Region:Asia

Author(s):Geetanshi

Product Code:KRAB5810

Pages:85

Published On:October 2025

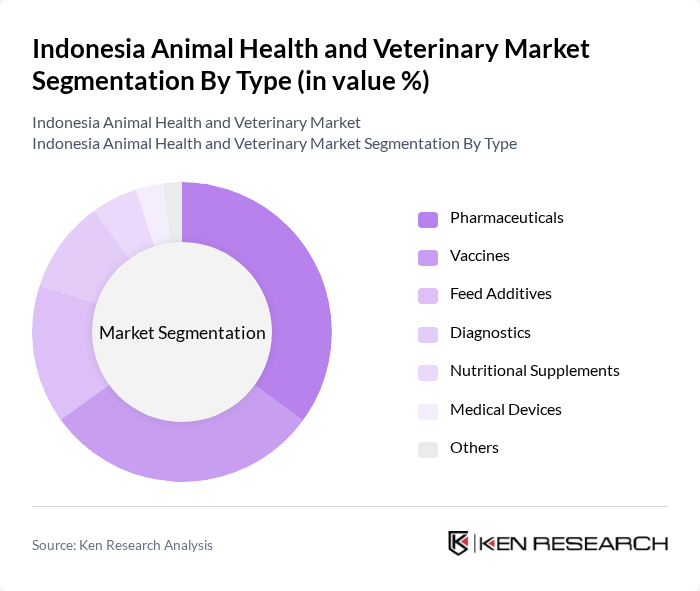

By Type:The market is segmented into various types, including Pharmaceuticals, Vaccines, Feed Additives, Diagnostics, Nutritional Supplements, Medical Devices, and Others. Among these, Pharmaceuticals and Vaccines are the most significant contributors, with therapeutics representing the largest segment, driven by the increasing prevalence of diseases in both companion and livestock animals. The demand for effective treatment options and preventive measures is propelling growth in these segments, with vaccines playing a crucial role in reducing livestock disease outbreaks.

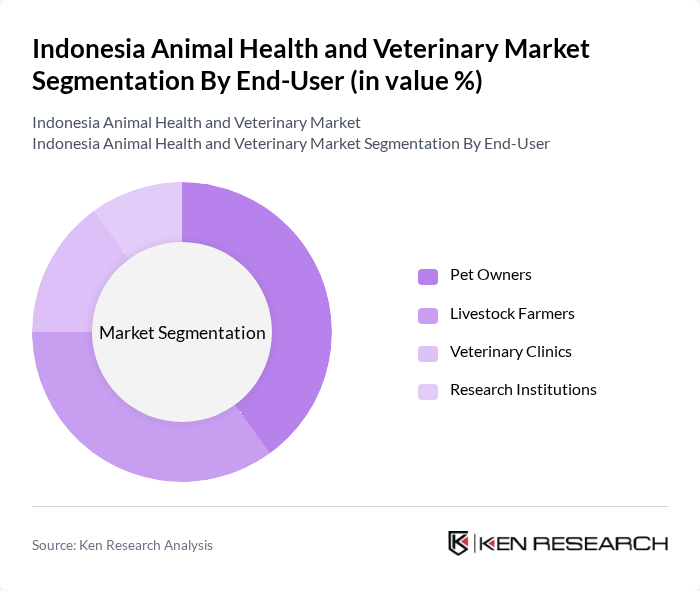

By End-User:The end-user segmentation includes Pet Owners, Livestock Farmers, Veterinary Clinics, and Research Institutions. Pet Owners and Livestock Farmers dominate the market, driven by the increasing number of pets and the growing livestock industry. The rising awareness of animal health and welfare among these groups is leading to higher spending on veterinary products and services, with veterinary hospitals and clinics providing essential care for companion animals while animal farms focus on production animal health solutions.

The Indonesia Animal Health and Veterinary Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Vaksindo Satwa Nusantara, PT. Medion Farma Jaya, PT. Indofarma Tbk, PT. Kimia Farma Tbk, PT. Sido Muncul, PT. Cargill Indonesia, PT. Japfa Comfeed Indonesia Tbk, PT. Charoen Pokphand Indonesia, PT. Nutrifood Indonesia, PT. Sarihusada Generasi Mahardhika, PT. Bina Karya Prima, PT. Sumber Alfaria Trijaya Tbk, PT. Sumber Daya Manusia, PT. Sari Bumi Sukses, PT. Sumber Sehat contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia animal health and veterinary market appears promising, driven by increasing awareness of animal welfare and health. The integration of technology in veterinary practices is expected to enhance service delivery, while government initiatives will likely improve access to veterinary care. Additionally, the growing trend towards preventive healthcare will encourage pet owners and livestock farmers to invest in regular health check-ups and vaccinations, fostering a more robust market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceuticals Vaccines Feed Additives Diagnostics Nutritional Supplements Medical Devices Others |

| By End-User | Pet Owners Livestock Farmers Veterinary Clinics Research Institutions |

| By Distribution Channel | Retail Sales (including pharmacies and veterinary clinics) Online Retail Direct Sales Others |

| By Product Formulation | Injectable Oral Topical |

| By Animal Type | Companion Animals (e.g., dogs, cats) Livestock (e.g., poultry, cattle, swine) Aquatic Animals |

| By Region | Java Sumatra Kalimantan Sulawesi |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Livestock Farmers | 150 | Farm Owners, Animal Health Managers |

| Animal Feed Suppliers | 80 | Sales Representatives, Product Managers |

| Veterinary Pharmaceutical Companies | 70 | Product Development Managers, Regulatory Affairs Specialists |

| Government Animal Health Officials | 50 | Policy Makers, Program Coordinators |

The Indonesia Animal Health and Veterinary Market is valued at approximately USD 470 million, driven by increasing pet ownership, livestock production, and advancements in veterinary technology and pharmaceuticals.