Region:Europe

Author(s):Shubham

Product Code:KRAB6555

Pages:96

Published On:October 2025

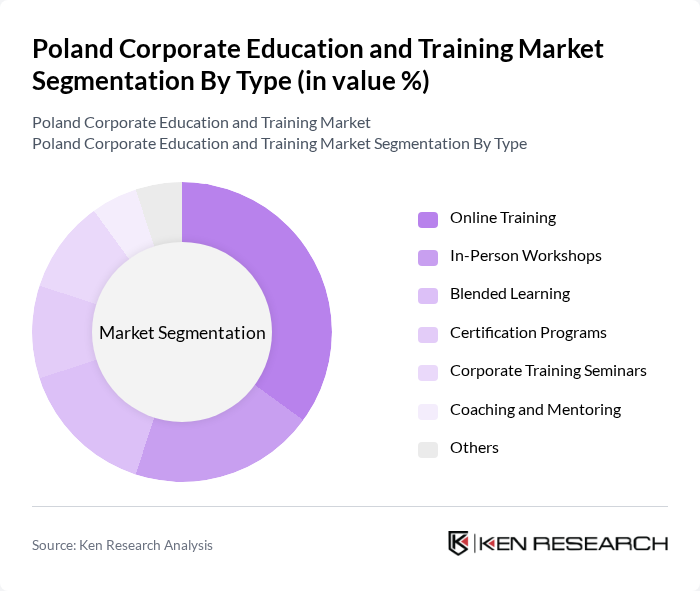

By Type:The market is segmented into various types of training programs, including Online Training, In-Person Workshops, Blended Learning, Certification Programs, Corporate Training Seminars, Coaching and Mentoring, and Others. Among these, Online Training has gained significant traction due to its flexibility and accessibility, especially in the wake of the COVID-19 pandemic, which accelerated the shift towards digital learning solutions.

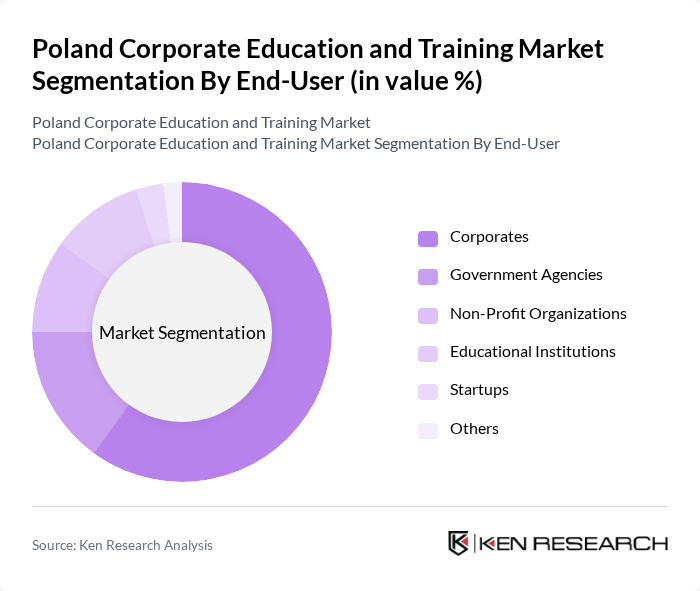

By End-User:The end-user segmentation includes Corporates, Government Agencies, Non-Profit Organizations, Educational Institutions, Startups, and Others. Corporates are the dominant end-users, as they invest heavily in employee training to enhance productivity and adapt to market changes. The increasing focus on employee development and retention strategies has led to a surge in corporate training initiatives.

The Poland Corporate Education and Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Skillsoft, LinkedIn Learning, Coursera, Udemy for Business, Pluralsight, D2L Corporation, SAP Litmos, TalentLMS, EdX, OpenSesame, Moodle, BizLibrary, Cornerstone OnDemand, Kallidus, LearnUpon contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corporate education and training market in Poland appears promising, driven by technological advancements and a growing emphasis on employee development. As organizations increasingly adopt hybrid learning models, the integration of digital tools will enhance training accessibility and engagement. Furthermore, the focus on soft skills training is expected to rise, aligning with the evolving demands of the labor market. Companies that embrace these trends will likely see improved employee performance and satisfaction, positioning themselves competitively in the marketplace.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Training In-Person Workshops Blended Learning Certification Programs Corporate Training Seminars Coaching and Mentoring Others |

| By End-User | Corporates Government Agencies Non-Profit Organizations Educational Institutions Startups Others |

| By Industry | IT and Software Manufacturing Healthcare Finance and Banking Retail Others |

| By Training Format | Workshops Webinars E-Learning Modules On-the-Job Training Simulation-Based Training Others |

| By Duration | Short-Term Courses Long-Term Programs Ongoing Training One-Time Workshops Others |

| By Delivery Method | Instructor-Led Training Self-Paced Learning Group Learning Virtual Classrooms Others |

| By Certification Type | Professional Certifications Skill-Based Certifications Compliance Certifications Industry-Specific Certifications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| IT Sector Corporate Training | 100 | HR Managers, Training Coordinators |

| Manufacturing Industry Skill Development | 80 | Operations Managers, Training Supervisors |

| Service Sector Employee Development | 90 | Learning and Development Heads, Team Leaders |

| Corporate Leadership Training Programs | 70 | Executive Coaches, HR Directors |

| Online Learning Platforms Usage | 85 | eLearning Specialists, IT Administrators |

The Poland Corporate Education and Training Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by the demand for employee upskilling and reskilling in response to technological advancements and changing market dynamics.