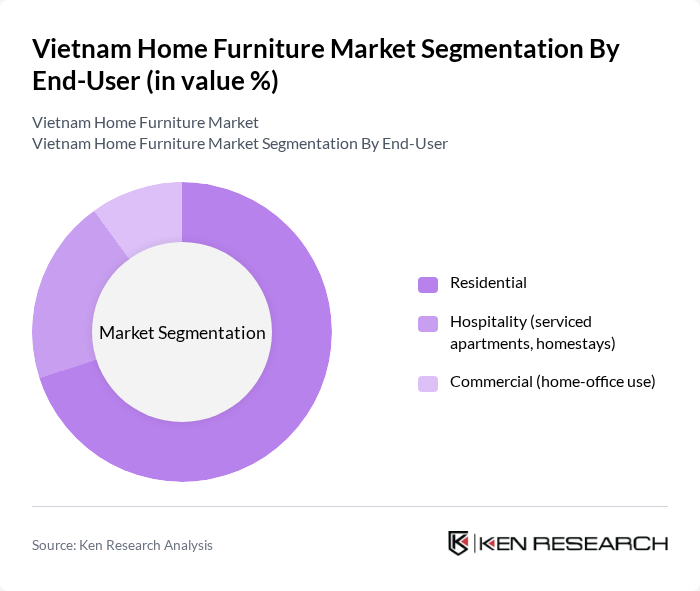

By End-User:The market can be segmented based on end-users, including residential, hospitality (serviced apartments, homestays), and commercial (home-office use). Each segment has distinct requirements and preferences, influencing the types of furniture purchased and the overall market dynamics. Residential demand is supported by ongoing urban housing development and e-commerce expansion, while hospitality and commercial purchases are influenced by project pipelines and design standardization needs.

The residential segment is the largest in the home furniture market, driven by the increasing number of households and the trend towards home improvement. Consumers are investing in quality furniture to enhance their living spaces, reflecting a growing emphasis on comfort and style. The rise of e-commerce has also made it easier for consumers to access a wide range of products, further boosting demand in this segment.

The Vietnam Home Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Vietnam, Ashley Furniture HomeStore Vietnam, Index Living Mall Vietnam, JYSK Vietnam, UMA Vietnam (Nhà Xinh legacy brand line), Nhà Xinh (AA Corporation), AA Corporation, Hòa Phát Furniture (N?i Th?t Hòa Phát), Xuân Hòa Furniture (N?i Th?t Xuân Hòa), ??c Khang Furniture (N?i Th?t ??c Khang), IBIE Furniture, BAYA (formerly UMA), Savimex (Savimex Corporation), Scansia Pacific, AA Decor (AA Group retail) contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam home furniture market is poised for significant transformation as consumer preferences evolve towards sustainability and technology integration. With urbanization and disposable income on the rise, the demand for innovative and eco-friendly furniture solutions is expected to grow. Companies that adapt to these trends by offering customizable and smart furniture options will likely capture a larger market share. Additionally, the expansion of e-commerce will continue to reshape the retail landscape, providing opportunities for brands to reach a broader audience.

| Segment | Sub-Segments |

|---|---|

| By Type | Kitchen Furniture Living-room Furniture Bedroom Furniture Dining-room Furniture Outdoor & Garden Furniture Study/Home-office Furniture Other Home Furniture (e.g., hallway, storage) |

| By End-User | Residential Hospitality (serviced apartments, homestays) Commercial (home-office use) |

| By Sales Channel | Home Centers Specialty Stores Flagship & Brand Stores Online Other Channels (manufacturer retailers, warehouse clubs, discount retailers, distributors, omnichannel) |

| By Price Range | Budget Mid-range Premium |

| By Material | Solid Wood Engineered Wood Metal Fabric & Leather Rattan/Bamboo & Other Materials |

| By Design Style | Contemporary/Modern Traditional/Classical Rustic/Scandinavian Industrial |

| By Functionality | Multi-functional Space-saving/Modular Standard |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 150 | Homeowners, Renters |

| Commercial Furniture Supply | 100 | Office Managers, Facility Managers |

| Online Furniture Shopping Behavior | 120 | eCommerce Shoppers, Digital Commerce Managers |

| Trends in Sustainable Furniture | 80 | Eco-conscious Consumers, Sustainability Advocates |

| Influence of Interior Design on Purchases | 90 | Interior Designers, Home Decor Influencers |

The Vietnam Home Furniture Market is valued at approximately USD 400 million, driven by rising disposable incomes, urbanization, and a growing middle class that prioritizes home aesthetics and comfort.