Philippines Animal Health and Veterinary Market Overview

- The Philippines Animal Health and Veterinary Market is valued at USD 690 million, based on a five-year historical analysis. This growth is primarily driven by increasing pet ownership, rising awareness of animal health, the expansion of livestock farming, and the adoption of advanced veterinary healthcare technologies. Demand for veterinary services and products has surged due to the growing emphasis on animal welfare, food safety standards, and the need to address zoonotic diseases and improve livestock productivity .

- Metro Manila, Cebu, and Davao remain the dominant regions in the Philippines Animal Health and Veterinary Market. Metro Manila leads due to its high population density and concentration of veterinary services, while Cebu and Davao benefit from significant agricultural activities and livestock farming, contributing to the demand for veterinary products and services .

- The Philippine government has implemented Republic Act No. 8485, known as the Animal Welfare Act of 1998, as amended by Republic Act No. 10631, issued by the Congress of the Philippines. This legislation mandates the humane treatment of animals and regulates the veterinary services sector, requiring proper licensing for veterinary establishments and compliance with animal care standards. The Act aims to ensure that animals receive adequate care and treatment, thereby promoting the growth of the animal health market by encouraging responsible pet ownership and livestock management.

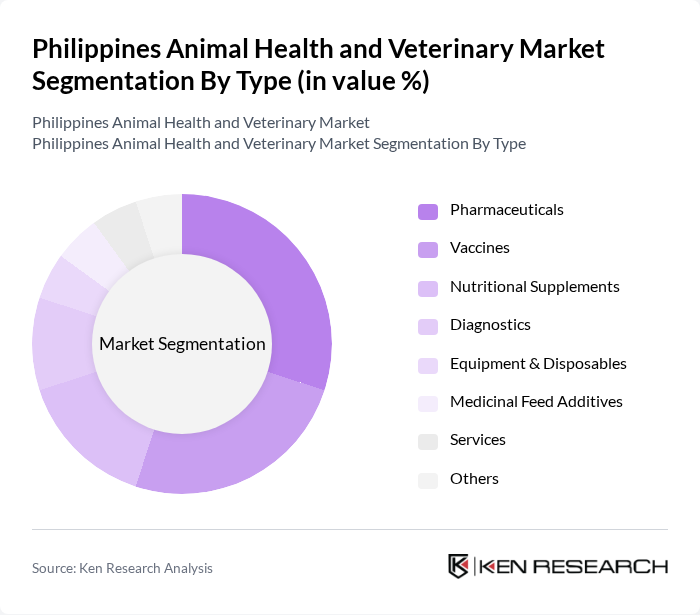

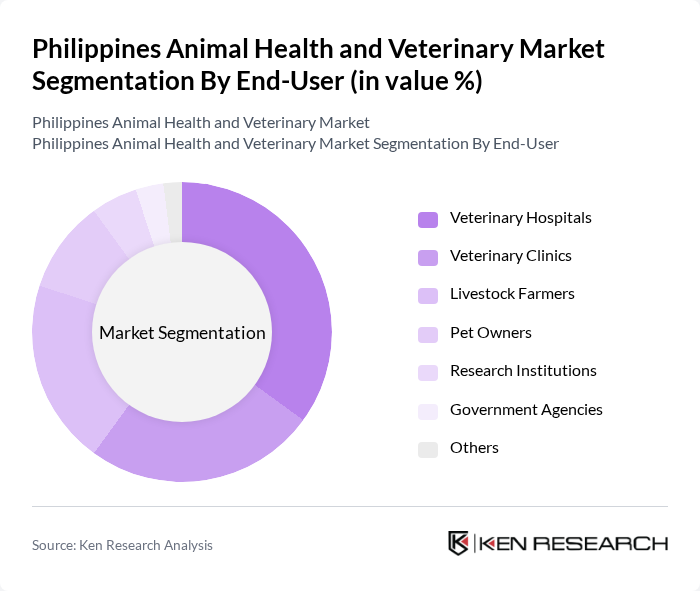

Philippines Animal Health and Veterinary Market Segmentation

By Type:The market is segmented into Pharmaceuticals, Vaccines, Nutritional Supplements, Diagnostics, Equipment & Disposables, Medicinal Feed Additives, Services, and Others. These subsegments address the diverse health needs of animals, including preventive care, disease treatment, nutritional support, and diagnostic solutions. Pharmaceuticals constitute the largest revenue-generating segment, while diagnostics are experiencing the fastest growth due to increasing demand for early disease detection and advanced veterinary care .

