Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA1248

Pages:98

Published On:August 2025

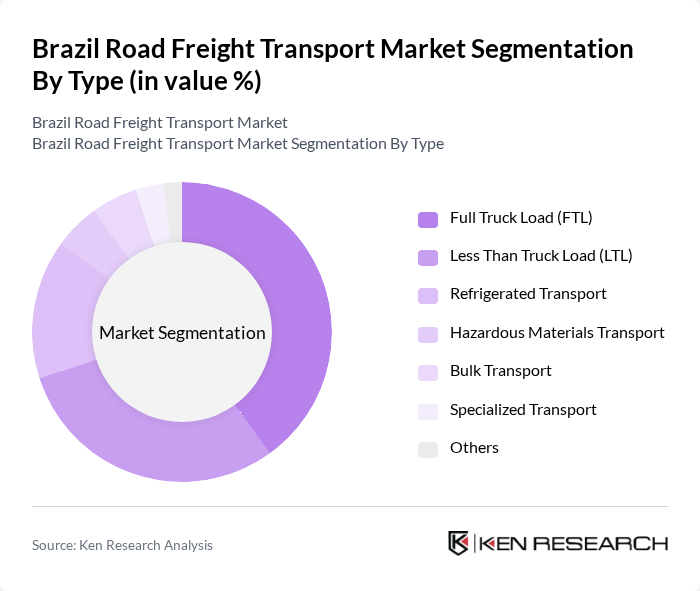

By Type:The road freight transport market can be segmented into Full Truck Load (FTL), Less Than Truck Load (LTL), Refrigerated Transport, Hazardous Materials Transport, Bulk Transport, Specialized Transport, and Others. FTL and LTL remain the most prominent segments due to their flexibility, cost-effectiveness, and ability to serve both large and small shipments. The demand for refrigerated transport is rising, driven by the growth of the food and pharmaceutical industries, while hazardous and bulk transport segments cater to specialized industrial and agricultural needs .

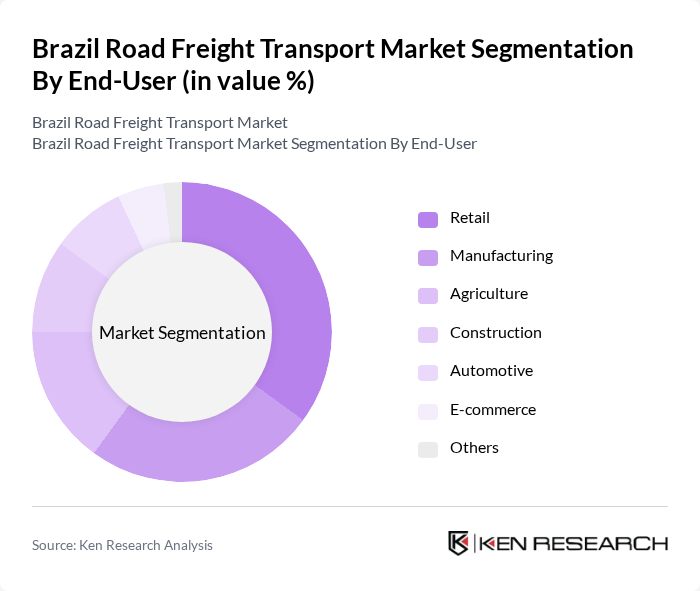

By End-User:The end-user segmentation includes Retail, Manufacturing, Agriculture, Construction, Automotive, E-commerce, and Others. Retail and e-commerce are the largest consumers of road freight services, driven by the rapid expansion of online shopping and the need for timely deliveries. Manufacturing, particularly automotive and metallurgy, is a major contributor, supported by significant investments in industrial production. Agriculture remains a key segment due to Brazil’s large-scale grain and commodity exports, while construction and automotive sectors also drive demand for specialized logistics solutions ; .

The Brazil Road Freight Transport Market is characterized by a dynamic mix of regional and international players. Leading participants such as JSL S.A., Rumo Logística, Translovato, Tegma Gestão Logística S.A., Grupo DSR, Log-In Logística Intermodal S.A., TNT Mercúrio, GOLLOG (Grupo Gol Linhas Aéreas), Expresso São Miguel, Transpanorama, Braspress Transportes Urgentes, Rodonaves (RTE Rodonaves), BBM Logística, Patrus Transportes Urgentes, and Coopercarga Logística contribute to innovation, geographic expansion, and service delivery in this space .

The Brazil road freight transport market is poised for significant transformation, driven by technological advancements and sustainability initiatives. As companies increasingly adopt digital solutions, such as route optimization and real-time tracking, operational efficiency is expected to improve. Additionally, the push for green logistics will likely lead to the adoption of electric vehicles and eco-friendly practices, aligning with global sustainability trends. These developments will create a more competitive landscape, enhancing service offerings and customer satisfaction in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Refrigerated Transport Hazardous Materials Transport Bulk Transport Specialized Transport Others |

| By End-User | Retail Manufacturing Agriculture Construction Automotive E-commerce Others |

| By Cargo Type | Dry Goods Perishable Goods Heavy Machinery Consumer Electronics Pharmaceuticals Others |

| By Service Type | Standard Transport Services Expedited Transport Services Intermodal Transport Services Value-Added Services Others |

| By Distribution Channel | Direct Sales Online Platforms Third-Party Logistics Providers Freight Brokers Others |

| By Fleet Type | Owned Fleet Leased Fleet Outsourced Fleet Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| By Destination | Domestic International |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Transport in Agriculture | 60 | Logistics Coordinators, Farm Managers |

| Manufacturing Supply Chain Logistics | 50 | Operations Managers, Supply Chain Analysts |

| Retail Distribution Networks | 55 | Distribution Managers, Retail Logistics Heads |

| Infrastructure and Regulatory Compliance | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Technology Adoption in Freight Transport | 45 | IT Managers, Innovation Leads |

The Brazil Road Freight Transport Market is valued at approximately USD 88 billion, reflecting significant growth driven by increased logistics demand, e-commerce expansion, and infrastructure investments over the past five years.