Region:Europe

Author(s):Dev

Product Code:KRAC0511

Pages:90

Published On:August 2025

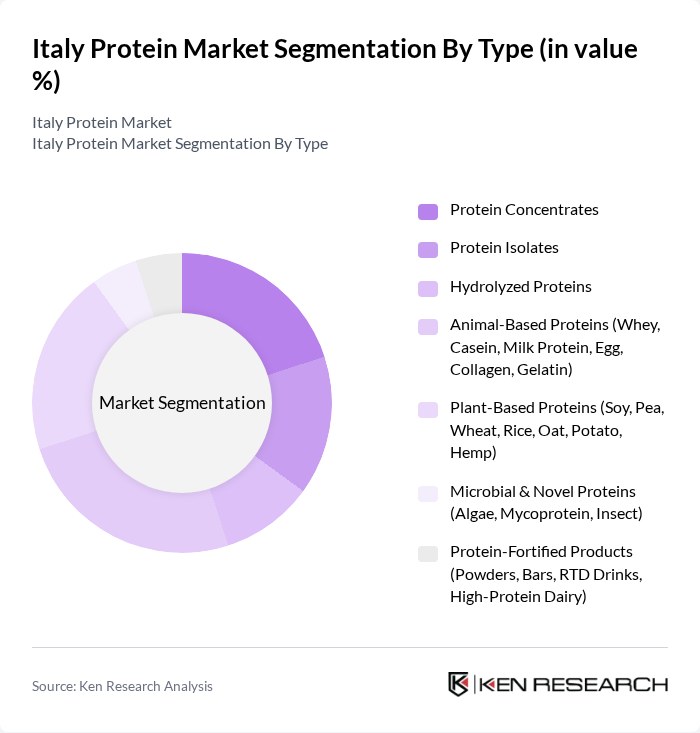

By Type:The protein market in Italy is segmented into various types, including Protein Concentrates, Protein Isolates, Hydrolyzed Proteins, Animal-Based Proteins, Plant-Based Proteins, Microbial & Novel Proteins, and Protein-Fortified Products. Each of these sub-segments caters to different consumer needs and preferences, with a notable trend towards plant-based options due to increasing veganism and health awareness ; .

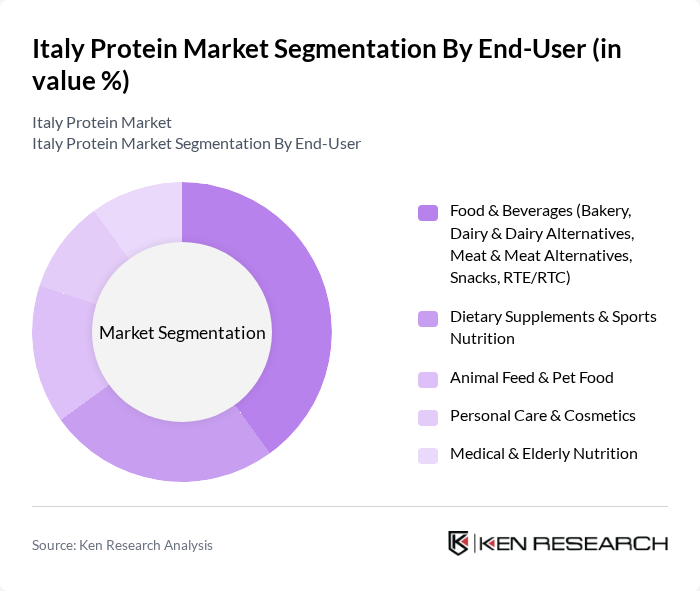

By End-User:The end-user segmentation of the protein market includes Food & Beverages, Dietary Supplements & Sports Nutrition, Animal Feed & Pet Food, Personal Care & Cosmetics, and Medical & Elderly Nutrition. The Food & Beverages segment is particularly dominant, driven by the increasing incorporation of protein in everyday food products and the rising trend of health-focused diets .

The Italy Protein Market is characterized by a dynamic mix of regional and international players. Leading participants such as Granarolo S.p.A., Parmalat S.p.A. (Lactalis Group), FrieslandCampina Ingredients, Arla Foods Ingredients Group P/S, Fonterra Co-operative Group Limited, Glanbia plc (Glanbia Performance Nutrition), Nestlé S.A., Danone S.A., Roquette Frères, ADM (Archer Daniels Midland Company), Cargill, Incorporated, Kerry Group plc, Ingredion Incorporated, Sacco System (CAGLIATE – Italy) / Sacco S.r.l., ENERVIT S.p.A. contribute to innovation, geographic expansion, and service delivery in this space ; .

The future of the Italy protein market appears promising, driven by increasing consumer demand for health-oriented products and innovative protein solutions. As the trend towards sustainable and plant-based proteins continues to grow, companies are likely to invest in research and development to create new offerings. Additionally, the expansion of e-commerce platforms will facilitate greater access to protein products, allowing consumers to explore diverse options. Overall, the market is poised for dynamic growth, adapting to evolving consumer preferences and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein Concentrates Protein Isolates Hydrolyzed Proteins Animal-Based Proteins (Whey, Casein, Milk Protein, Egg, Collagen, Gelatin) Plant-Based Proteins (Soy, Pea, Wheat, Rice, Oat, Potato, Hemp) Microbial & Novel Proteins (Algae, Mycoprotein, Insect) Protein-Fortified Products (Powders, Bars, RTD Drinks, High-Protein Dairy) |

| By End-User | Food & Beverages (Bakery, Dairy & Dairy Alternatives, Meat & Meat Alternatives, Snacks, RTE/RTC) Dietary Supplements & Sports Nutrition Animal Feed & Pet Food Personal Care & Cosmetics Medical & Elderly Nutrition |

| By Distribution Channel | Supermarkets & Hypermarkets Specialty Health Stores & Pharmacies Online Retail/E-commerce Gyms, Fitness Studios & Direct-to-Consumer HoReCa & Foodservice |

| By Application | Functional Foods & Beverages Sports & Performance Nutrition Infant, Clinical & Elderly Nutrition Meat & Dairy Alternatives Animal Nutrition |

| By Price Range | Economy Mid-Range Premium Private Label |

| By Packaging Type | Bulk (Sacks, Drums, IBCs) Retail (Pouches, Tubs, Bottles) Ready-to-Drink/On-the-Go Eco-Friendly & Recyclable |

| By Source | Animal Plant Microbial & Novel Organic Conventional |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Protein Preferences | 140 | Health-conscious Consumers, Fitness Enthusiasts |

| Retail Protein Product Offerings | 90 | Store Managers, Category Buyers |

| Food Manufacturer Insights | 80 | Product Development Managers, Marketing Directors |

| Nutritionist Perspectives | 60 | Registered Dietitians, Nutrition Consultants |

| Trends in Plant-Based Proteins | 70 | Food Scientists, Sustainability Officers |

The Italy Protein Market is valued at approximately USD 380 million, reflecting a significant growth trend driven by increasing health consciousness, a shift towards plant-based diets, and rising demand for protein supplements in fitness and wellness sectors.