Region:Europe

Author(s):Rebecca

Product Code:KRAB5852

Pages:99

Published On:October 2025

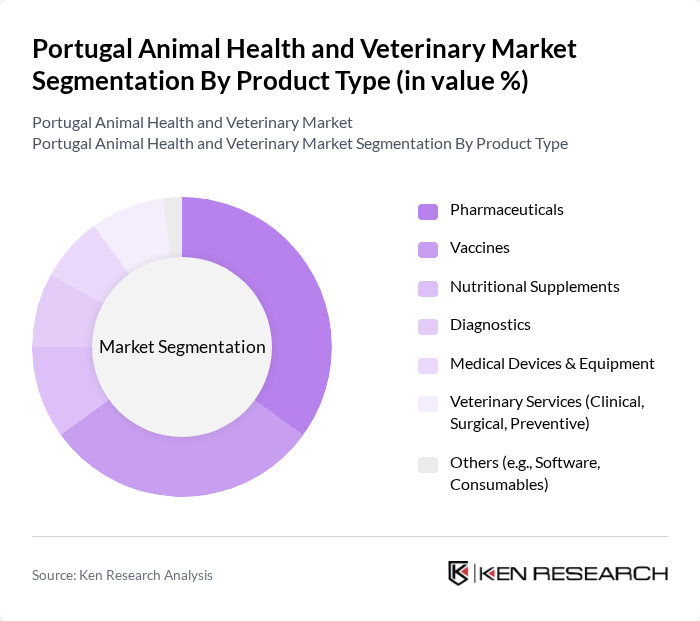

By Product Type:The product type segmentation includes various categories such as pharmaceuticals, vaccines, nutritional supplements, diagnostics, medical devices & equipment, veterinary services, and others. Among these, pharmaceuticals and vaccines are the leading subsegments due to their critical role in disease prevention and treatment in both companion animals and livestock. The increasing prevalence of zoonotic diseases, the rising demand for preventive healthcare, and the adoption of advanced diagnostic solutions are driving the growth of these subsegments .

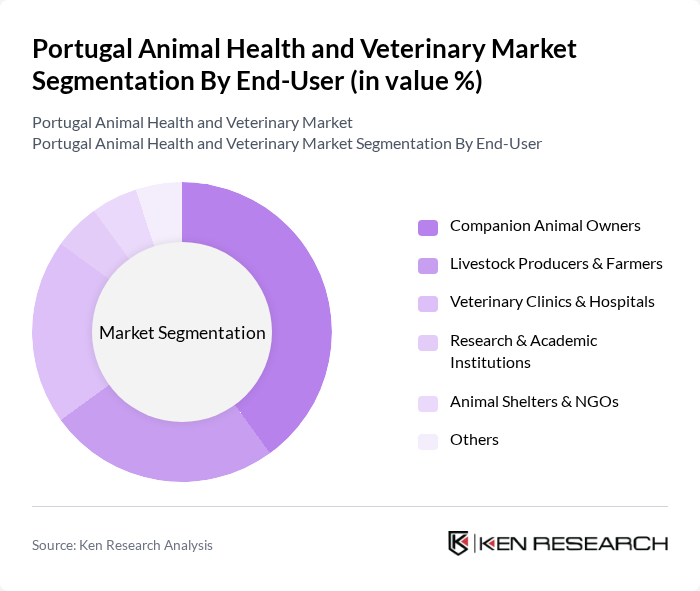

By End-User:The end-user segmentation encompasses companion animal owners, livestock producers & farmers, veterinary clinics & hospitals, research & academic institutions, animal shelters & NGOs, and others. Companion animal owners represent the largest segment, driven by the increasing trend of pet adoption and the growing willingness to spend on pet healthcare. This trend is further supported by the rise in disposable income, urbanization, and changing consumer attitudes towards pet care .

The Portugal Animal Health and Veterinary Market is characterized by a dynamic mix of regional and international players. Leading participants such as Independent Vetcare Ltd (IVC Evidensia), Unavets Group SL, Zoetis Inc., Merck Animal Health, Boehringer Ingelheim Animal Health, Elanco Animal Health, Vetoquinol, Dechra Pharmaceuticals, Virbac, IDEXX Laboratories, Neogen Corporation, Phibro Animal Health, Alltech, PetIQ, VetPartners contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Portugal animal health and veterinary market appears promising, driven by increasing pet ownership and advancements in veterinary technology. As the market evolves, the integration of telemedicine and AI in diagnostics will enhance service delivery and accessibility. Furthermore, a growing focus on preventive care and sustainability in animal health products will likely shape consumer preferences, leading to innovative solutions that cater to the needs of pet owners and livestock producers alike.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Pharmaceuticals Vaccines Nutritional Supplements Diagnostics Medical Devices & Equipment Veterinary Services (Clinical, Surgical, Preventive) Others (e.g., Software, Consumables) |

| By End-User | Companion Animal Owners Livestock Producers & Farmers Veterinary Clinics & Hospitals Research & Academic Institutions Animal Shelters & NGOs Others |

| By Distribution Channel | Veterinary Clinics & Hospitals Online Retail & E-commerce Pharmacies & Drugstores Direct Sales (Manufacturers to End-User) Distributors & Wholesalers Others |

| By Animal Type | Companion Animals (Dogs, Cats, Others) Livestock (Cattle, Swine, Poultry, Sheep & Goats, Others) Aquaculture Exotic & Zoo Animals Others |

| By Service Type | Preventive Care (Vaccination, Deworming, etc.) Emergency & Critical Care Surgical Services Diagnostic & Laboratory Services Telemedicine & Remote Consultation Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Application | Therapeutic Preventive Diagnostic Surgical Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 60 | Veterinarians, Clinic Managers |

| Animal Health Product Distributors | 40 | Sales Managers, Product Managers |

| Livestock Farmers | 70 | Farm Owners, Livestock Managers |

| Pet Owners | 90 | Pet Owners, Veterinary Technicians |

| Regulatory Bodies | 40 | Policy Makers, Veterinary Inspectors |

The Portugal Animal Health and Veterinary Market is valued at approximately USD 270 million. This valuation reflects the growth in pet ownership, increased awareness of animal health, and advancements in veterinary technology, driving demand for pharmaceuticals, vaccines, and diagnostic services.