Region:Asia

Author(s):Rebecca

Product Code:KRAE2718

Pages:99

Published On:February 2026

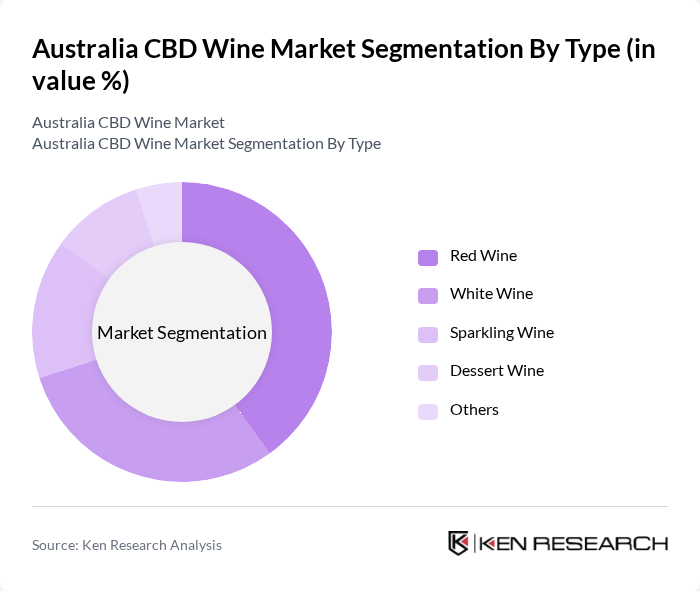

By Type:The market is segmented into various types of wine, including Red Wine, White Wine, Sparkling Wine, Dessert Wine, and Others. Each type caters to different consumer preferences and occasions, with Red and White wines being the most popular due to their established market presence and consumer familiarity. Sparkling wines are gaining traction for celebrations, while Dessert wines and Others provide niche options for specific tastes.

The Red Wine segment leads the market, driven by its popularity among consumers who appreciate full-bodied flavors and the health benefits associated with moderate consumption. White Wine follows closely, appealing to those who prefer lighter, crisper options. The Sparkling Wine segment is also growing, particularly for social events and celebrations, while Dessert Wine and Others cater to niche markets, providing unique flavors and experiences.

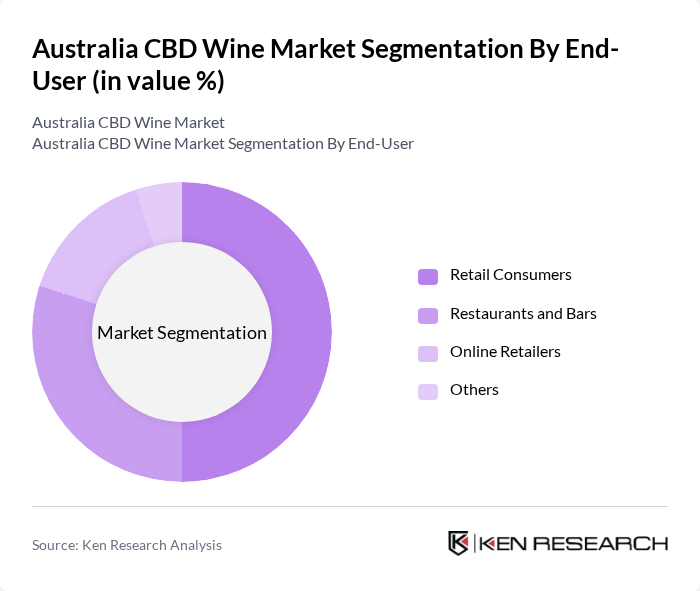

By End-User:The market is segmented based on end-users, including Retail Consumers, Restaurants and Bars, Online Retailers, and Others. Retail Consumers dominate the market as they seek convenient access to CBD wine, while Restaurants and Bars contribute significantly by offering curated selections to enhance dining experiences. Online Retailers are emerging as a vital channel, especially post-pandemic, as consumers increasingly prefer home delivery options.

Retail Consumers represent the largest segment, driven by the growing trend of home consumption and the desire for wellness-oriented products. Restaurants and Bars are crucial for introducing CBD wine to new consumers, enhancing their dining experiences with unique offerings. Online Retailers are rapidly gaining market share, providing convenience and a wider selection, particularly appealing to younger demographics who prefer digital shopping.

The Australia CBD Wine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Innocent Bystander, Stone & Wood Brewing Co., Yalumba Family Winemakers, De Bortoli Wines, Jacob's Creek, Penfolds, Brown Brothers, Seppelt, Henschke, d'Arenberg, McGuigan Wines, Clare Valley Wine Company, Tread Softly, Pizzini Wines, Alpha Box & Dice contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia CBD wine market appears promising, driven by increasing consumer awareness and acceptance of CBD products. As regulations become clearer, more brands are likely to enter the market, enhancing product diversity. Additionally, the trend towards health and wellness will continue to influence consumer preferences, leading to innovative product offerings. The integration of e-commerce platforms will further facilitate direct-to-consumer sales, allowing brands to reach a broader audience and adapt to changing market dynamics effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Red Wine White Wine Sparkling Wine Dessert Wine Others |

| By End-User | Retail Consumers Restaurants and Bars Online Retailers Others |

| By Packaging Type | Bottles Cans Tetra Packs Others |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores E-commerce Others |

| By Price Range | Premium Mid-Range Economy Others |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Others |

| By Occasion | Social Gatherings Celebrations Everyday Consumption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Wine Retailers | 150 | Store Managers, Wine Buyers |

| Wine Consumers in CBD | 200 | Regular Wine Drinkers, Occasional Buyers |

| Distributors and Wholesalers | 100 | Sales Representatives, Distribution Managers |

| Winemakers in the Region | 80 | Vineyard Owners, Production Managers |

| Industry Experts and Analysts | 50 | Market Analysts, Wine Consultants |

The Australia CBD Wine Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer interest in health and wellness, as well as the rising acceptance of CBD-infused products.