Region:Europe

Author(s):Dev

Product Code:KRAA1624

Pages:84

Published On:August 2025

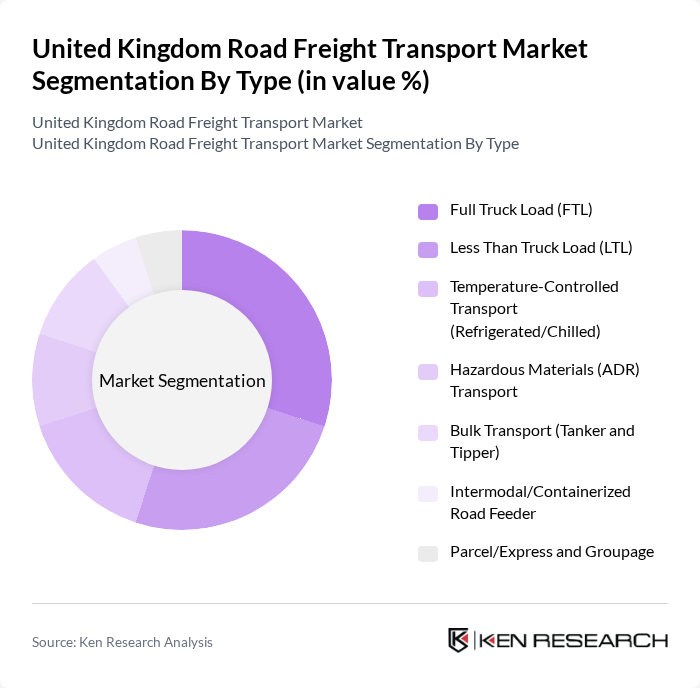

By Type:The road freight transport market can be segmented into various types, including Full Truck Load (FTL), Less Than Truck Load (LTL), Temperature-Controlled Transport, Hazardous Materials Transport, Bulk Transport, Intermodal/Containerized Road Feeder, and Parcel/Express and Groupage. Each of these sub-segments caters to different logistical needs and customer requirements.

The Full Truck Load (FTL) segment is currently dominating the market due to its efficiency in transporting large volumes of goods directly from the supplier to the customer. This aligns with UK market coverage where truckload (FTL) and contract logistics remain core offerings for major providers, with e-commerce and retail replenishment sustaining demand for dedicated and time-definite movements.

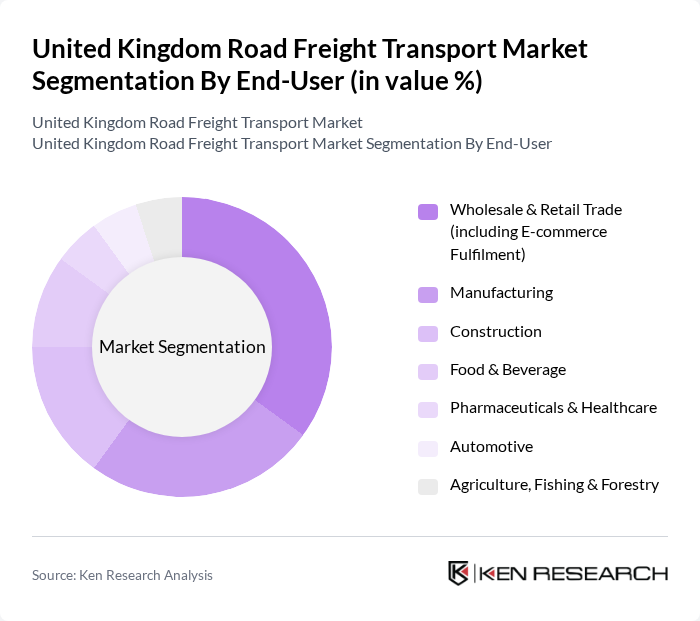

By End-User:The road freight transport market serves various end-user industries, including Wholesale & Retail Trade (including E-commerce Fulfilment), Manufacturing, Construction, Food & Beverage, Pharmaceuticals & Healthcare, Automotive, and Agriculture, Fishing & Forestry. Each sector has unique logistics requirements that influence the demand for road freight services.

The Wholesale & Retail Trade sector, particularly driven by e-commerce, is the leading end-user in the road freight transport market. UK sector analyses consistently attribute road freight demand to online retail penetration and parcel flows, alongside contract logistics for grocery and general merchandise networks.

The United Kingdom Road Freight Transport Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain (UK), XPO Logistics (UK), DPDgroup UK, Wincanton plc, Eddie Stobart (Culina Group), Kuehne+Nagel (UK), FedEx Express/TNT (UK), UPS (United Parcel Service) UK, Palletways (Imperial/DP World), GEODIS (UK), DB Schenker (UK), DSV Road Ltd (UK), Tuffnells Parcels Express, Gist Limited, A.P. Moller – Maersk (Maersk Logistics & Services UK), Royal Mail Group, Stobart Biomass Transport (Renewable Energy Logistics), Hermes/Evri (Evri Parcels), DX Group, The Pallet Network (TPN) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK road freight transport market is poised for transformation, driven by technological innovations and a growing emphasis on sustainability. As companies increasingly adopt automation and AI-driven logistics solutions, operational efficiencies are expected to improve significantly. Additionally, the shift towards sustainable transport practices will likely reshape industry standards, encouraging investments in electric and hybrid vehicles. These trends will create a more resilient and adaptable market, positioning it for long-term growth amidst evolving consumer demands and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Temperature-Controlled Transport (Refrigerated/Chilled) Hazardous Materials (ADR) Transport Bulk Transport (Tanker and Tipper) Intermodal/Containerized Road Feeder Parcel/Express and Groupage |

| By End-User | Wholesale & Retail Trade (including E-commerce Fulfilment) Manufacturing Construction Food & Beverage Pharmaceuticals & Healthcare Automotive Agriculture, Fishing & Forestry |

| By Service Type | Dedicated Contract Carriage Palletized Distribution Networks Freight Forwarding (Road) Warehousing, Fulfilment and Distribution Freight Brokerage / 4PL |

| By Fleet Size | Small Fleet (1-10 Vehicles) Medium Fleet (11-50 Vehicles) Large Fleet (51+ Vehicles) |

| By Geographic Coverage | Domestic International (Cross-Border UK–EU and beyond) Regional/Local |

| By Delivery Speed | Same-Day Delivery Next-Day Delivery Economy/Standard Delivery |

| By Pricing Model | Per Mile / Distance-Based Weight/Volume-Based Tariff Contractual/Rate Card Dynamic/Surcharge-Linked (fuel, congestion, peak) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Freight Transport | 120 | Logistics Managers, Fleet Operators |

| Temperature-Controlled Transport | 90 | Operations Managers, Compliance Officers |

| Construction Materials Transport | 60 | Supply Chain Directors, Project Managers |

| Hazardous Materials Transport | 50 | Safety Managers, Regulatory Affairs Specialists |

| Last-Mile Delivery Services | 80 | eCommerce Managers, Delivery Operations Supervisors |

The United Kingdom Road Freight Transport Market is valued at approximately USD 6770 billion, with recent assessments placing it around USD 69 billion. This valuation reflects the market's growth driven by logistics demand from e-commerce, retail, and manufacturing activities.