Region:Europe

Author(s):Rebecca

Product Code:KRAC0188

Pages:80

Published On:August 2025

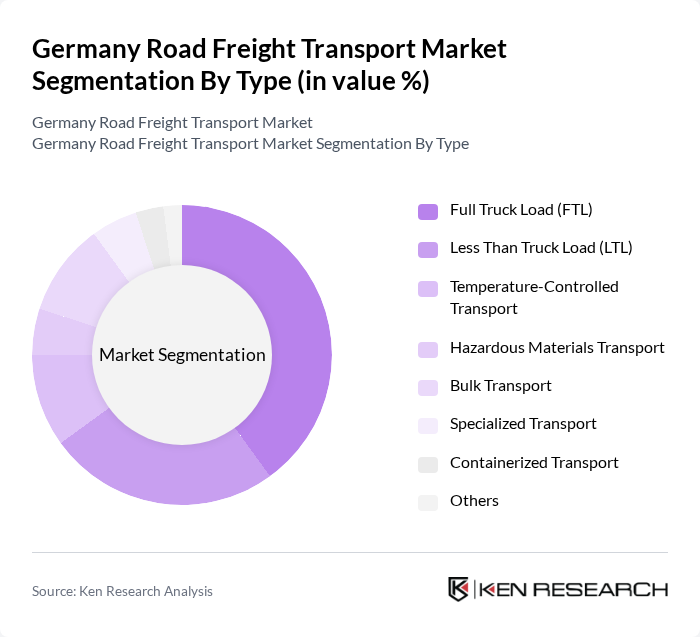

By Type:The road freight transport market can be segmented into various types, including Full Truck Load (FTL), Less Than Truck Load (LTL), Temperature-Controlled Transport, Hazardous Materials Transport, Bulk Transport, Specialized Transport, Containerized Transport, and Others. Among these, Full Truck Load (FTL) is the leading sub-segment, primarily due to its efficiency in transporting large volumes of goods directly from the sender to the receiver without intermediate stops. This method is favored by manufacturers and retailers who require timely deliveries of bulk products. The market is also witnessing growth in temperature-controlled and containerized transport, driven by the expansion of food, pharmaceutical, and cross-border trade segments .

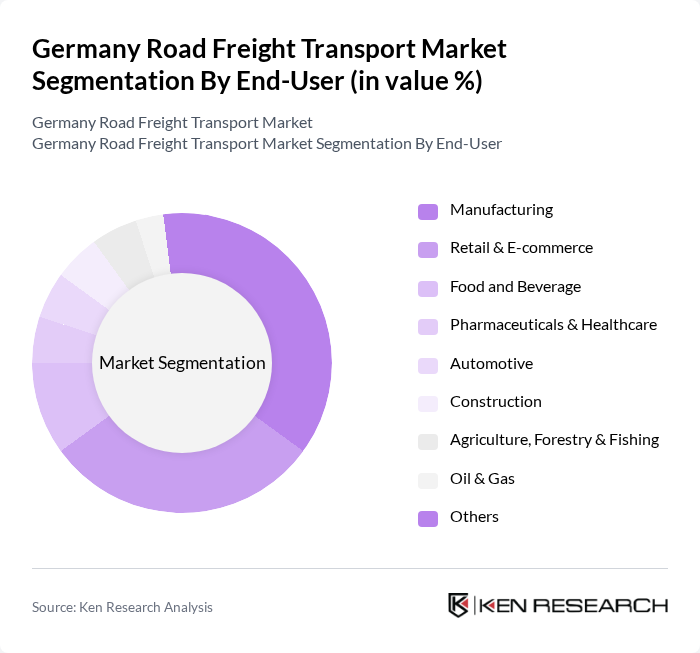

By End-User:The end-user segmentation of the road freight transport market includes Manufacturing, Retail & E-commerce, Food and Beverage, Pharmaceuticals & Healthcare, Automotive, Construction, Agriculture, Forestry & Fishing, Oil & Gas, and Others. The Manufacturing sector remains the dominant end-user, relying heavily on road freight for the timely delivery of raw materials and finished goods. Growth in the manufacturing sector, increased construction activity, and the expansion of e-commerce and organic agriculture are key drivers for road freight demand across these segments .

The Germany Road Freight Transport Market is characterized by a dynamic mix of regional and international players. Leading participants such as DB Schenker, DHL Freight, Kuehne + Nagel, DSV, XPO Logistics, GEODIS, Raben Group, Hellmann Worldwide Logistics, FIEGE Logistik, DACHSER, UPS Supply Chain Solutions, TFG Transfracht, Emons Spedition, Hoyer Group, LKW WALTER contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany road freight transport market appears promising, driven by technological advancements and a focus on sustainability. As companies increasingly adopt green logistics practices, the demand for eco-friendly transport solutions is expected to rise. Additionally, the integration of digital technologies, such as IoT and data analytics, will enhance operational efficiency and decision-making. These trends will likely shape the market landscape, fostering innovation and competitiveness in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Temperature-Controlled Transport Hazardous Materials Transport Bulk Transport Specialized Transport Containerized Transport Others |

| By End-User | Manufacturing Retail & E-commerce Food and Beverage Pharmaceuticals & Healthcare Automotive Construction Agriculture, Forestry & Fishing Oil & Gas Others |

| By Service Type | Dedicated Contract Carriage Freight Brokerage Intermodal Services Expedited Freight Services Last-Mile Delivery Others |

| By Fleet Size | Small Fleets (1-10 vehicles) Medium Fleets (11-50 vehicles) Large Fleets (51+ vehicles) |

| By Geographic Coverage | Domestic International Regional |

| By Delivery Speed | Same-Day Delivery Next-Day Delivery Standard Delivery |

| By Pricing Model | Flat Rate Per Mile/Kilometer Rate Volume-Based Pricing Dynamic/Spot Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| FTL Market Insights | 100 | Fleet Managers, Operations Directors |

| LTL Service Providers | 80 | Logistics Coordinators, Sales Managers |

| Regulatory Compliance in Road Freight | 60 | Compliance Officers, Safety Managers |

| Impact of E-commerce on Freight Demand | 70 | eCommerce Logistics Managers, Supply Chain Analysts |

| Technological Innovations in Freight Transport | 50 | IT Managers, Innovation Leads |

The Germany Road Freight Transport Market is valued at approximately USD 66 billion, driven by increasing demand for logistics services, particularly due to the rise of e-commerce and efficient supply chain solutions.