Region:Asia

Author(s):Shubham

Product Code:KRAB1236

Pages:98

Published On:October 2025

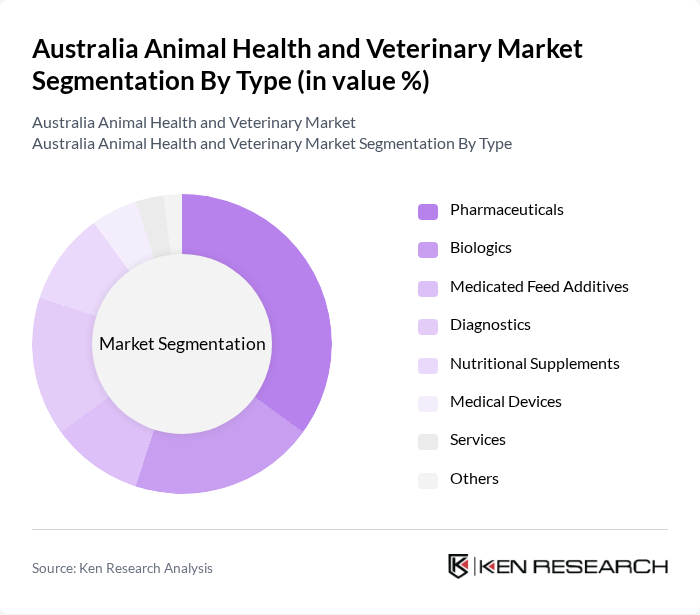

By Type:The market is segmented into Pharmaceuticals, Biologics, Medicated Feed Additives, Diagnostics, Nutritional Supplements, Medical Devices, Services, and Others. Each of these segments addresses diverse animal health needs. Pharmaceuticals and diagnostics are particularly significant, driven by the demand for chronic disease management, preventive care, and early disease detection. Advanced diagnostics and targeted therapeutics are increasingly adopted, while biologics and nutritional supplements support both preventive and therapeutic strategies for companion and production animals .

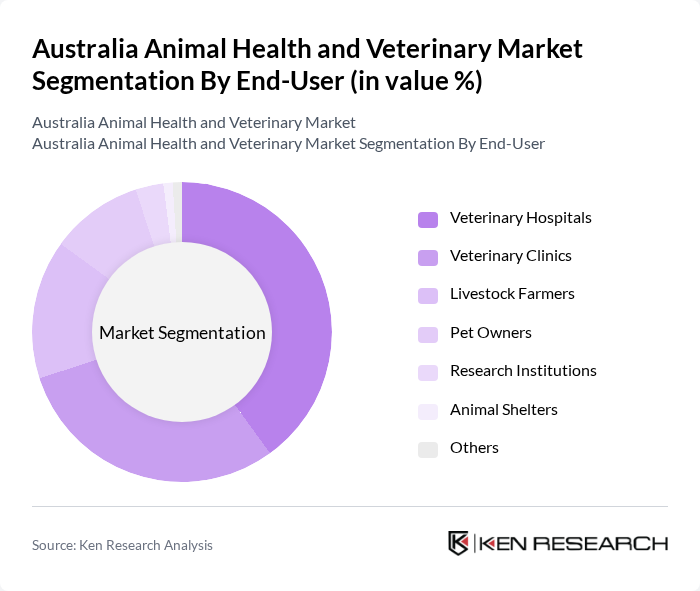

By End-User:The end-user segmentation includes Veterinary Hospitals, Veterinary Clinics, Livestock Farmers, Pet Owners, Research Institutions, Animal Shelters, and Others. Veterinary hospitals and clinics are the primary consumers, reflecting the high demand for professional veterinary care and advanced diagnostics. Livestock farmers and pet owners are significant segments due to the dual focus on production and companion animal health, while research institutions and animal shelters contribute to innovation and welfare initiatives .

The Australia Animal Health and Veterinary Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health, Elanco Animal Health, Boehringer Ingelheim Animal Health, Virbac, Ceva Santé Animale, IDEXX Laboratories, Neogen Corporation, Vetoquinol, Phibro Animal Health Corporation, Dechra Pharmaceuticals, Bimeda Animal Health, Biogenesis Bagó, Apiam Animal Health Limited, VetPartners Australia Pty Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia Animal Health and Veterinary Market appears promising, driven by ongoing trends in pet ownership and technological integration. As pet ownership continues to rise, the demand for veterinary services is expected to increase, particularly in urban areas. Additionally, the growing emphasis on preventive healthcare and animal welfare will likely shape service offerings, while advancements in telemedicine will enhance accessibility, ensuring that veterinary care remains a priority for pet owners across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceuticals Biologics Medicated Feed Additives Diagnostics Nutritional Supplements Medical Devices Services Others |

| By End-User | Veterinary Hospitals Veterinary Clinics Livestock Farmers Pet Owners Research Institutions Animal Shelters Others |

| By Product Category | Therapeutics (Vaccines, Parasiticides, Anti-Infectives, Medical Feed Additives, Others) Diagnostics (Immunodiagnostic Tests, Molecular Diagnostics, Diagnostic Imaging, Clinical Chemistry, Others) Companion Animal Products Livestock Products Equine Products Aquaculture Products Others |

| By Distribution Channel | Retail Sales Veterinary Clinics Online Retail Pharmacies Direct Sales Others |

| By Region | New South Wales & Australian Capital Territory Victoria & Tasmania Queensland Western Australia South Australia & Northern Territory Others |

| By Animal Type | Dogs and Cats (Companion Animals) Horses Ruminants (Cattle, Sheep, Goats) Swine Poultry Aquaculture Others |

| By Service Type | Preventive Care Surgical Services Emergency Care Specialty Services (Oncology, Orthopedics, Cardiology, etc.) Telehealth/Remote Consultation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 120 | Veterinarians, Clinic Managers |

| Animal Health Product Manufacturers | 85 | Product Managers, Sales Directors |

| Pet Owners | 150 | Pet Owners, Animal Care Enthusiasts |

| Livestock Farmers | 75 | Farm Owners, Animal Husbandry Experts |

| Veterinary Associations | 45 | Association Leaders, Policy Makers |

The Australia Animal Health and Veterinary Market is valued at approximately USD 1.7 billion, reflecting a significant growth trend driven by increasing pet ownership, advancements in veterinary technology, and a rising focus on preventive care and chronic disease management in animals.