Region:Asia

Author(s):Shubham

Product Code:KRAA2245

Pages:95

Published On:August 2025

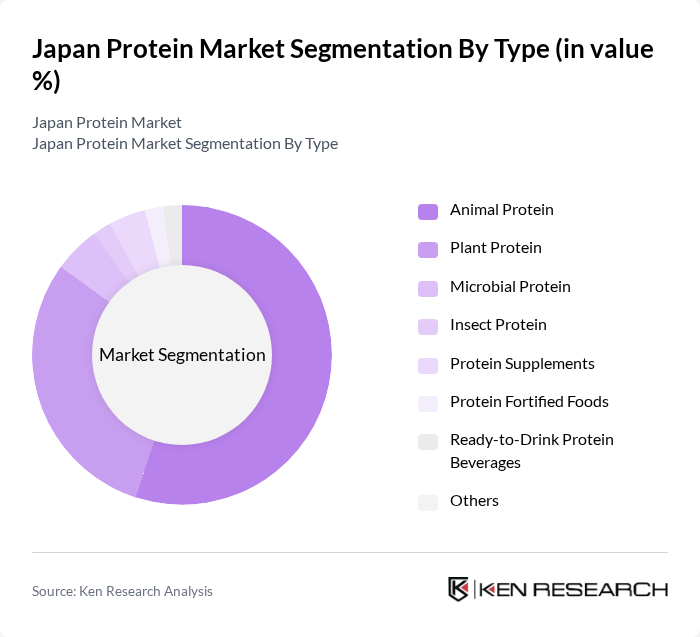

By Type:The protein market in Japan can be segmented into various types, including animal protein, plant protein, microbial protein, insect protein, protein supplements, protein-fortified foods, and ready-to-drink protein beverages. Among these, animal protein remains the most dominant segment, driven by traditional dietary preferences and the high consumption of dairy, seafood, and meat products. However, plant protein is gaining significant traction due to the rising trend of vegetarianism, flexitarian diets, and health-conscious consumers seeking alternative protein sources. The rapid growth of plant-based protein is also supported by innovation in pea, soy, and texturized vegetable protein products, as well as increasing consumer awareness of sustainability and allergen-free options .

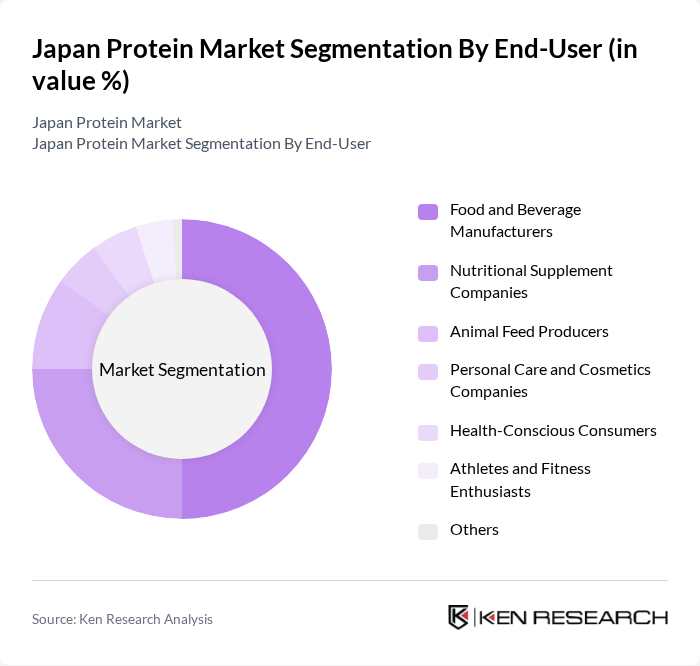

By End-User:The end-user segmentation of the protein market includes food and beverage manufacturers, nutritional supplement companies, animal feed producers, personal care and cosmetics companies, health-conscious consumers, athletes, and fitness enthusiasts. The food and beverage manufacturers segment is the largest, as they incorporate protein into various products to meet consumer demand for healthier options. Nutritional supplements are also significant, particularly among fitness enthusiasts seeking to enhance their performance and recovery. The animal feed sector is driven by the demand for high-quality protein sources in livestock and aquaculture, while personal care and cosmetics companies utilize proteins for functional and marketing benefits in beauty products .

The Japan Protein Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ajinomoto Co., Inc., Meiji Holdings Co., Ltd., Nippon Protein Co., Ltd., Maruha Nichiro Corporation, Otsuka Pharmaceutical Co., Ltd., Kewpie Corporation, Asahi Group Holdings, Ltd., Suntory Holdings Limited, Morinaga Milk Industry Co., Ltd., Nisshin Seifun Group Inc., Showa Sangyo Co., Ltd., Marubeni Corporation, Yamasa Corporation, Takeda Pharmaceutical Company Limited, Kirin Holdings Company, Limited, Archer Daniels Midland Company (Japan), Arla Foods Ingredients (Japan) contribute to innovation, geographic expansion, and service delivery in this space.

The Japan protein market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, the demand for innovative protein products, particularly those that are plant-based and functional, is expected to increase. Additionally, the expansion of e-commerce platforms will facilitate greater access to diverse protein options, enhancing consumer choice. Companies that adapt to these trends and invest in sustainable practices will likely thrive in this competitive landscape, positioning themselves for long-term success.

| Segment | Sub-Segments |

|---|---|

| By Type | Animal Protein Casein and Caseinates Collagen Egg Protein Gelatin Milk Protein Whey Protein Other Animal Protein Plant Protein Soy Protein Pea Protein Rice Protein Wheat Protein Potato Protein Hemp Protein Other Plant Protein Microbial Protein Algae Protein Mycoprotein Insect Protein Protein Supplements Protein Fortified Foods Ready-to-Drink Protein Beverages Others |

| By End-User | Food and Beverage Manufacturers Nutritional Supplement Companies Animal Feed Producers Personal Care and Cosmetics Companies Health-Conscious Consumers Athletes and Fitness Enthusiasts Others |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Health Food Stores Specialty Stores Direct Sales Others |

| By Application | Food and Beverages Bakery Dairy and Dairy Alternatives Meat, Poultry, Seafood & Alternatives Snacks Confectionery Breakfast Cereals Condiments/Sauces Ready-to-Eat/Ready-to-Cook Foods Nutritional Supplements Animal Feed Personal Care and Cosmetics Pharmaceuticals Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Packaging Type | Bulk Packaging Retail Packaging Single-Serve Packaging Others |

| By Brand Type | National Brands Private Labels Generic Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Protein Preferences | 120 | Health-conscious Consumers, Fitness Enthusiasts |

| Retail Protein Product Sales | 90 | Store Managers, Category Buyers |

| Food Service Industry Insights | 70 | Restaurant Owners, Menu Planners |

| Protein Production Insights | 60 | Farmers, Protein Manufacturers |

| Nutrition Expert Opinions | 50 | Dietitians, Nutrition Researchers |

The Japan Protein Market is valued at approximately USD 1.7 billion, reflecting a significant growth trend driven by increasing health consciousness, demand for high-protein diets, and innovations in food technology.