Region:Global

Author(s):Rebecca

Product Code:KRAC0313

Pages:91

Published On:August 2025

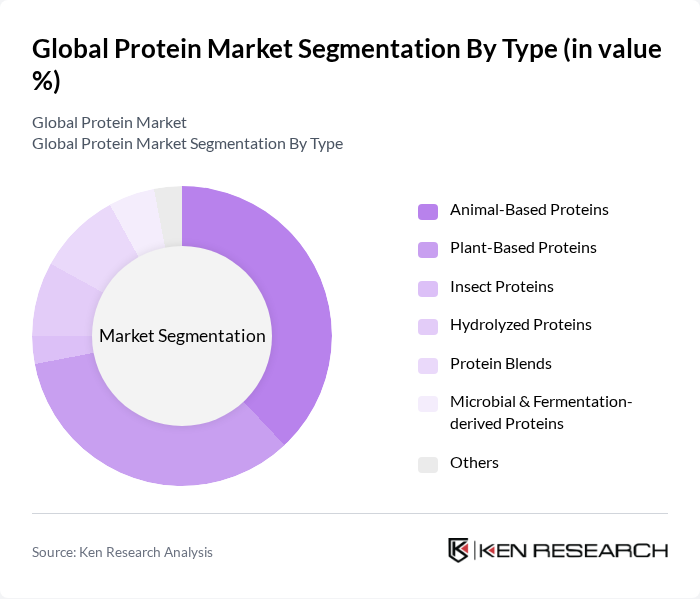

By Type:The protein market can be segmented into various types, including Animal-Based Proteins, Plant-Based Proteins, Insect Proteins, Hydrolyzed Proteins, Protein Blends, Microbial & Fermentation-derived Proteins, and Others. Among these,Plant-Based Proteinsare currently experiencing the fastest growth, driven by the increasing trend towards vegetarianism and veganism, as well as the growing awareness of health benefits associated with plant-based diets. Consumers are increasingly seeking sustainable and ethical food sources, which has led to a surge in demand for plant-based protein products.

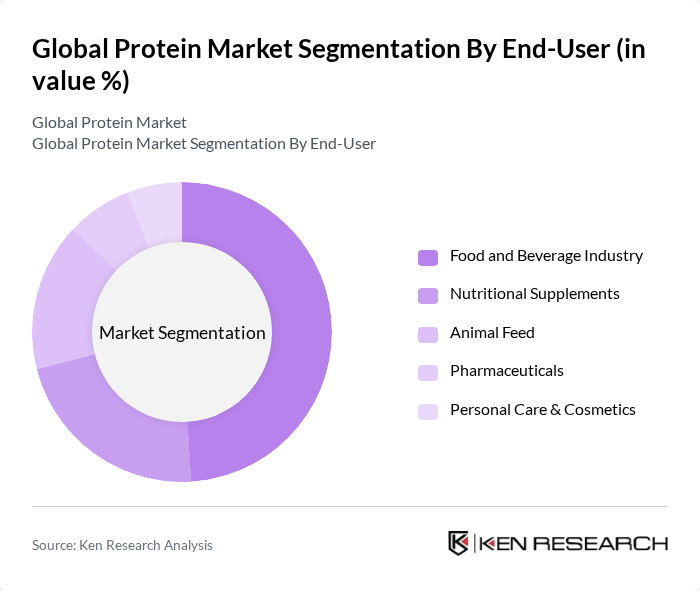

By End-User:The protein market is also segmented by end-user categories, including Food and Beverage Industry, Nutritional Supplements, Animal Feed, Pharmaceuticals, and Personal Care & Cosmetics. TheFood and Beverage Industryis the leading segment, driven by the increasing incorporation of protein in various food products, including snacks, beverages, and meal replacements. The growing trend of health and wellness among consumers has led to a higher demand for protein-enriched foods, making this segment a significant contributor to market growth.

The Global Protein Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Danone S.A., Abbott Laboratories, PepsiCo, Inc., The Kraft Heinz Company, Unilever PLC, Archer Daniels Midland Company (ADM), Cargill, Incorporated, DuPont de Nemours, Inc. (IFF), Ingredion Incorporated, Oatly Group AB, Beyond Meat, Inc., Tyson Foods, Inc., Emsland Group, Myprotein (The Hut Group), Kerry Group plc, Roquette Frères S.A., Glanbia plc, dsm-firmenich AG, International Flavors & Fragrances Inc. (IFF) contribute to innovation, geographic expansion, and service delivery in this space.

The protein market is poised for transformative growth, driven by innovations in product development and a shift towards sustainable practices. As consumer preferences evolve, companies are increasingly focusing on clean label products and personalized nutrition solutions. The rise of e-commerce is also reshaping distribution channels, making protein products more accessible. Furthermore, collaborations with health and wellness brands are expected to enhance market penetration, catering to the growing demand for functional foods that support overall health and well-being.

| Segment | Sub-Segments |

|---|---|

| By Type | Animal-Based Proteins Plant-Based Proteins Insect Proteins Hydrolyzed Proteins Protein Blends Microbial & Fermentation-derived Proteins Others |

| By End-User | Food and Beverage Industry Nutritional Supplements Animal Feed Pharmaceuticals Personal Care & Cosmetics |

| By Application | Sports Nutrition Weight Management Meal Replacement Functional Foods Infant Nutrition |

| By Distribution Channel | Online Retail (E-Retailers) Supermarkets/Hypermarkets Health Food Stores Direct Sales Specialty Stores |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa China India |

| By Price Range | Budget Mid-Range Premium |

| By Product Form | Powder (Dry) Bars Ready-to-Drink (Liquid) Capsules/Tablets Hydrolysates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Animal Protein Producers | 100 | Farm Owners, Production Managers |

| Plant-Based Protein Manufacturers | 70 | Product Development Managers, Marketing Directors |

| Retail Sector Protein Sales | 110 | Category Managers, Retail Buyers |

| Food Service Industry | 60 | Restaurant Owners, Menu Planners |

| Consumer Insights on Protein Preferences | 140 | Health-Conscious Consumers, Fitness Enthusiasts |

The Global Protein Market is valued at approximately USD 52.6 billion, reflecting a significant growth trend driven by increasing health consciousness and the rising demand for protein-rich diets, particularly in the food and beverage industry.