Region:Asia

Author(s):Rebecca

Product Code:KRAB4100

Pages:90

Published On:October 2025

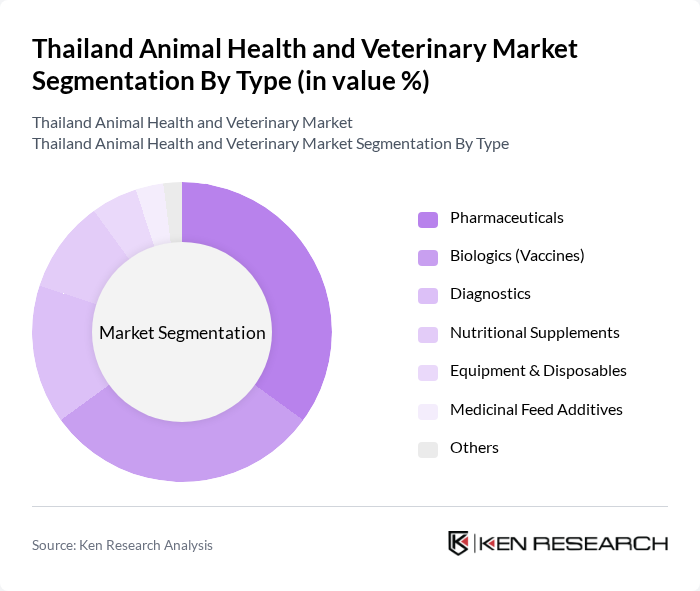

By Type:The market is segmented into Pharmaceuticals, Biologics (Vaccines), Diagnostics, Nutritional Supplements, Equipment & Disposables, Medicinal Feed Additives, and Others. Pharmaceuticals and Biologics are the leading segments due to the increasing prevalence of infectious and zoonotic diseases in animals and the growing focus on preventive healthcare. The demand for diagnostics is also rising as veterinarians and livestock producers seek accurate and timely information to manage animal health and productivity .

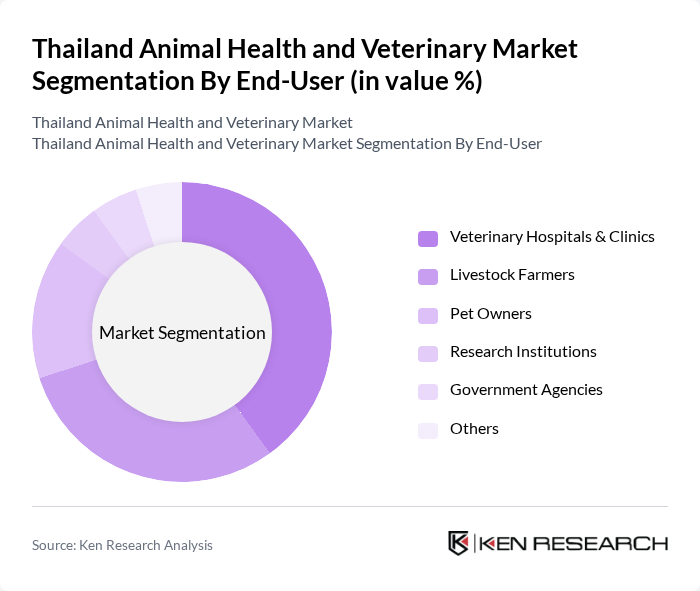

By End-User:The end-user segmentation includes Veterinary Hospitals & Clinics, Livestock Farmers, Pet Owners, Research Institutions, Government Agencies, and Others. Veterinary Hospitals & Clinics are the dominant segment, driven by the increasing number of pet owners, the expansion of specialized veterinary services, and the growing trend of pet insurance and wellness programs. Livestock Farmers also represent a significant portion of the market, as they require veterinary care to maintain animal health, productivity, and compliance with disease control regulations .

The Thailand Animal Health and Veterinary Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health, Boehringer Ingelheim, Elanco Animal Health, Ceva Santé Animale, Vetoquinol SA, IDEXX Laboratories Inc., Virbac SA, Dechra Pharmaceuticals, Phibro Animal Health Corporation, Alltech Inc., Huvepharma, Kemin Industries, Betagro Group, Thai Foods Group Public Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand Animal Health and Veterinary Market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The integration of telemedicine and digital health solutions is expected to enhance service accessibility, particularly in underserved areas. Additionally, the growing emphasis on preventive care and specialized veterinary services will likely reshape the market landscape, fostering innovation and improving animal health outcomes. As consumer awareness increases, the demand for high-quality, sustainable animal health products will also rise, creating new avenues for growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceuticals Biologics (Vaccines) Diagnostics Nutritional Supplements Equipment & Disposables Medicinal Feed Additives Others |

| By End-User | Veterinary Hospitals & Clinics Livestock Farmers Pet Owners Research Institutions Government Agencies Others |

| By Distribution Channel | Retail Sales Veterinary Clinics Online Retail Direct Sales Distributors Others |

| By Animal Type | Companion Animals Livestock Aquaculture Poultry Others |

| By Service Type | Preventive Care Emergency Care Routine Check-ups Surgical Services Consultation Others |

| By Price Range | Budget Mid-range Premium Others |

| By Region | Central Thailand Northern Thailand Southern Thailand Northeastern Thailand Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 60 | Veterinarians, Clinic Managers |

| Livestock Farmers | 100 | Farm Owners, Animal Husbandry Specialists |

| Animal Health Product Distributors | 40 | Sales Managers, Distribution Coordinators |

| Regulatory Bodies | 40 | Policy Makers, Veterinary Inspectors |

| Animal Feed Manufacturers | 50 | Production Managers, Quality Control Officers |

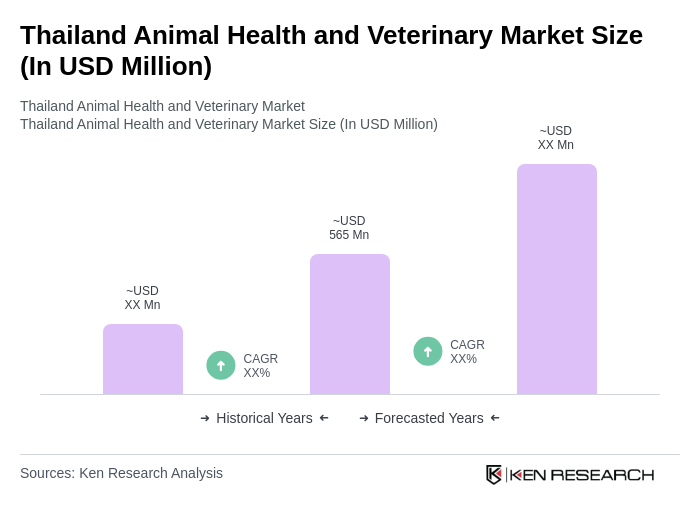

The Thailand Animal Health and Veterinary Market is valued at approximately USD 565 million, reflecting significant growth driven by increased pet ownership, animal welfare awareness, and advancements in veterinary healthcare infrastructure.