Region:Asia

Author(s):Shubham

Product Code:KRAB0727

Pages:94

Published On:August 2025

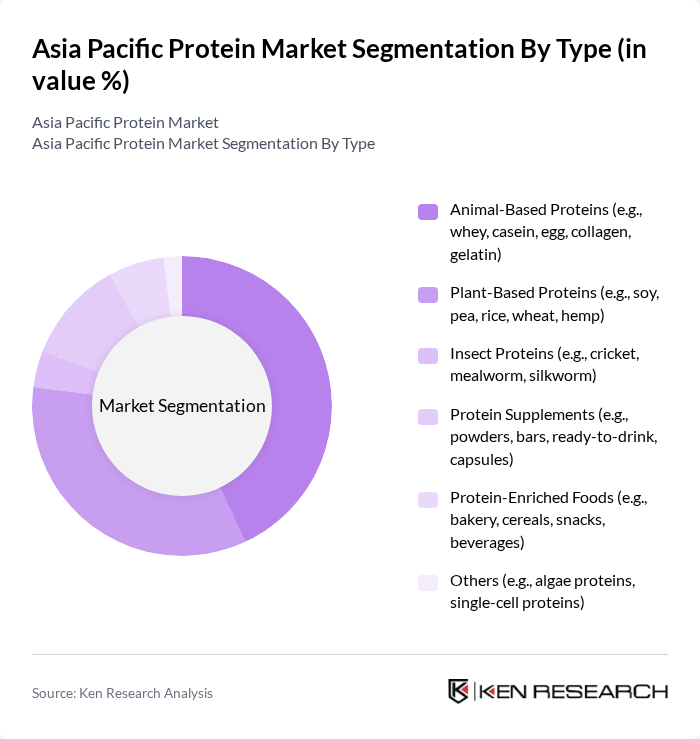

By Type:The protein market can be segmented into various types, including animal-based proteins, plant-based proteins, insect proteins, protein supplements, protein-enriched foods, and others. Among these, animal-based proteins, particularly whey and casein, have been leading the market due to their high nutritional value and widespread use in food and dietary supplements. However, plant-based proteins are rapidly gaining traction as consumers shift towards healthier and more sustainable dietary options, supported by the rising vegan and vegetarian population and increasing product innovation .

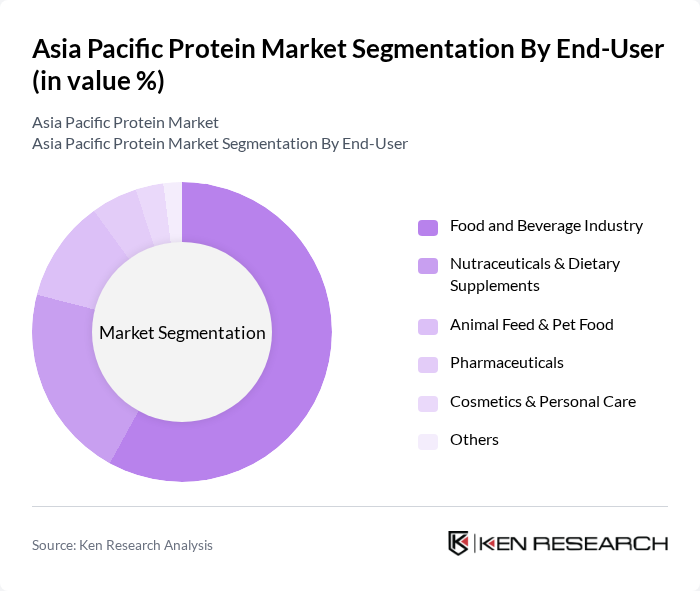

By End-User:The end-user segmentation includes the food and beverage industry, nutraceuticals and dietary supplements, animal feed and pet food, pharmaceuticals, cosmetics and personal care, and others. The food and beverage industry remains the largest end-user segment, driven by the increasing incorporation of protein in various food products and the rising demand for health-oriented food options. Nutraceuticals and dietary supplements are also expanding rapidly, reflecting the region’s growing focus on preventive healthcare and wellness .

The Asia Pacific Protein Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Tyson Foods, Inc., Cargill, Inc., Archer Daniels Midland Company (ADM), DuPont de Nemours, Inc. (IFF Nutrition & Biosciences), Olam International Limited, Wilmar International Limited, Ingredion Incorporated, Kerry Group plc, DSM-Firmenich, Fonterra Co-operative Group Limited, Axiom Foods, Inc., MycoTechnology, Inc., Beyond Meat, Inc., Eat Just, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Asia Pacific protein market is poised for transformative growth, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, the demand for eco-friendly protein sources is expected to rise, with a projected increase in plant-based protein consumption by 30% in future. Additionally, innovations in protein fortification and personalized nutrition are anticipated to reshape product offerings, catering to health-conscious consumers seeking tailored dietary solutions. This dynamic landscape presents significant opportunities for market players to capitalize on emerging trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Animal-Based Proteins (e.g., whey, casein, egg, collagen, gelatin) Plant-Based Proteins (e.g., soy, pea, rice, wheat, hemp) Insect Proteins (e.g., cricket, mealworm, silkworm) Protein Supplements (e.g., powders, bars, ready-to-drink, capsules) Protein-Enriched Foods (e.g., bakery, cereals, snacks, beverages) Others (e.g., algae proteins, single-cell proteins) |

| By End-User | Food and Beverage Industry Nutraceuticals & Dietary Supplements Animal Feed & Pet Food Pharmaceuticals Cosmetics & Personal Care Others |

| By Distribution Channel | Online Retail/E-commerce Supermarkets/Hypermarkets Specialty Stores (e.g., health food stores, sports nutrition stores) Direct Sales (B2B, institutional) Others (e.g., pharmacies, convenience stores) |

| By Application | Food Products (e.g., bakery, dairy alternatives, meat analogues) Dietary Supplements Sports Nutrition Functional Foods & Beverages Infant & Elderly Nutrition Others |

| By Source | Organic Conventional Others (e.g., non-GMO, specialty) |

| By Price Range | Economy Mid-Range Premium |

| By Region | China India Japan Southeast Asia (e.g., Thailand, Vietnam, Indonesia, Malaysia, Singapore, Philippines) Oceania (Australia, New Zealand) South Korea Rest of Asia Pacific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Animal Protein Producers | 60 | Farm Owners, Production Managers |

| Plant-Based Protein Manufacturers | 50 | Product Development Managers, Marketing Directors |

| Retailers of Protein Products | 70 | Category Managers, Purchasing Agents |

| Health and Nutrition Experts | 40 | Dietitians, Nutrition Researchers |

| Consumers of Protein Products | 100 | Health-Conscious Shoppers, Fitness Enthusiasts |

The Asia Pacific Protein Market is valued at approximately USD 8 billion, driven by rising disposable incomes, health consciousness, and the growth of the food and beverage industry. This market reflects a significant shift towards both animal-based and plant-based protein sources.