Region:North America

Author(s):Rebecca

Product Code:KRAA1372

Pages:86

Published On:August 2025

By Source:The protein market is segmented by source into animal-based proteins, plant-based proteins, microbial and fermentation-derived proteins, insect proteins, and cultivated proteins. Animal-based proteins—including meat, poultry, dairy, eggs, and seafood—continue to dominate due to established consumption patterns and supply chains. However, plant-based proteins are experiencing robust growth as consumers seek healthier and more sustainable dietary options, supported by the expansion of production facilities and increased consumer awareness .

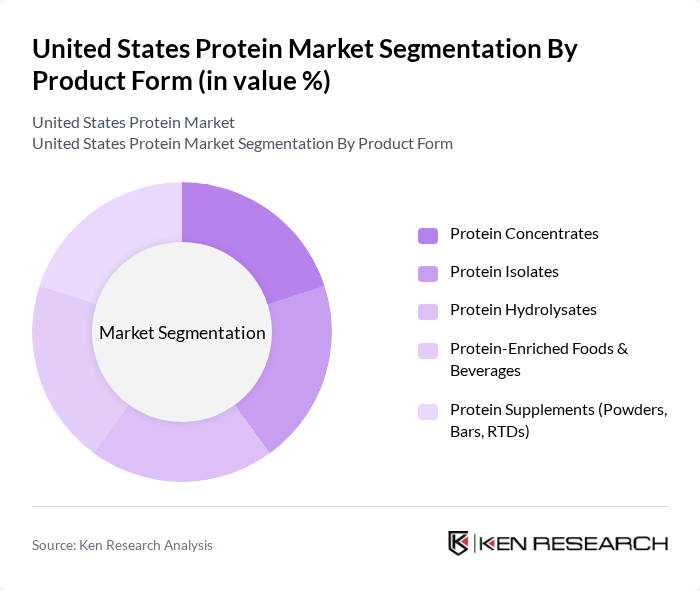

By Product Form:The market is further segmented by product form, including protein concentrates, protein isolates, protein hydrolysates, protein-enriched foods and beverages, and protein supplements. Protein supplements—especially powders and bars—lead this segment, driven by the growing fitness culture, demand for convenient nutrition, and increased adoption of plant-based and functional protein products. Protein-enriched foods and beverages are also gaining traction as consumers seek high-protein options for everyday consumption .

The United States Protein Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tyson Foods, Inc., JBS USA Holdings, Inc., Cargill, Incorporated, Smithfield Foods, Inc., Beyond Meat, Inc., Impossible Foods Inc., Archer Daniels Midland Company (ADM), CHS Inc., Darling Ingredients Inc., MGP Ingredients, Inc., Nestlé USA, Inc., General Mills, Inc., Kraft Heinz Company, Hormel Foods Corporation, Oatly Group AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. protein market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, the demand for innovative protein products is expected to grow. Additionally, sustainability will play a pivotal role, with consumers increasingly favoring environmentally friendly options. Companies that adapt to these trends by investing in research and development, as well as sustainable practices, will likely capture significant market share and drive future growth in this dynamic industry.

| Segment | Sub-Segments |

|---|---|

| By Source | Animal-Based Proteins (Meat, Poultry, Dairy, Eggs, Seafood) Plant-Based Proteins (Soy, Pea, Wheat, Rice, Potato, Others) Microbial & Fermentation-Derived Proteins (Algae, Mycoprotein, Precision Fermentation) Insect Proteins Cultivated (Lab-Grown) Proteins |

| By Product Form | Protein Concentrates Protein Isolates Protein Hydrolysates Protein-Enriched Foods & Beverages Protein Supplements (Powders, Bars, RTDs) |

| By Application | Food & Beverage Nutraceuticals & Dietary Supplements Sports & Performance Nutrition Animal Feed & Pet Food Personal Care & Cosmetics |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Direct Sales (B2B, D2C) Others |

| By End-User | Retail Consumers Food Service & Hospitality Sports & Fitness Centers Healthcare & Clinical Nutrition Others |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Animal Protein | 120 | Health-conscious Consumers, Families |

| Market Trends in Plant-based Proteins | 90 | Vegans, Vegetarians, Health Enthusiasts |

| Retail Insights on Protein Products | 60 | Store Managers, Category Buyers |

| Food Service Industry Protein Usage | 50 | Chefs, Restaurant Owners |

| Protein Supplement Market Dynamics | 55 | Fitness Trainers, Nutritionists |

The United States Protein Market is valued at approximately USD 2.7 billion, reflecting a significant growth trend driven by increasing consumer demand for high-protein diets and the adoption of plant-based protein sources.