Region:Asia

Author(s):Rebecca

Product Code:KRAB0203

Pages:89

Published On:August 2025

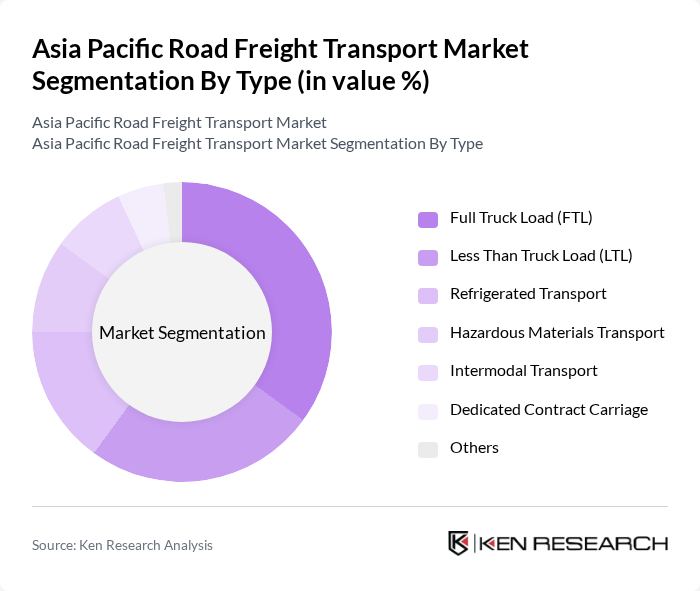

By Type:The market is segmented into various types of road freight transport services, including Full Truck Load (FTL), Less Than Truck Load (LTL), Refrigerated Transport, Hazardous Materials Transport, Intermodal Transport, Dedicated Contract Carriage, and Others. Each of these sub-segments caters to different logistics needs and customer requirements. Full Truck Load (FTL) services dominate the market, particularly for large-volume shipments across inter-regional corridors, while LTL and specialized services such as refrigerated and hazardous materials transport are growing due to rising demand in retail, food, and chemicals sectors .

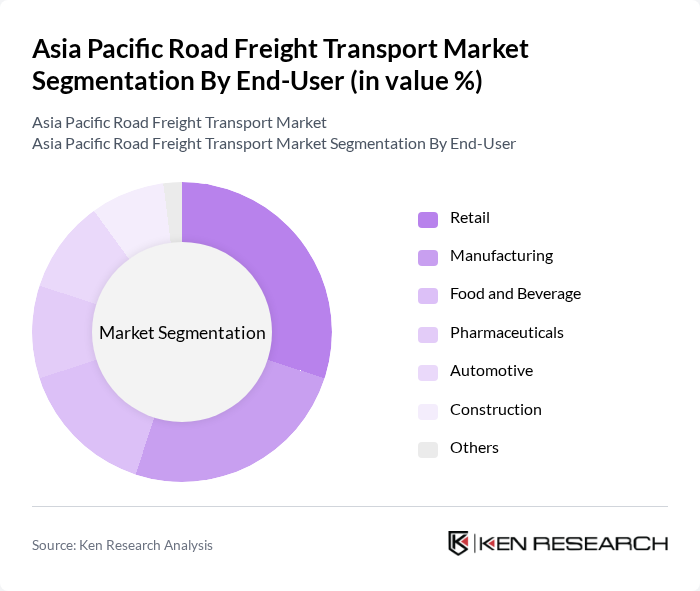

By End-User:The road freight transport market serves various end-user industries, including Retail, Manufacturing, Food and Beverage, Pharmaceuticals, Automotive, Construction, and Others. Each sector has unique logistics requirements that influence the demand for specific transport services. Retail and manufacturing sectors are the largest consumers, driven by the growth of e-commerce, industrial output, and the need for timely distribution of goods .

The Asia Pacific Road Freight Transport Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, Toll Group, Yamato Holdings Co., Ltd., Nippon Express Holdings, Inc., Sinotrans Limited, SF Express, CJ Logistics Corporation, Linfox, Gati Limited, Agility Logistics, CEVA Logistics, DB Schenker (Asia Pacific), Kerry Logistics Network Limited contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Asia Pacific road freight transport market is poised for significant transformation, driven by technological innovations and evolving consumer preferences. As e-commerce continues to expand, logistics providers will increasingly adopt automation and AI-driven solutions to enhance operational efficiency. Furthermore, sustainability will become a focal point, with companies prioritizing eco-friendly practices to meet regulatory requirements and consumer expectations, ultimately shaping a more resilient and adaptive transport landscape in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Refrigerated Transport Hazardous Materials Transport Intermodal Transport Dedicated Contract Carriage Others |

| By End-User | Retail Manufacturing Food and Beverage Pharmaceuticals Automotive Construction Others |

| By Region | China India Japan Southeast Asia Australia & Oceania South Korea Rest of Asia Pacific |

| By Service Type | Standard Freight Services Expedited Freight Services Specialized Freight Services Value-Added Services |

| By Delivery Mode | Road Transport Last-Mile Delivery Cross-Border Road Freight Intermodal Transport |

| By Fleet Type | Owned Fleet Leased Fleet Third-Party Logistics Fleet |

| By Pricing Model | Fixed Pricing Dynamic Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 100 | Logistics Coordinators, Supply Chain Managers |

| Manufacturing Supply Chain | 80 | Operations Directors, Procurement Managers |

| E-commerce Fulfillment Strategies | 90 | eCommerce Operations Managers, Logistics Analysts |

| Government Transport Policy Impact | 40 | Policy Makers, Regulatory Affairs Specialists |

| Technology Adoption in Freight | 60 | IT Managers, Innovation Leads in Logistics |

The Asia Pacific Road Freight Transport Market is valued at approximately USD 510 billion, reflecting significant growth driven by increasing logistics demand, urbanization, and e-commerce expansion across the region.