Region:Asia

Author(s):Shubham

Product Code:KRAC0789

Pages:82

Published On:August 2025

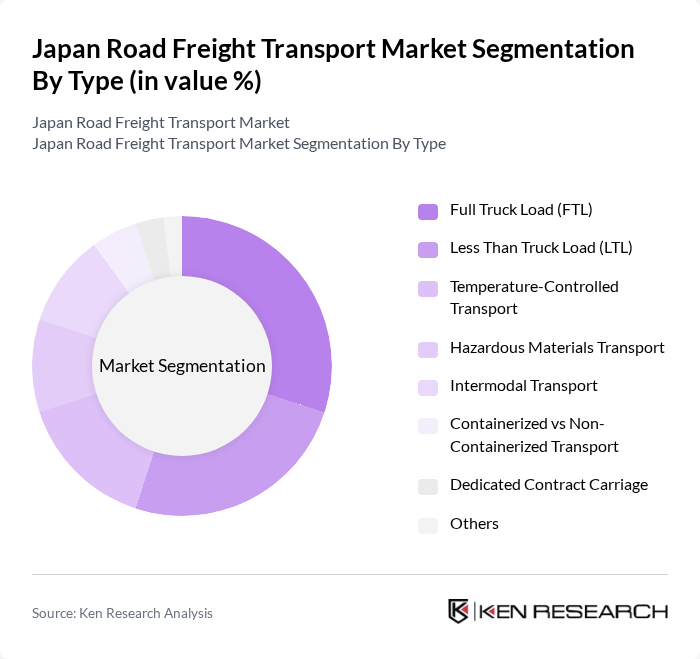

By Type:The market can be segmented into various types, including Full Truck Load (FTL), Less Than Truck Load (LTL), Temperature-Controlled Transport, Hazardous Materials Transport, Intermodal Transport, Containerized vs Non-Containerized Transport, Dedicated Contract Carriage, and Others. Each of these segments caters to different logistics needs and customer requirements. FTL and LTL remain the dominant segments, with temperature-controlled and intermodal transport gaining traction due to the growth in perishable goods and integrated logistics solutions .

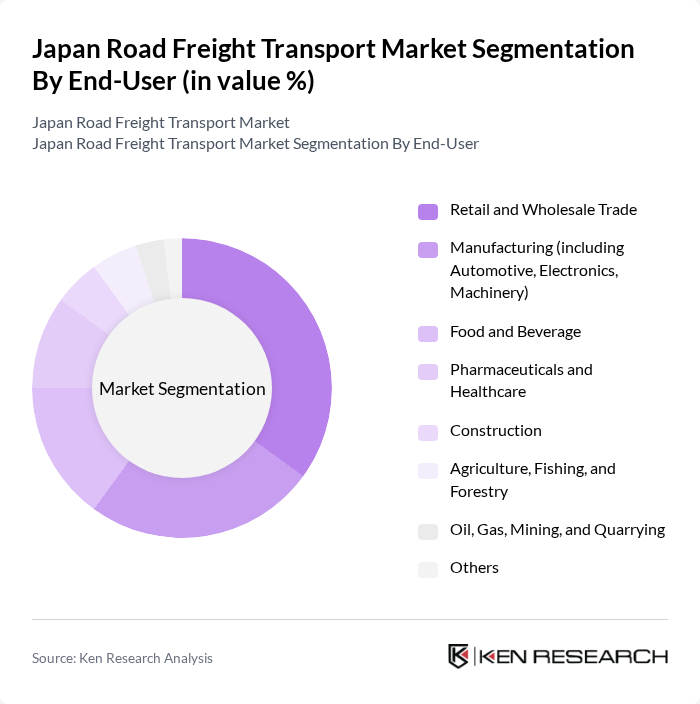

By End-User:The end-user segmentation includes Retail and Wholesale Trade, Manufacturing (including Automotive, Electronics, Machinery), Food and Beverage, Pharmaceuticals and Healthcare, Construction, Agriculture, Fishing, and Forestry, Oil, Gas, Mining, and Quarrying, and Others. Each sector has unique logistics requirements that influence the demand for road freight transport services. Retail, wholesale, and manufacturing are the leading end-users, reflecting Japan’s strong consumer base and industrial output .

The Japan Road Freight Transport Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Express Co., Ltd., Yamato Holdings Co., Ltd., Sagawa Express Co., Ltd., Seino Holdings Co., Ltd., Fukuyama Transporting Co., Ltd., Kintetsu World Express, Inc., Japan Post Co., Ltd., Marubeni Corporation, Mitsui-Soko Holdings Co., Ltd., Hitachi Transport System, Ltd., Trancom Co., Ltd., Senko Group Holdings Co., Ltd., SG Holdings Co., Ltd., DHL Japan, Inc., Sankyu Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of Japan's road freight transport market is poised for transformation, driven by technological innovations and evolving consumer preferences. As e-commerce continues to expand, logistics providers will increasingly focus on enhancing last-mile delivery capabilities and integrating sustainable practices. Additionally, the collaboration between logistics companies and technology providers will foster the development of smart logistics solutions, improving efficiency and reducing environmental impact. These trends will shape the industry's landscape, ensuring it remains competitive and responsive to market demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Temperature-Controlled Transport Hazardous Materials Transport Intermodal Transport Containerized vs Non-Containerized Transport Dedicated Contract Carriage Others |

| By End-User | Retail and Wholesale Trade Manufacturing (including Automotive, Electronics, Machinery) Food and Beverage Pharmaceuticals and Healthcare Construction Agriculture, Fishing, and Forestry Oil, Gas, Mining, and Quarrying Others |

| By Service Type | Standard Freight Services Expedited Freight Services Specialized Freight Services Value-Added Services (e.g., Warehousing, Packaging, Customs Clearance) Others |

| By Fleet Type | Owned Fleet Leased Fleet Third-Party Logistics (3PL) Fleet Others |

| By Delivery Model | Direct Delivery Hub-and-Spoke Model Drop Shipping Last-Mile Delivery Others |

| By Geographic Coverage | Urban Areas Rural Areas Regional Transport National Transport Cross-Border Transport Others |

| By Pricing Model | Flat Rate Pricing Distance-Based Pricing Weight-Based Pricing Time-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Road Freight Operations | 100 | Logistics Coordinators, Supply Chain Managers |

| Manufacturing Supply Chain Logistics | 80 | Operations Managers, Plant Managers |

| E-commerce Fulfillment Services | 60 | eCommerce Logistics Managers, Distribution Center Supervisors |

| Cold Chain Logistics for Food Products | 40 | Quality Assurance Managers, Logistics Directors |

| Automotive Parts Distribution | 50 | Procurement Managers, Warehouse Operations Managers |

The Japan Road Freight Transport Market is valued at approximately USD 130 billion, driven by factors such as e-commerce growth, just-in-time manufacturing, and efficient supply chain management. This valuation reflects a comprehensive analysis over the past five years.