By End-User:The market’s end-users include Veterinary Hospitals, Veterinary Clinics, Livestock Farmers, Pet Owners, Research Institutions, Government Agencies, and Others. Veterinary hospitals and clinics represent the largest share, reflecting the growing demand for professional veterinary services, while livestock farmers and pet owners continue to drive demand for animal health products and preventive care .

Philippines Animal Health and Veterinary Market Competitive Landscape

The Philippines Animal Health and Veterinary Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health (MSD Animal Health), Elanco Animal Health, Boehringer Ingelheim Animal Health, Ceva Santé Animale, Virbac, Vetoquinol, Phibro Animal Health Corporation, IDEXX Laboratories, Inc., Neogen Corporation, Alltech, Huvepharma, Kemin Industries, Mars Petcare (Philippines), Univet Nutrition and Animal Healthcare Company (UNAHCO, Inc.), B-Meg (San Miguel Foods, Inc.), Pacific Vet Group Philippines, Inc. (PVGPI), Medivet Group Philippines, Agrichexers Corporation, and Santeh Feeds Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Philippines Animal Health and Veterinary Market Industry Analysis

Growth Drivers

- Increasing Pet Ownership:The Philippines has seen a significant rise in pet ownership, with approximately 23 million households owning pets as of in future. This trend is driven by urbanization and changing lifestyles, leading to a growing demand for veterinary services and products. The pet care market is projected to reach PHP 50 billion in future, reflecting a robust increase in spending on pet health and wellness, including vaccinations and preventive care.

- Rising Demand for Livestock Health Products:The livestock sector in the Philippines is crucial, contributing around PHP 300 billion to the national economy in future. With a population of over 110 million, the demand for livestock health products is surging, driven by the need for food security and quality meat production. The government’s focus on enhancing livestock health through vaccinations and supplements is expected to further boost this segment, with an estimated growth of 10% annually.

- Government Initiatives for Animal Health:The Philippine government has implemented various initiatives to improve animal health, including the Animal Health Program, which allocated PHP 1.5 billion in future for disease control and prevention. These initiatives aim to enhance veterinary services and promote biosecurity measures, thereby increasing the overall health of livestock and pets. Such government support is vital for fostering a sustainable animal health market, encouraging investments in veterinary infrastructure.

Market Challenges

- Limited Access to Veterinary Care in Rural Areas:Approximately 60% of the Philippine population resides in rural areas, where access to veterinary care is severely limited. Many rural communities lack sufficient veterinary clinics, leading to inadequate animal health services. This gap results in higher mortality rates among livestock and pets, hindering the overall growth of the animal health market. Addressing this issue is crucial for ensuring equitable access to veterinary care across the country.

- High Cost of Veterinary Services:The cost of veterinary services in the Philippines can be prohibitive, with average consultation fees ranging from PHP 500 to PHP 1,500. This financial barrier limits access to essential health services for many pet owners and livestock farmers, particularly in lower-income brackets. As a result, many individuals may forgo necessary treatments, leading to poorer health outcomes for animals and stunting market growth in the veterinary sector.

Philippines Animal Health and Veterinary Market Future Outlook

The future of the Philippines animal health and veterinary market appears promising, driven by increasing pet ownership and government support for livestock health. The integration of technology in veterinary practices, such as telemedicine, is expected to enhance service delivery, particularly in underserved areas. Additionally, the rising awareness of animal welfare will likely lead to increased spending on preventive healthcare and innovative products, fostering a more robust market environment in the coming years.

Market Opportunities

- Expansion of Telemedicine in Veterinary Care:The adoption of telemedicine in veterinary care presents a significant opportunity, especially in rural areas. With an estimated 30% of pet owners willing to use telehealth services, this trend can improve access to veterinary consultations and follow-ups, reducing travel costs and time for pet owners while enhancing overall animal health management.

- Development of Innovative Animal Health Products:There is a growing demand for innovative animal health products, including organic and natural solutions. The market for such products is projected to grow by 15% annually, driven by increasing consumer awareness of animal welfare and health. Companies that invest in research and development of these products can capture a significant share of the expanding market, meeting the needs of health-conscious pet owners and livestock farmers.