Region:Global

Author(s):Rebecca

Product Code:KRAE2720

Pages:83

Published On:February 2026

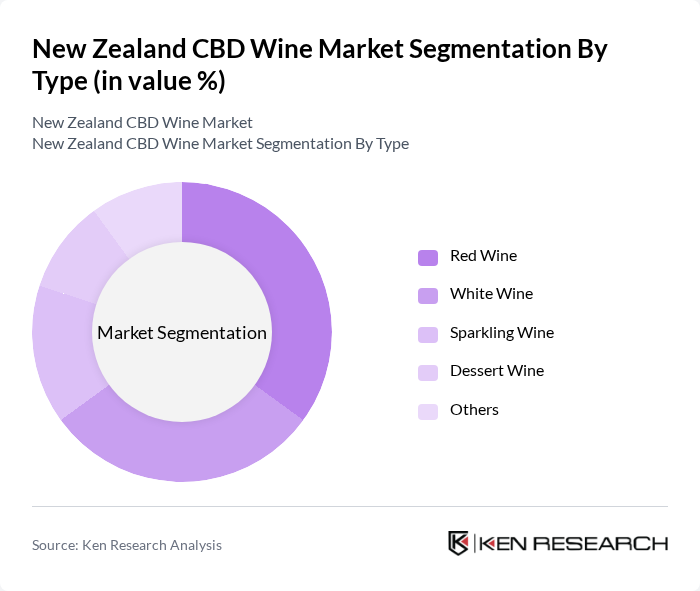

By Type:The market is segmented into various types of CBD wine, including Red Wine, White Wine, Sparkling Wine, Dessert Wine, and Others. Among these, Red Wine and White Wine are the most popular choices among consumers, driven by their established presence in the wine market and the growing trend of health-conscious drinking. Sparkling Wine and Dessert Wine are also gaining traction, particularly during festive occasions, while the "Others" category includes niche products that cater to specific consumer preferences.

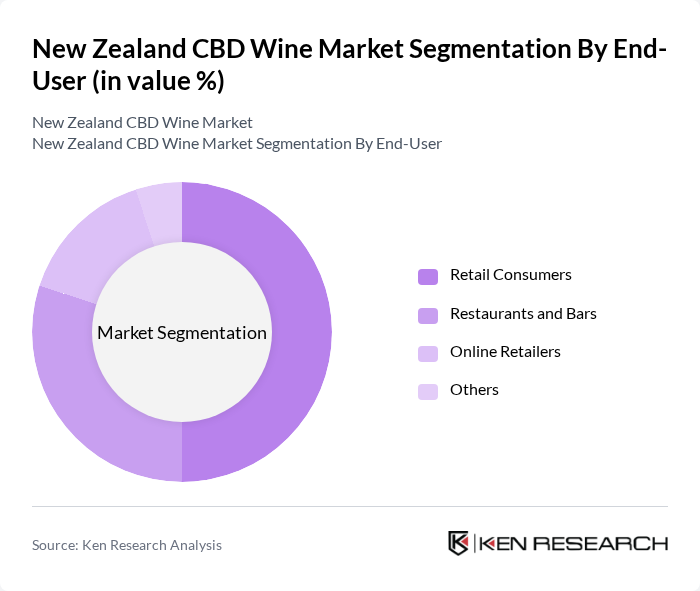

By End-User:The end-user segmentation includes Retail Consumers, Restaurants and Bars, Online Retailers, and Others. Retail Consumers represent the largest segment, as the growing trend of home consumption and the increasing availability of CBD wine in supermarkets and specialty stores drive demand. Restaurants and Bars are also significant contributors, as they offer unique CBD wine experiences to patrons, while Online Retailers are gaining popularity due to the convenience of e-commerce.

The New Zealand CBD Wine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Invivo Wines, Aroha Wines, The Hemp Farm, Ovine Wines, The Wine Vault, Wildflower Wine, Hemptails, The Good Wine Co., Kahu Wines, Greenstone Wines, The Hemp Collective, Pure CBD Wine, Kiwi Hemp Wine, The Natural Wine Co., EcoVino contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand CBD wine market appears promising, driven by increasing consumer awareness and acceptance of CBD products. As the market matures, innovations in product development and marketing strategies will likely enhance consumer engagement. Additionally, the anticipated growth in e-commerce channels will facilitate broader distribution, allowing CBD wine to reach a wider audience. The focus on sustainability and organic ingredients will further align with consumer preferences, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Red Wine White Wine Sparkling Wine Dessert Wine Others |

| By End-User | Retail Consumers Restaurants and Bars Online Retailers Others |

| By Packaging Type | Bottles Cans Tetra Packs Others |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores E-commerce Others |

| By Price Range | Premium Mid-Range Economy Others |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Others |

| By Occasion | Social Gatherings Celebrations Everyday Consumption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| CBD Wine Producers | 50 | Winemakers, Production Managers |

| Retailers of CBD Products | 75 | Store Owners, Category Managers |

| Consumers of CBD Wine | 100 | Wine Enthusiasts, Health-Conscious Consumers |

| Regulatory Bodies | 30 | Policy Makers, Compliance Officers |

| Industry Experts and Analysts | 40 | Market Analysts, Industry Consultants |

The New Zealand CBD wine market is valued at approximately USD 150 million, reflecting a growing consumer interest in health and wellness products and the rising acceptance of CBD-infused beverages as alternatives to traditional alcoholic drinks.