Region:Global

Author(s):Rebecca

Product Code:KRAB4081

Pages:80

Published On:October 2025

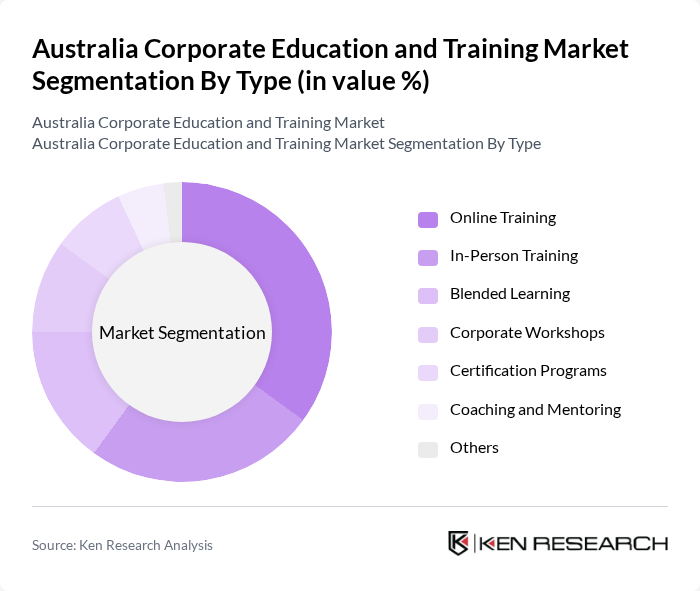

By Type:The market is segmented into various types of training methods, including Online Training, In-Person Training, Blended Learning, Corporate Workshops, Certification Programs, Coaching and Mentoring, and Others. Online Training has gained significant traction due to its flexibility and accessibility, allowing employees to learn at their own pace. In-Person Training remains relevant for hands-on skills and team-building exercises, while Blended Learning combines the best of both worlds. Corporate Workshops and Certification Programs are essential for specialized skills, and Coaching and Mentoring provide personalized guidance.

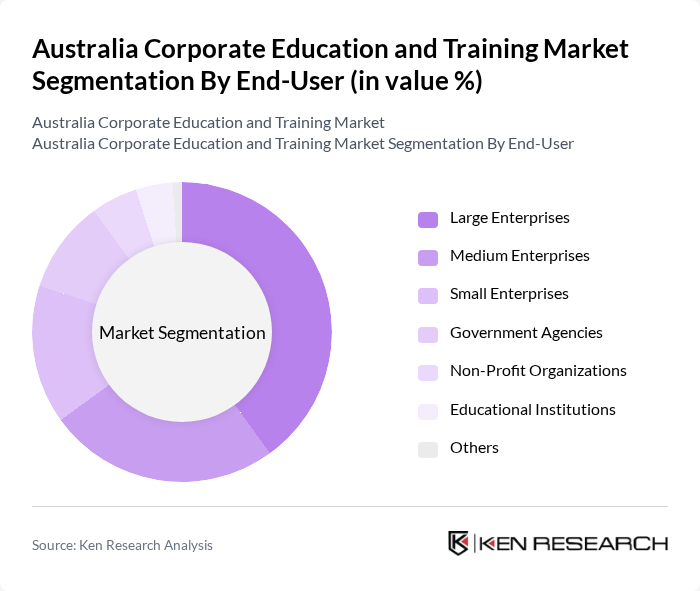

By End-User:The end-user segmentation includes Large Enterprises, Medium Enterprises, Small Enterprises, Government Agencies, Non-Profit Organizations, Educational Institutions, and Others. Large Enterprises dominate the market due to their substantial training budgets and the need for comprehensive employee development programs. Medium and Small Enterprises are increasingly recognizing the importance of training, while Government Agencies and Non-Profit Organizations focus on compliance and skill enhancement for their workforce. Educational Institutions also play a vital role in providing training solutions.

The Australia Corporate Education and Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as SEEK Learning, Open Colleges, Upskilled, TAFE Queensland, Australian Institute of Management, Learning Tree International, Coursera, Udemy for Business, Pearson Australia, Navitas, RMIT Online, Monash University, Deakin University, The Learning Network, Skillsoft contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corporate education and training market in Australia appears promising, driven by ongoing digital transformation and a heightened focus on employee development. As organizations increasingly adopt hybrid work models, the demand for flexible and accessible training solutions will continue to rise. Furthermore, the integration of advanced technologies such as artificial intelligence and data analytics will enhance personalized learning experiences, ensuring that training programs are tailored to individual employee needs and organizational goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Training In-Person Training Blended Learning Corporate Workshops Certification Programs Coaching and Mentoring Others |

| By End-User | Large Enterprises Medium Enterprises Small Enterprises Government Agencies Non-Profit Organizations Educational Institutions Others |

| By Industry | Information Technology Healthcare Finance Manufacturing Retail Hospitality Others |

| By Delivery Mode | Virtual Classrooms Mobile Learning Self-Paced Learning Instructor-Led Training Hybrid Models Others |

| By Duration | Short Courses (Less than 1 Month) Medium Courses (1-3 Months) Long Courses (More than 3 Months) Ongoing Training Programs Others |

| By Certification Type | Professional Certifications Academic Certifications Industry-Specific Certifications Compliance Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Free Courses Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training in IT Sector | 120 | Training Managers, IT Directors |

| Healthcare Workforce Development | 110 | HR Managers, Training Coordinators |

| Financial Services Education Programs | 100 | Compliance Officers, Learning & Development Heads |

| Manufacturing Skills Training | 90 | Operations Managers, Safety Trainers |

| Retail Sector Employee Training | 110 | Store Managers, Regional Training Leads |

The Australia Corporate Education and Training Market is valued at approximately USD 7.74 billion, reflecting a significant growth driven by the demand for upskilling and reskilling in the workforce, as well as the rise of digital learning platforms.